The full guide to steering committees for your banks and credit unions

A profitability steering committee is a group of people from across a financial institution that meets regularly to identify all of the uses of profitability information, develop a rollout and education plan, and review methodologies, tools, and results of efforts to drive profits.

The popularity of profitability steering committees at banks and credit unions is rapidly growing as the number of financial institutions with committees rose from 17% in 2019 to 38% in 2020.1

Why are banks forming profitability steering committees?

Cross-functional profitability steering committees help financial institutions better serve community needs while returning dividends to shareholders or members by meeting regularly to analyze profitability, review metrics and methodologies, establish profitability guidelines, and institute strategic changes. For example, committees can drive strategic improvement by defining a profitability-based incentive plan that aligns employee compensation with overall institutional strategy — ultimately rewarding employees for driving profit, not merely volume, and enhancing the client experience.

If your institution is among the 62% of banks and credit unions that do not currently use a profitability steering committee, consider these five reasons to form one:

- Create a timeline and methods for establishing metrics: Any process with lasting value has rigorous methodology behind it.

- Promote visibility and buy-in to profitability metrics: By setting standards for data, conversations can move beyond calculation methodology to making decisions based on uniform, accepted data.

- Focus on the results, not the calculation: Since data standards are established upfront, a committee can avoid debate around accuracy or relevance of the reports and therefore turn its focus to the results, incorporating profitability metrics, and ways to improve profitability.

- Leverage profitability metrics for incentive compensation: Once the current state of profitability has been determined, committee members can decide how to incentivize loan officers and relationship managers to grow their portfolios in a profitable manner.

- Define a process for continued improvement: Profitability is a journey, not a destination. The profitability measurement process should produce timely, consistent, and accurate information that guides strategic business decisions.

Who should participate in the steering committee?

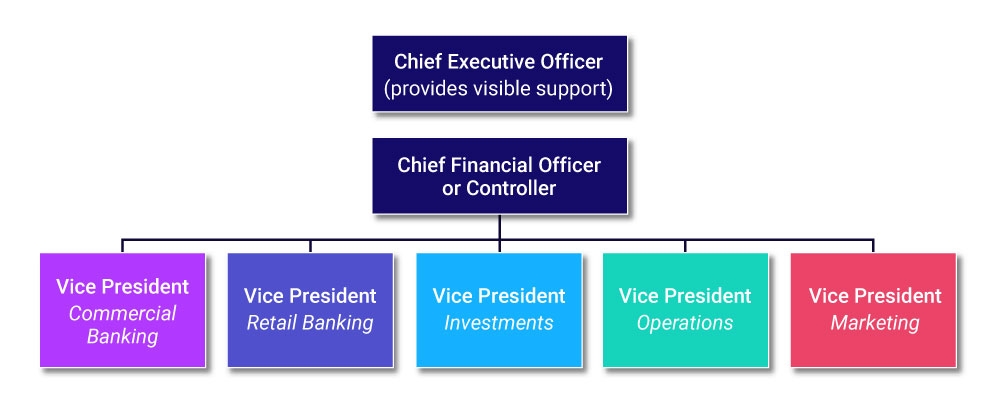

Successful profitability steering committees receive visible support from the CEO and the board. However, the CEO doesn’t need to serve on the committee.

In a typical configuration (Figure 1), the CFO or Controller chairs the committee, which is comprised of senior leaders representing major departments across the institution. Every department should be represented on the board, with an odd number of members to prevent tie votes.

The committee is charged with five major roles:

- Establish and maintain definitions and rules of profitability measurement at the organizational unit, product, and customer levels

- Define organizational units, products, and allocation methodologies

- Select funds transfer pricing (FTP) methodologies

- Choose methodology for allocating capital

- Define report formats, including line items and basis for comparison

What are the goals of a profitability steering committee?

Overall, a profitability steering committee develops and approves techniques and methodologies to drive profitability. Getting buy-in from the C-suite down to the frontline workers is critical at each stage of profitability system implementation, bringing different departments together and encouraging participation in the process.

The committee must also link profitability measurement processes and management processes to financial results. This goal may require intense education across the institution, especially for those incentivized for improving profitability results and their managers. Finally, the profitability steering committee is responsible for monitoring the measurement process, making adjustments, and measuring the results.

When should the committee gather and achieve milestones?

As the first order of business, establish a committee charter that outlines duties and responsibilities, reporting relationships, and approximate timelines for meetings and goal achievement.

- Strategy (1-2 months): Define profitability for the institution, including the preferred type of profitability analysis. Determine where and when to make lending decisions at the product level, customer level, or instrument level. Establish how profitability reports will be shared, whether at the institution, branch, department, or some other level.

- Technology Assessment and Adoption (7-9 months): Determine what profitability system you need, develop requirements, research potential vendors, and issue an RFP. Leave ample time for implementation, depending on your profitability strategies, the technology you have, and what you’re implementing.

Your profitability system implementation will encompass myriad decision points, such as:- Funds transfer pricing – Yield curves, duration assumptions on non-maturity instruments, liquidity premiums, prepayment speeds, and the amount of history to price

- Organizational Profitability – Allocation of full-absorption versus marginal costing; waterfall versus direct costing; loan loss provision, charge-offs, and recoveries; profitability metrics to use (e.g. RAROC); and reporting hierarchy and distribution

- Customer and Product Profitability – Fully allocated expenses versus standard unit rate, identification of survey groups for product support and revenue centers, definition of product and service categories to be measured, and identification of individuals to approve cost surveys

- ALLL & RAROC – Coverage ratio by loan products, risk factors to be included in Allowance for Loan and Lease Losses (ALLL) calculations, and selection of a provisioning method

- Incorporation of Results (3-6 months) — If your institution is using branch scorecards, can profitability data be incorporated into the scorecard? How will results impact bonuses at the contributor, department, and branch levels? The committee should establish a regular cadence for meetings beyond system implementation to monitor and refine profitability analytics and reporting.

Be sure to set aside training time so users are comfortable with all aspects of profitability, including analysis and reporting.

Where will the committee add value and oversight?

The benefits of a profitability steering committee far outweigh the time and effort required to establish the committee, get buy-in, set goals, implement the right technology, and create reporting mechanisms to incent workers for behaviors that increase profitability.

Expect to see benefits in three areas — analysis and decision points for review, reporting breadth and accuracy, and including profitability metrics into incentive compensation plans — by incorporating these capabilities:

- Funds Transfer Pricing, including spreads by product, charges, and credits to funds users and funds providers

- Customer Profitability trends, including unit rates and the grouping/ownership of customer relationships

- Organizational Profitability trends and identification of efficiencies and inefficiencies

- RAROC model, comparing allocated capital to total capital

- Loan Loss and Provision model, comparing actual loan reserves and losses to loan provision at the instrument level and assessing the impact on individual customer profit as credit quality changes

- Presentation of results to management that can include such metrics as profitability trends, profit center comparisons, product and services comparisons, and top- or bottom-performing customers/members

- Incorporation of results in KPI reporting, establishing goals and hurdle rate comparisons, defining branch-controlled aspects of profitability, establishing balanced scorecards for all profit centers, and incorporating profitability metrics into existing reports

The Future of Finance Includes Steering Committees

More financial institutions see the benefits of profitability steering committees to create consistent, repeatable processes that drive profitability throughout the institution. A committee creates the authority, structure, and consensus for implementation and should include stakeholders from every department. The work of the committee is a continual process to set standards, adopt the right infrastructure, align profitability metrics to institutional goals and employee incentives, and monitor performance.

Axiom™ FTP & Profitability provides enhanced visibility into the customers, segments, branches, and products that drive the greatest value to help finance leaders measure performance inclusive of risk characteristics and costs, such as a changing regulatory environment or evolving market dynamics. Measure and analyze full profit contribution and risk-adjusted return on capital (RAROC), with a highly configurable costing engine, matched-term funds transfer pricing, inclusion of direct costs and income, provision, and capital rules.

1 2020 Profitability Perspectives: Findings Reveal the Need for Specific Leadership Action. Syntellis Performance Solutions and Financial Managers Society, 2020.

Yours peers also read:

The 5 Ws of Profitability Steering Committees in Banks and Credit Unions

Take These 5 Steps for Greater Profitability