Conventional wisdom holds that as interest rates rise, Net Interest Margins and hence overall profitability improve. The reality is much more complex than that.

On one hand, higher interest rates mean higher lending rates, and those increases don’t necessarily come with commensurate increases on the deposit side of the balance sheet. Other factors that typically are part of a higher, more volatile rate environment — such as high inflation and slowing of economic growth — may negatively influence outcomes. Higher interest rates may affect customers’ ability to repay loans and overall credit quality, and significantly shift balances from non-interest-bearing demand to higher-yielding time deposits and other longer-term liability products.

Effective margin planning for these types of major market shifts requires a comprehensive approach; finance professionals must assess all potential risks and returns associated with changing economic conditions.

Six best practices for better margin planning are:

1. Understand How Margin Planning Differs from ALM

At a fundamental level, it is important to know the difference between margin planning at a bank and the asset liability management (ALM) function. Both aim to help financial institutions manage risk and return, but budgeting and forecasting (i.e., margin planning) provides more of a distributed and detailed approach by focusing on individual business units, departments, cost centers, or even customer relationships. With implementation of funds transfer pricing (FTP), these forecasts also establish global funds cost parameters to gauge earnings above or below those thresholds, without factoring in interest rates.

By contrast, ALM looks at products in terms of their rate sensitivity — including fixed, variable, adjustable, and others — as well as expected and unexpected changes in market values. It may look at outcomes over a range of multiple economic scenarios.

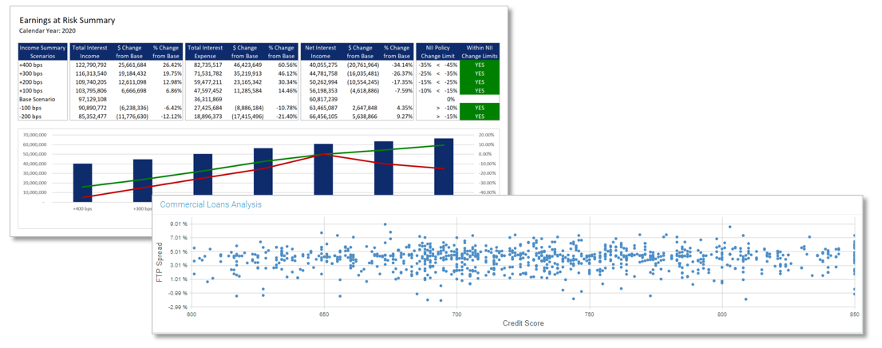

ALM typically only factors interest rate and market risk in its models, not credit or other operational risks driven by changing economic circumstances. Budgeting and forecasting, on the other hand, involve detailed planning for noninterest income, expense, and capital expense planning (Figure 1). Finance leaders should find the right balance of detail and aggregation for comparative analysis, while ensuring efficient margin planning.

2. Develop a Comprehensive Vision

Margin planning aims to establish a comprehensive view of the future to understand performance drivers and how they interrelate. It moves away from siloed business approaches to optimize opportunities across different business areas.

Fee income was a primary focus for financial institutions to earn returns in a low-rate environment, but rising interest rates change that dynamic and the types of products customers demand. In trying to predict demand, bank and credit union leaders should weigh whether customers will keep non- or low-interest bearing products, move to time deposits, or take their business away entirely in search of yield elsewhere.

Consider how to retain existing customers and attract new business to hit growth targets. Examine pricing for fee revenue, rates, and yields for profitable growth. How institutions structure lending activities can affect interest rate risk, liquidity risk, credit risk, and operational risk, depending on the business.

The shifting cost to serve the customer is another crucial consideration. Institutions need capital to bolster branch networks or to offer deposit products, and to find and retain good employees in a tight labor market.

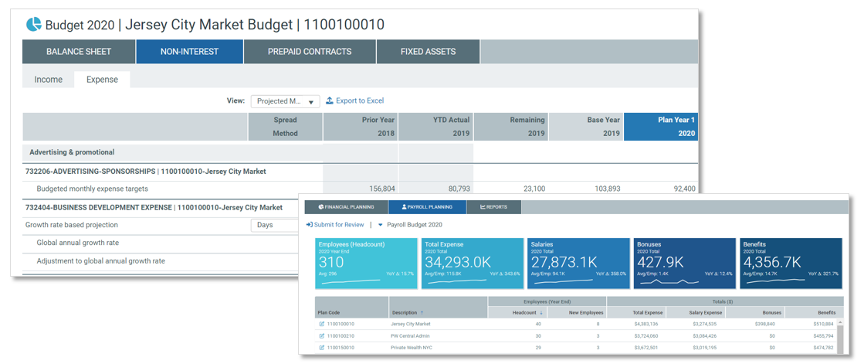

For accurate and meaningful projections, financial institutions need a unified financial planning and analysis solution that provides intelligent and driver-based balance planning, with mapped interest calculations. The solution should allow for instrument-level cash-flow projections and FTP results so the existing portfolio is projected forward with real runoff results.

It should include fixed asset and project planning that can be reviewed and selectively approved, depending on your budget horizon. Employee-level planning capabilities with detailed salary, bonus, benefits, and tax calculations that sunset properly also help establish accurate variance reporting throughout the year.

Syntellis’ Axiom Financial Institutions Suite is a comprehensive solution that delivers these features, provides informed department-level income statements, and helps finance leaders see the full picture clearly by presenting interest/non-interest information layered in with FTP and allocations.

3. Get a Complete View of Economic Performance

Siloed processes prevent many financial institution leaders from seeing a complete view of economic performance, but software solutions can bring together systems, data, and team members to present a clear, complete picture.

Imagine easily incorporating various risk assessment tools into one comprehensive view of future risks and expected returns for assuming those risks.

Visibility also helps improve contingency plans in normal times and during unexpected events such as a pandemic or market crash. Similarly, rolling forecasting empowers financial institutions to assess risks and returns continuously for optimal contingency planning. This is especially important in forecasting margins relative to cash-flow runoff from the current book of business.

An effective financial planning and analysis solution provides insight to the planning process while it occurs, including the ability to easily view and make inputs to the balance sheet, non-interest income, prepaids, and fixed assets (Figure 2). The AxiomTM Financial Institutions Suite updates key performance indicator reports in real time to help finance leaders gauge performance, and quickly pinpoint variances down to the department level.

4. Measure Performance Consistently Between Actuals and Forecasts

There often is a significant disconnect between how financial institutions measure historical performance and how they budget for the future. The budgeting process typically emphasizes controlling overhead, which is important, but can’t drive revenue or top-line growth.

Finance leaders need to think about the future in terms of performance drivers, as with sales forecasting. Questions to ask include:

-

What new loans can we offer?

-

What new deposits can we attract?

-

How can we retain existing customers?

Measure what’s important to your institution’s future performance, not only the past. Most planning tools focus on the general ledger (GL) — which is designed for financial accounting — and can’t meet broader management, accounting, and analysis needs.

For example, the GL may have loans broken down by reporting line item or call code, but that’s not how bankers think about the products. They focus on loans in terms of industries, collateral, or other characteristics that aren’t reflected in the GL. Additionally, there is a disconnect between ALM projections and margin planning — using ALM for interest rate risk management is crucial but cannot be done in a silo. Connect these practices to gauge actual performance.

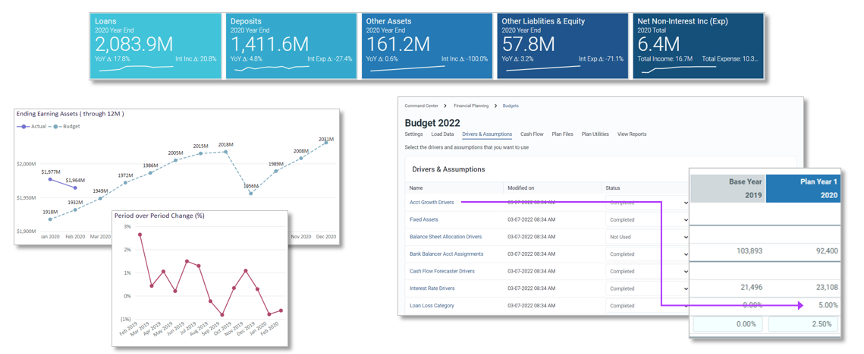

Finance leaders must also use consistent measures institution-wide, whether with period-over-period reporting, ratios, or other measures. This allows for apples-to-apples comparisons to help identify and quantify what factors contribute to shifts in performance.

Running variance reports at different intervals helps leaders assess variances over time to identify temporary blips and ongoing trends. Routine reporting capabilities also alert you to issues as they arise to ensure timely analysis and action.

5. Provide an Interactive Planning Process

Margin planning should be an interactive process that invites feedback and engagement from managers. Too often, managers receive a spreadsheet with numerous input assumptions from the institution’s centralized accounting group. This approach disincentivizes actual planning because they’re just adding numbers from their group or unit with no opportunity to provide substantive feedback.

An intuitive and interactive financial planning and analysis solution empowers managers to enter changes and immediately view how those changes affect the balance sheet and P&L, such as how a change in new business volume growth affects net interest margin or how increasing one product over another may impact required capital. This interactive component is enormously valuable and keeps people engaged in the process.

The transparency and workflow control that an interactive solution provides is also increasingly important for regulators. Dashboards and other reports provide quick visuals for key performance indicators, including both the metrics and whether performance is positive or negative relative to benchmarks (Figure 3).

Individuals can chart and calculate changes and variances, such as actuals to budget, actuals to forecast, budget to forecast, or other comparisons. This information can help finance leaders identify patterns in the way they plan, duplicate successes, and make needed improvements.

6. Ensure Accuracy in Your Modeling

Technology makes it easier than ever to ensure accurate margin planning. For example, making runoff projections from the current book of business based on a clear understanding of individual loan and deposit contracts on an account-by-account level is easy with the Axiom Financial Institutions Suite.

A sound financial planning and analysis tool and a breadth of historical data fuel accurate projection models. Look for a software solution that uses high accounting standards in models and reflects company and regulatory policies — such as leveraging ratio limits or cash and balance-due requirements — to provide “guardrails” for the planning process.

Modern planning and analysis solutions automatically generate balance sheet projections at branch or company levels and process consolidations throughout planning to avoid surprises.

Banks and credit unions should compare and trend their budget against actuals to keep plans rooted in reality. Consider how changes in one area will affect others. For example, charge-off and recovery ratio assumptions must be reviewed when making changes to a loan plan because those changes will alter the loan loss plan.

Ultimately, financial institutions should work to develop plans that are supported from every point of view — not just the numbers on the balance sheet, but all of the components that support and lead to those figures. A robust margin planning solution, such as the Axiom Financial Institutions Suite, makes it easy to follow these best practices for optimal margin planning in a shifting economic environment.

Banks, credit unions, and other financial services institutions have successfully weathered the pandemic storm and express optimism about 2022. Success requires careful planning and the right tools. Syntellis’ Axiom Financial Institutions Suite provides integrated financial planning software to efficiently and accurately budget, model scenarios, transform data into insights, and drive profitability.

Learn more about financial planning with Axiom

At Atrium Health Navicent, ‘Axiom Financial Planning Helps Us Respond to Actual Changes as They Occur’

Tips for Financial Agility and Sustainable Growth in 2022