It’s time for university and college CFOs to ground their institution’s goals in financial realities—and that requires more robust data and a more modern financial planning approach.

The stakes for higher education are high, and no one knows this better than the financial leaders for colleges and universities.

Today, 56 percent of senior leaders in higher education believe their school won’t be viable in the next five to 10 years. A drill-down into the survey results shows CFOs are even more pessimistic about their institution’s chances for survival:

- 66 percent of higher education finance professionals believe the business model for higher education is not sustainable over the next five to 10 years. That’s an increase in negative sentiment of 19 percent in one year.

- 82 percent believe higher education lags other industries in adopting modern financial practices and tools—up 18 points over last year’s survey.

- Yet a significant portion of colleges and universities are not planning to adopt more modern financial practices. 44 percent of higher education institutions don’t plan to improve long-range financial planning capabilities, while 52 percent have no plans to modernize capital planning and tracking.

These are scary statistics, made scarier by the lack of action demonstrated by the nation’s colleges and universities.

Given the increasing pressures higher education institutions face—like significant cuts in funding, lower net tuition, and increased competition for students—the ability to quickly adjust strategies and plans in the face of changing business circumstances is crucial to survival.

But many institutions don’t have the data they need to

increase institutional agility.

This presents a critical opportunity for CFOs to strengthen line of sight into their institution’s performance and the action steps needed for success. There are four strategies higher education CFOs should consider.

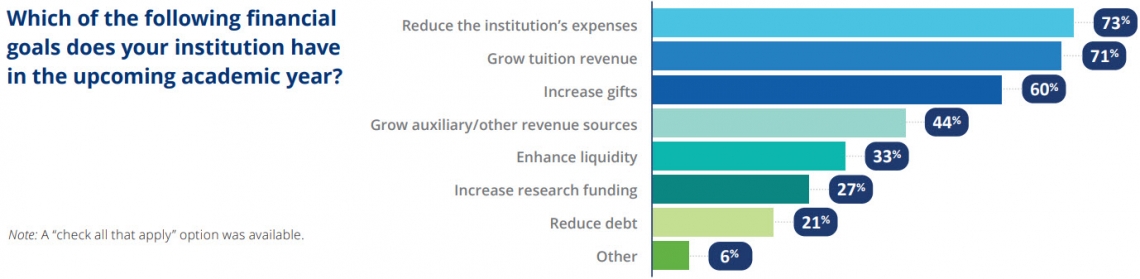

Strategy #1: Ground Financial Goals in Reality

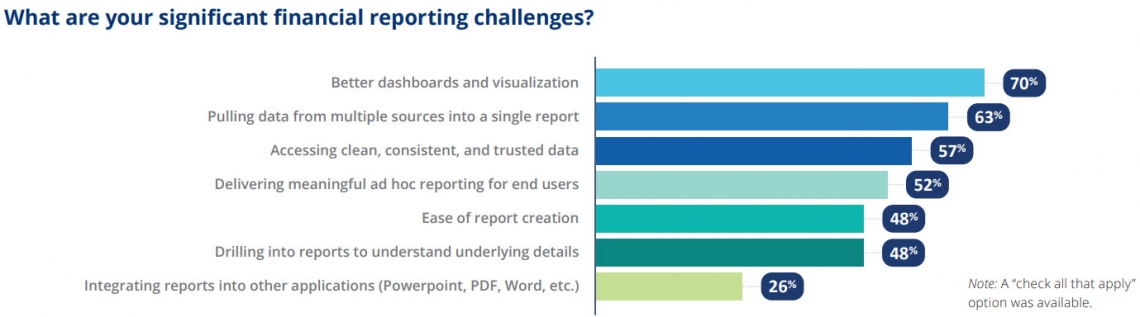

52 percent of higher education CFOs say they face significant financial reporting challenges, including lack of ability to drill down into cost reports to understand their expenses. Without the ability to visualize factors driving program, student, and administrative costs, CFOs are left making educated guesses based on limited insight. In a continually changing landscape, that approach is no longer enough.

CFOs should push for investment in more robust tools for

data reporting and analysis

To achieve their institution’s top goals, CFOs should push for investment in more robust tools for data reporting and analysis. Such tools reduce guesswork and encourage accountability in financial planning. Types of tools CFOs should consider include:

- Tools that support streamlined reporting and analysis—without manual data integration

- Executive dashboards that highlight trends, variances, and outliers

- Solutions that provide the ability to create personalized reports for in-depth analysis

- Systems that support automated distribution of reports in a variety of formats

- Solutions that integrate statements for ease of use in financial reporting

Strategy #2: Use Financial Planning and Analysis to Drive Improvements

The number of leaders who say their institutions are not planning to improve important financial processes is alarming. Taking steps to modernize financial processes is demanding and resource-intensive work, to be certain. Yet it’s also an area where institutions can gain tangible benefits.

Consider initiative-based scenario planning to develop financial projections, and deploy ongoing risk and sensitivity analyses. These analyses ensure the institution can afford to execute its strategy. They also provide the basis for informed strategic and operational decisions in a rapidly changing environment.

Strategy #3: Conduct Rolling Forecasts

Nearly one out of four higher education institutions do not conduct in-year reforecasting, and 29 percent do so just once or twice a year. To protect their institution’s viability in 2019 and beyond, CFOs should consider quarterly or monthly reforecasting or rolling forecasts.

CFOs should consider quarterly or monthly reforecasting or rolling forecasts

Rolling forecasts support more frequent updates to financial plans and are more responsive to changing conditions. We’re seeing many financially challenged industries move toward more frequent in-year reforecasting or use rolling forecasting to replace or enhance the budgeting process.

Strategy #4: Use Key Performance Indicators (KPIs) to Measure and Communicate Current Financial Position and Future Outlook

More than half of higher education institutions don’t use KPIs to measure and communicate their financial health—a 14-point increase in the past year. It’s true that KPIs are a challenge for higher education institutions: Few industry-specific benchmarks for revenue and productivity are available, and institutions struggle to define, calculate, or share KPIs with leaders and boards. However, we’re seeing the emergence of increasingly sophisticated systems and tools that make KPI reporting easier—increasing transparency around financial health and performance. CFOs should explore new tools for KPI measurement and reporting to assess the value of this approach.

Time for a New Value Proposition

With higher education institutions feeling the squeeze of higher costs and increased competition for revenue, it’s time for CFOs to modernize their institution’s financial reporting systems and approach. The tools are available to support solid, data-enriched decision making. Bold action based on data-driven financial insight will strengthen an institution’s viability—now and in the future.

From financial planning to budgeting and beyond

Explore Axiom Higher Education Suite