National Hospital Flash Report Results: May 2020

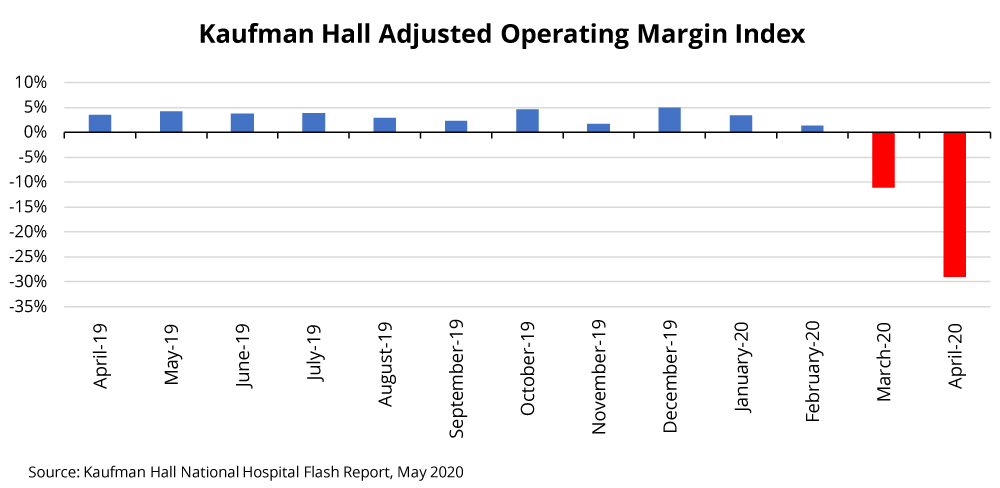

Hospitals across the country suffered a brutal month in April, as steep volume and revenue declines drove record-poor margin performance, setting the stage for not only a difficult recovery, but a permanently changed healthcare delivery environment.

Operating EBITDA Margins fell 174% compared to the same period last year and were down 118% from March, as hospitals felt the first full month of COVID-19’s impacts. Operating Margins fell 282% year-over-year and 120% compared to March. Median hospital Operating Margins fell to –29%, as measured by the Kaufman Hall Hospital Operating Margin index.

April’s devastating results follow a challenging March, when hospitals first saw the pandemic cause across-the-board volume declines starting mid-month. In April, Operating Room Minutes fell 61% compared to April 2019—more than triple the declines seen the month before. Discharges fell 30% year-over-year, and Emergency Department Visits dropped 43%. Outpatient Revenues fell 50% year-over-year and 51% below budget, while Inpatient Revenues declined 25% year-over-year and fell 30% below budget.

Dig into Comprehensive Hospital Performance Data from 800+ Hospitals

Read Full National Hospital Flash Report

April’s steep losses came despite aggressive cost-cutting efforts at many hospitals. Even as hospitals look to resume non-urgent procedures, there is widespread uncertainty as to when patients will return, with the virus’ path still unpredictable and nearly 40% of consumers uncomfortable seeking care at a hospital, according to new Kaufman Hall survey findings.

In addition to the immediate financial damage, a volume and revenue shock of this magnitude will lead to major changes in healthcare delivery. While healthcare leaders work to quantify the pandemic’s near-term financial implications and develop sophisticated financial recovery plans, they must also develop a viewpoint about the post-COVID environment and plans for the roles their organizations should play.

At a minimum, hospitals and health systems will need to address major changes in:

- Care models, with the rise in telehealth and new needs to manage infectious diseases

- Cost structure, as organizations seek to regain financial stability in the face of steep revenue losses and possibly permanent changes in demand

- Competitive dynamics, as organizations of different scales and capabilities position themselves for the post-COVID world

April’s results clarify the perilous position that hospitals are in, as well as the potential magnitude of change. Data in the coming months will continue to shape our understanding of the challenges ahead.

For the full report on the financial damages from COVID in April, access the National Hospital Flash Report.

For more information about managing the effects of COVID, learn about our COVID Financial Recovery Services, or email covidrecovery@kaufmanhall.com.