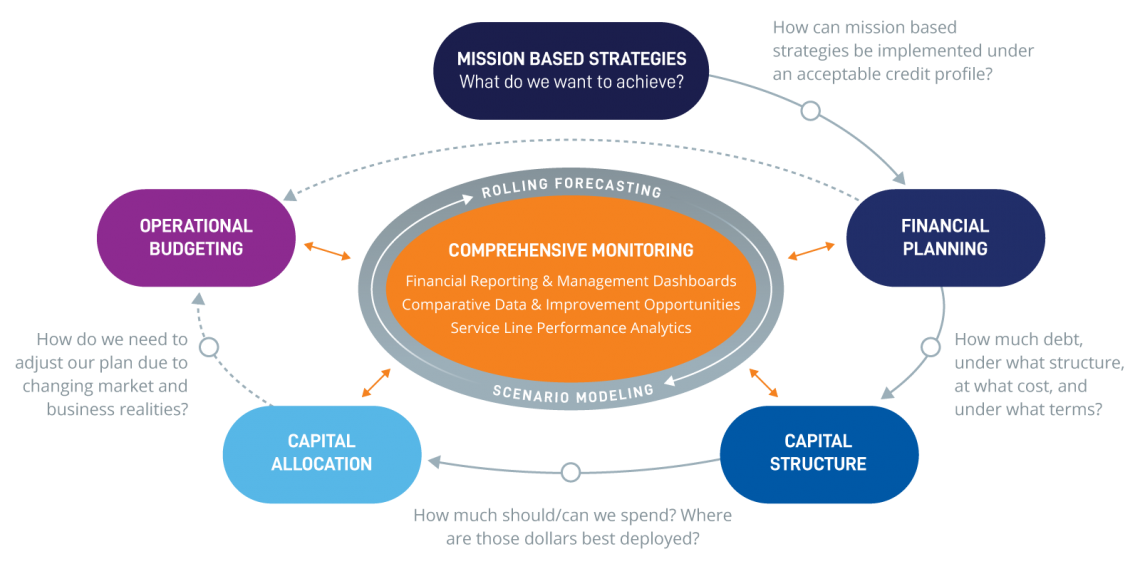

The recovery planning process from COVID-19 will require healthcare leaders to continuously coordinate assessment, forecasting, modeling, alignment, and strategic planning activities as internal and external environments change.

Having the right financial planning software will determine the ease and effectiveness of these efforts.

Although the volume impact of COVID-19 hospital cases has been regional, the financial impact of lost revenues due to lower volumes and the postponement (or loss) of elective surgeries has affected virtually every healthcare organization. Finance teams are planning for “recovery” and “new normal” scenarios, which requires an integrated and highly disciplined approach to financial management and capital allocation.

Healthcare leaders need data analysis, demand modeling, and financial planning on a scale likely more sophisticated than most hospital organizations have previously undertaken. Software tools will play an important role integrating strategic and financial planning to support more confident decision-making.

As organizations support more integrated and continuous planning processes, software tools will need to answer key questions. Planning and analysis capabilities will need to work simultaneously across three dimensions:

- Now – Timely feedback to current performance, national and regional trends, and opportunities to improve

- Near – Forecasting tools that can incorporate timely feedback on how current performance trends may impact business strategies

- Far – Projection tools that frame how a disciplined approach to financial planning and capital management can support business strategies long term.

Planning for when elective surgeries can resume at full capacity and how to make up cancelled procedures will be an important driver of recovery, but considerable uncertainty exists around timing and volume expectations.

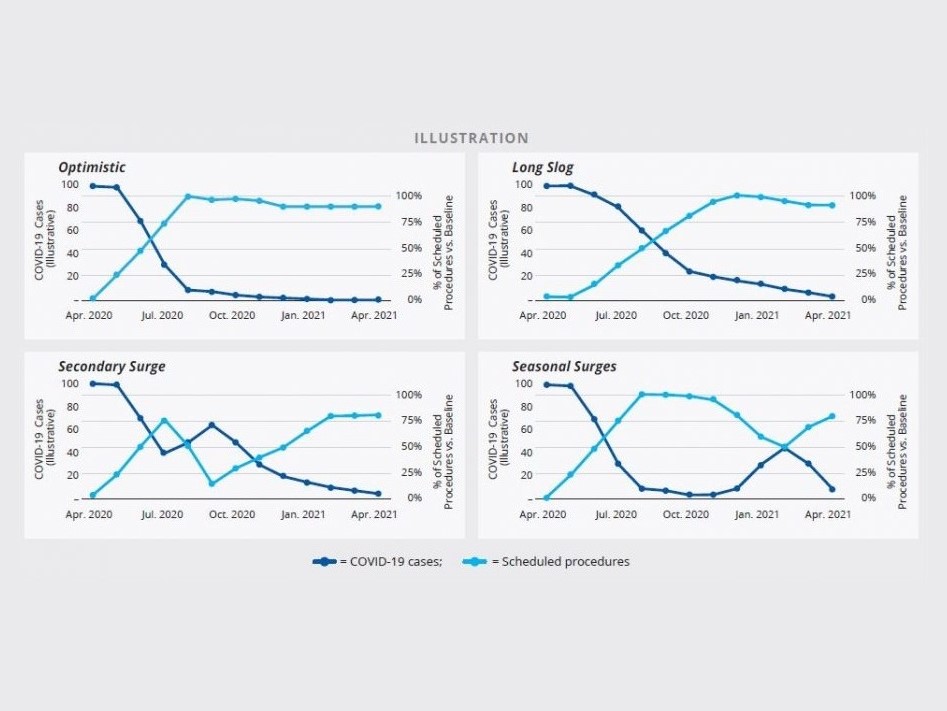

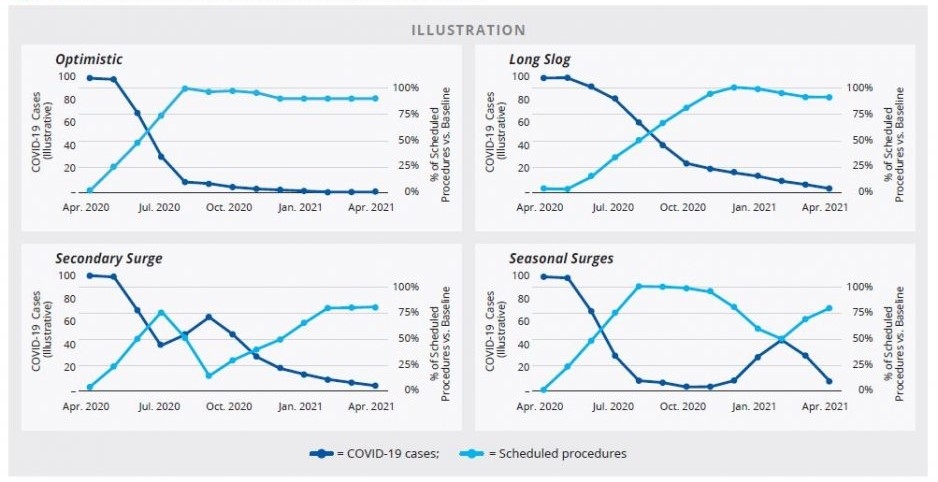

Likely scenarios for COVID-19 recovery

Planning assumptions should consider four likely scenarios:

Scenario 1: Optimistic

A quick recovery. This scenario assumes that COVID-19 cases peaked in mid- to late April, declined moderately into May, will decline sharply through the summer, and fall to near zero through the winter, fall, and spring.

Scenario 2: Pessimistic

A long slog. The surge of COVID-19 cases extends through May, then slows through the summer, fall, and winter, with a small number of cases persisting into spring.

Scenario 3: Second Wave

Secondary surges. This scenario assumes a peak in mid- to late April, a second, smaller peak in the fall, followed by a relatively steady decline in cases through next spring.

Scenario 4: Seasonal Recurrence

Seasonal surges. The final scenario assumes a relatively sharp decline in cases after April, but another peak in the fall and winter, at roughly the time of the original outbreak. This scenario expects COVID-19 to continue to appear seasonally.

The following charts depict the four possible scenarios related to how COVID-19 may impact timing of when elective cases resume and at what level.

Across these scenarios, a broad set of planning assumptions will be impacted.

When modeling various scenarios, start with a baseline of current trends and future expectations and then “layer on” the impact of discretely modeled initiatives.

Performing models and forecasts of growth and cost containment initiatives is difficult and time-consuming when using standalone spreadsheets—tasks that modern software can perform easily. Given the level of expected uncertainty, various scenarios must be modeled efficiently, adjusted as new information is known, and used to provide guidance on how financial and capital plans should be adjusted to meet current business realities.