Forward-thinking colleges and universities find strategic financial planning invaluable to gauge the impact of new buildings, major initiatives, the addition or closure of a department, and pivots like those occurring during the pandemic.

While a budget captures current effects, robust long-range planning tools show potential impacts in five years, 10 years, or longer, including the ramifications on revenues, expenses, credit rating, profit-and-loss statements, strategic plans, and many other dimensions.

Kerry Romine, Director of Strategy and Planning at the University of North Texas (UNT) System, is a veteran Axiom™ Long-Range Planning user. UNT System operates a shared-services model, employing about 500 people in central administration to support 45,000 students.

Romine shares two hypothetical use cases for Axiom Long-Range Planning: a building renovation and COVID-19 impact.

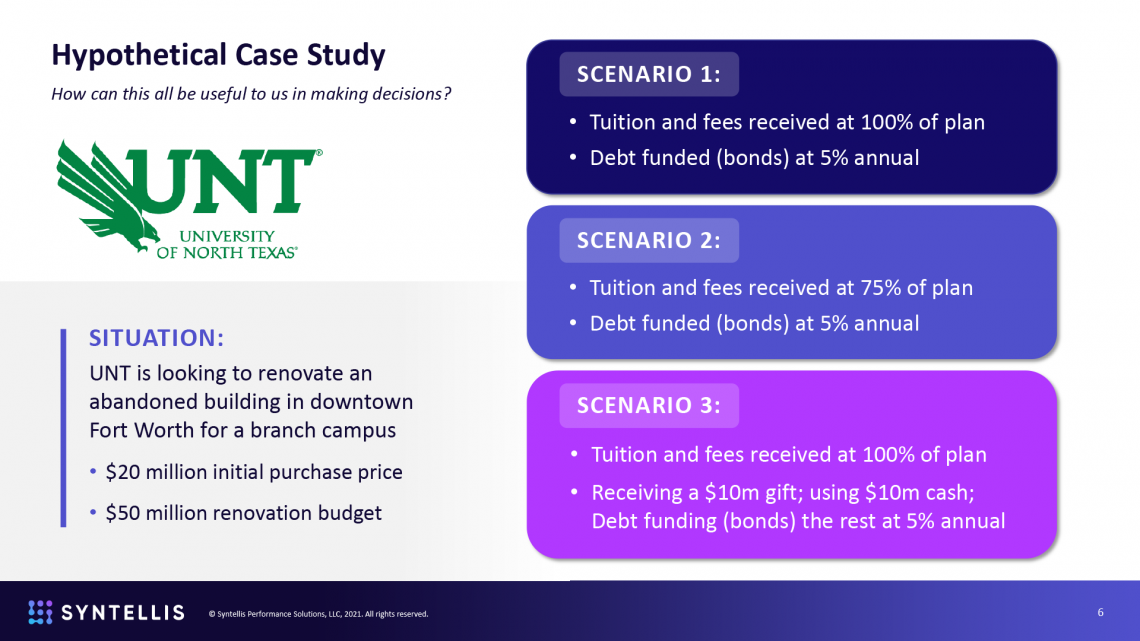

Example A: Building Renovation

Expanding a university’s footprint can take years of careful planning and impact operations for decades — these impacts can be positive, negative, or mixed. Assuming debt to fund a major renovation requires approvals at the highest levels of the university, if not approval at the regional or state level.

Arming yourself with pertinent and relevant data on the proposal goes a long way toward understanding the financial impacts, answering questions from executives, and gaining buy-in or approval of initiatives.

In this hypothetical example (Figure 1), the university system is looking to buy and renovate an abandoned building for a branch campus, with a total outlay of $70 million. Scenario 1 anticipates receiving 100% of projected tuition and fees from the new building and financing the monetary outlay with bonds at a 5% annual rate. Scenario 2 is slightly more pessimistic, lowering projected tuition and fees to 75% while maintaining the funding arrangement. Scenario 3 is more optimistic, assuming full tuition and fees plus a $10 million cash gift that would lower the debt funding to $60 million.

Finance officials can create dozens of scenarios, altering these two variables or creating countless others to fine-tune a proposal. Scenario impacts flow to the consolidated balance sheet, allowing executives to see potential medium- and long-range impacts across financial categories.

However, Romine cautions against creating too many scenarios to avoid analysis paralysis. He recommends using three to five possibilities in most cases and focusing on the scenarios and their potential impacts at a high level, rather than the nitty-gritty details.

“We’re talking about big needle movers here,” says Romine. “If you think about tuition and fees, if 1% equals $100,000, then maybe [create scenarios] every 10%. But I would caution you at getting too detailed in this. You have to keep your executives laser-focused on what the goal really is.”

Example B: COVID-19 Impacts

When it came to modeling the impacts of COVID-19 on 2020-2021 campus operations, Romine made an exception to his rule of running no more than a handful of scenarios, creating a few dozen. As conditions changed and potential paths forward emerged, Romine says, new modeling gave university officials and the Board of Regents the intelligence they needed to guide decision-making.

In these hypothetical scenarios (Figure 2), Romine varied the percentage of tuition and fees received and the length of campus closings, while keeping a 50% refund of housing and dining fees for one semester consistent throughout the models. Scenario 1 showed the university system receiving 90% of tuition and fees and a one semester campus closure. Scenario 2 budgeted 80% of tuition and fees and campus closed through the summer. Scenario 3 budgeted for 70% of anticipated tuition and fees, a campus closure through May 2021, and the indefinite delay of capital expenditures. The latter scenario, while more pessimistic on tuition/fee revenue and campus closures, mitigates those downturns somewhat with the CapEx spending delay. Presenting a variety of scenarios gave executives options and demonstrated how a decision impacts the balance sheet in five years, 10 years, or longer.

Strategic financial planning isn’t about changes on a micro level such as a department or a program emphasis within a school. In the COVID-19 scenarios, Romine points out that UNT campuses generate $225 million in tuition and fees annually, making each 10% gradient a $20+ million revenue swing.

UNT System continues to model for potential, lingering COVID-19 impacts such as declining efficacy of current vaccines and what impact that could have on university operations. Romine says Axiom Long-Range Planning makes it simple to change variables, import outside data for analysis, and export scenarios to other systems, allowing users to grow into the software as their comfort level with the software and desire for more sophisticated modeling rise.

“Axiom LRP allows you to do things outside the system, too, that you just don’t envision right now,” Romine says.

Syntellis’ Axiom™ Long-Range Planning empowers higher education professionals to model multiple scenarios and develop mid- and long-term financial plans that are stress tested and aligned to strategic goals. Users can develop driver-based models, build GAAP-based financial statements, and deliver executive dashboards to communicate financial plans across the institution.

Learn more about Axiom Financial Planning for Higher Education:

4 Best Practices for Long-Range Strategic Financial Planning

UNT System Uses Scenario Modeling to Inform Strategic Decisions