Although there is light at the end of the pandemic tunnel, U.S. hospitals and health systems continue to feel the effects.

Following January’s record high number of COVID-19 hospitalizations, February inpatient volumes declined as outpatient volumes continue their downward trend. Expenses rose while margins, volumes, and total revenues all fell compared with February 2020, the last full month before the pandemic’s U.S. impact began.

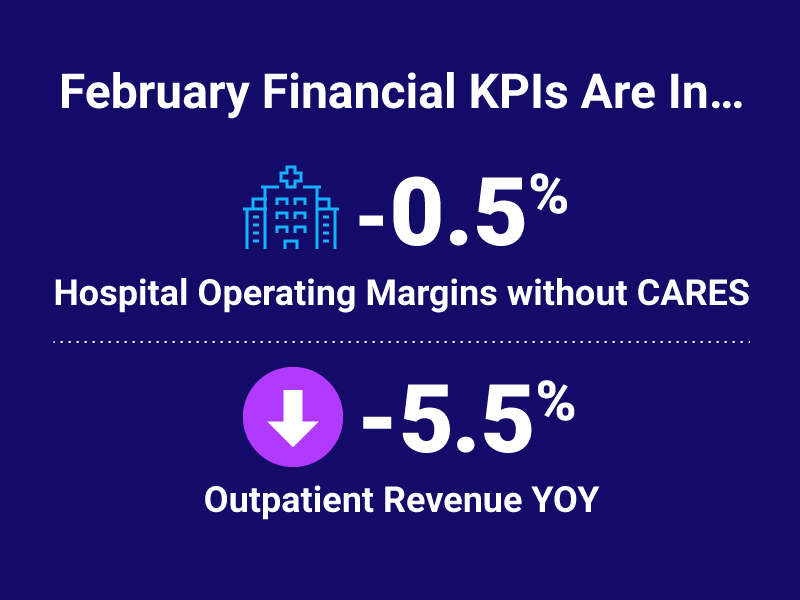

Here are the February 2021 financial KPIs for U.S. hospitals and health systems:

#1 — Operating Margins remain slim

Compared to February 2020, Operating Margin was -0.5% without CARES funding and 0.4% with CARES.

#2 — Emergency Departments continue to struggle

Emergency Departments have seen double-digit volume declines since the pandemic began, down 25.6% year to date (YTD) and 26.8% year over year (YOY).

#3 — Outpatient Revenue still down

Outpatient visits and procedures continue to fall, -8.8% YTD and -5.5% YOY. This is the 10th time in 11 months that Outpatient Revenue fell behind prior year numbers.

#4 — Length of Stay higher

Average Length of Stay rose 8.5% YTD but declined 3.4% compared to January, indicating fewer high-acuity COVID-19 patients.

#5 — OR Minutes decline again

Hospitals continue to struggle with excess capacity, with Operating Room Minutes down 13% YTD and 6.9% compared to last year.

Monthly spotlight: Adjusted Revenue and Expenses

Isolating benchmarks for adjusted revenue per discharge, one would be pleased by the double-digit increases in year-to-date and year-over-year numbers — Net Patient Service Revenue (NPSR) per Adjusted Discharge rose 16.9% YTD and 14.9% YOY, reflecting higher acuity and length of stay among inpatients.

However, adjusted expenses are rising even faster, negating any potential financial gains. Total Expense per Adjusted Discharge numbers increased 24.4% YTD and 19.6% YOY.

Turning data into action

Although hospital C-suite and financial managers long for a return to normalcy, a wholesale return to pre-pandemic operations is unlikely. No one is sure when — or if — patient volumes will return, and the strong trend toward telehealth visits during the pandemic will continue even as in-person visits ramp up. Hospital leaders should be monitoring their payer contracts closely to maximize revenues and better understand how shifts in care will impact finances.

Axiom™ Contract Management helps organizations predict and manage payments, using an organization’s own claims data and payer contracts. Estimate the financial impact of new contracts through “what-if” modeling to get an accurate picture of revenue by patient and better manage contracts, claims, and payments.

Learn more about Comparative Analytics

6 Benchmarking and Comparative Analytics Best Practices

Market Analysis and Monthly Hospital & Physician KPIs: October 2023