Most healthcare providers use traditional annual budgeting processes, but the significant impacts of COVID-19 have made current budgets virtually unusable and introduced tremendous uncertainty into future assumptions.

Amid so much uncertainty, healthcare finance professionals are asking why, how, and when to budget.

The 2021 budget planning process is unlike any other, requiring adjustments to align established financial planning targets down to an operational level and setting new performance improvement expectations.

Strategies to address budgeting challenges

Challenges to 2021 budgeting are bigger than ever due to distracted leadership, more time needed to project the remainder of the 2020 budget, uncertainty about what to incorporate for 2021, and not knowing when the pandemic will subside.

The starting point for the 2021 budget will largely depend on an organization’s fiscal year end, but challenges and solutions are the same across all timelines. Start with what you know:

- At the department level, develop your budget as best you can using historical relationships and volume assumptions you currently have. Any attempt to incorporate the impact of COVID-19 at the department level now will be an exercise in futility since the volume recovery is unknown.

- Layer in the impact of COVID-19 at the entity level.

- Based on your analysis of lost volumes, revenue, and expenses, quantify the impact by entity and place it in a single department within each entity. This will give you a total annual budget for Board presentation and approval purposes.

Utilizing current year forecasting capabilities

Given the widespread impacts of COVID-19, few established budgets reflect reality. Assumptions for 2021 are anybody’s guess. To recalibrate budgets, Axiom™ software has built-in tools to enable monthly reforecasting of plan targets for the remainder of the current year.

Designed for efficiency, the tools support modeling top-down global assumptions with the ability to make more detailed, bottoms-up refinements by department.

How current year forecasting capabilities work:

- Step 1 – Update global assumption drivers, and apply impacts across departments

- Step 2 – Reflect department-specific changes

- Step 3 – Capture additional impacts on assumptions relating to bad debt and other revenue

- Step 4 – Assess the financial impacts, including total and department-specific impacts

This automated approach effectively captures the nuances related to volume growth and, as a result, could be used to update the monthly budget.

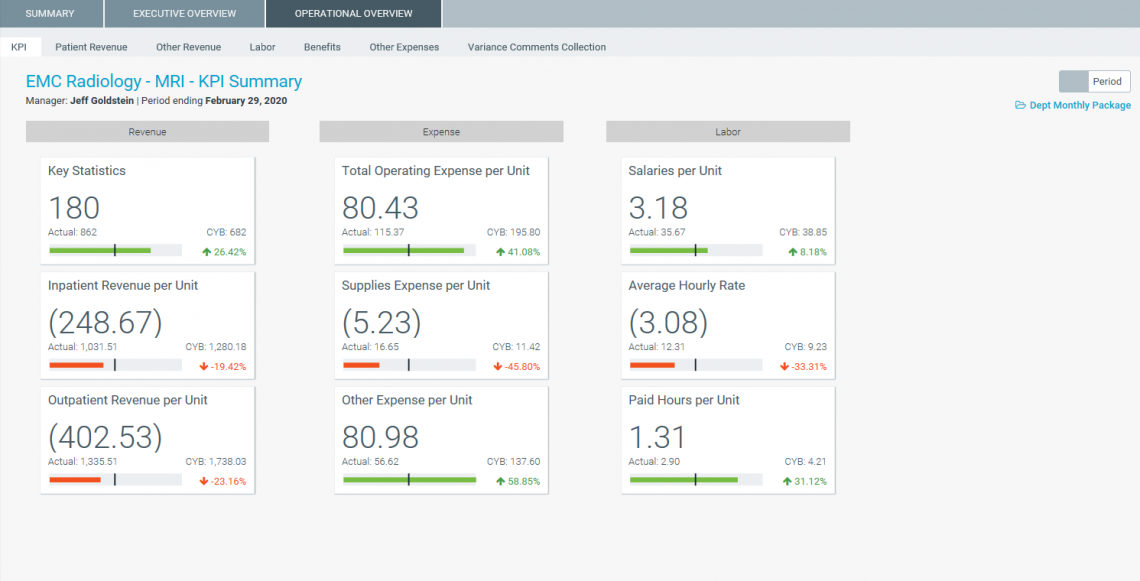

Effective management reporting

The pandemic has also created challenges in traditional management reporting. Especially for those organizations that focus on total dollar and variance percentages to plan, the significant gaps between original targets and current actuals provide little guidance.

Alternatively, traditional month-end variance analysis can apply rolling forecasting principals and shift the focus from dollar variances to analyzing per-unit trends. For example, Axiom software has reports and dashboards that highlight per-unit relationships across revenue, labor, and other expense categories.

Overall considerations to make budgeting cycles more efficient

Efficient budgeting processes help managers make informed decisions and, when necessary, react faster to changing circumstances. Syntellis recommends four best practices to reduce both staff effort and process time without compromising essential budget information:

- Consolidate relevant data into one place. A true enterprise planning solution securely aggregates data from pertinent source systems into one place. These solutions integrate with enterprise resource planning systems and allow for the capture of offline or unstructured data sources. This approach enables users to quickly and easily leverage a range of financial and nonfinancial data for use in budgeting, reporting, analysis, and planning.

- Automate your budgeting process with modern technology. Budgeting using stand-alone spreadsheets is highly error-prone and lacks a meaningful audit trail. Leveraging a solution that automatically consolidates data, manages planning assumptions, and provides real-time reporting allows organizations to reduce cycle times and take advantage of driver-based planning models. This agility enables organizations to model options and make better decisions more quickly.

- Get the right people involved at the right time. The budget process requires not only input from budget submitters, but also negotiations, trade-offs, and approvals. Intuitive budget input forms allow non-finance users to easily review and submit budget requests. These tools drive budget input to the level of the healthcare organization that will manage spending, which increases confidence in the budget process and fosters buy-in for financial plans.

- Spend planning time and effort on strategic activities. Rather than starting from scratch each year, organizations can create a reasonable baseline budget using one of two methodologies: (1) based on prior-year history with inflation factors, or (2) driver-based using a projected factor, such as patient count or total FTEs.

Axiom can rapidly generate these baseline budgets and distribute them across the organization. This approach increases efficiency while also improving accuracy and level of detail where it makes sense. Organization leaders can then simply plan by exception from the baseline.

Ultimately, the budget process should be placed in the context of the organization’s long-range strategic financial plan and proceed from that plan. As budget cycles become more efficient, organizations will be better positioned to align the budget process with the planning process and better equipped to recover quickly.