As the pandemic forced some universities to shift to an online-only model, students and parents are pushing back on higher education’s value proposition. Some even question whether college has become "glorified Skype."

Now, higher ed finance leaders must consider: “How can we tighten planning processes to reduce spending — especially when the move to online education is more expensive than anticipated?”

Universities’ costs are coming under fire from a number of directions, even as they face a 10% increase in operating expenses this fall to reopen during a pandemic. This financial hit deepens higher education’s existing financial woes, from relatively flat tuition revenue to declines in lucrative international enrollments. According to a recent article, enrollment could be impacted more than originally expected, with up to 40% of college freshman not attending in fall 2020. Meanwhile, the move to an online-only model at some institutions eliminates auxiliary revenue such as room and board, which can comprise 9% to 11% of an institution’s revenue, depending on the type of institution.

It’s an environment that forces finance leaders to rethink their institution’s business model, including the way in which they budget.

The Business Case for Reforecasting

No longer can administrators afford inefficient planning processes. With revenue streams under pressure, fundraising revenue likely to decrease, and states collectively scaling back funding, administrative teams must do more with less. This requires teams to streamline budget processes and reallocate resources based on emerging goals.

Reforecasting is one critical way that finance leaders can support more informed financial and operational decision-making in a time of extreme volatility. It involves reassessing the budget at regular intervals — typically, one to four times a year — and making changes to the budget based on current trends and activity.

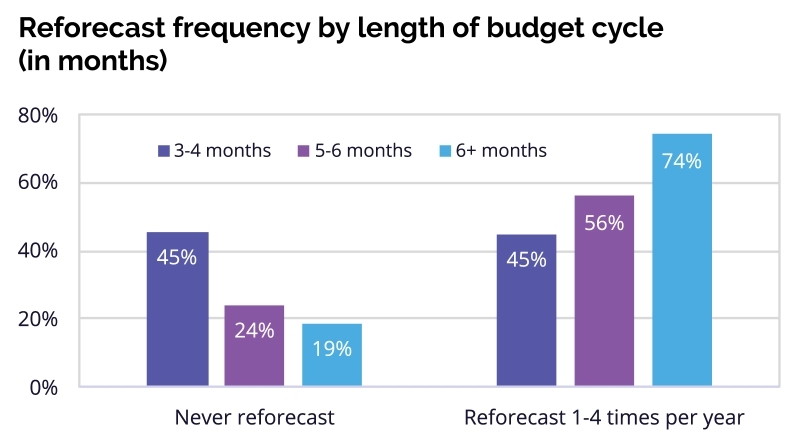

A Syntellis Performance Solutions survey found that 74% of institutions whose budgeting cycles last longer than six months reforecast one to four times a year. That’s important because the data used during long budgeting cycles can quickly become outdated. Without reforecasting, institutions with long budgeting cycles find themselves hard-pressed to react to an institution’s changing needs — critical during the pandemic.

But frequent reforecasting has been slow to take off in many college and universities — one in five institutions with long budgeting cycles do not reforecast at all. Three reasons stand out:

- Cultural barriers to reforecasting. Because institutions spend so much time preparing their budget, there is a sense that the budget is monolithic. As a result, leaders typically do not want to touch it again.

- Inadequate budgeting and forecasting solutions leave leaders reluctant to reforecast. Only one-half of higher education institutions have budgeting and reforecasting software they are satisfied with (54%), and 21% do not have a budgeting and forecasting solution at all. Typically, long budgeting cycles — six months or longer — signal the inadequacy of financial tools. Without the right tools, the budgeting process is prolonged, and the ability to adjust the budget to fit the institution’s changing needs is limited. Finance teams in these institutions often rely on Excel spreadsheets for budgeting and decision-making.

- Reforecasting adds even more work to finance teams. Budgeting cycles in higher education are trending longer: 43% of institutions spend more than six months on budgeting, compared with 34% in 2018 and 38% in 2019. Given the amount of effort that goes into these cycles, the idea of digging back into an institution’s assumptions at regular intervals can be a hard pill for teams to swallow.

EXHIBIT 1:

Source: Higher Education Financial Trends: Priorities, Challenges, and Insights to Get Ahead in 2020, Syntellis Performance Solutions, 2020.

But resistance to reforecasting can hamper data-based decision-making as financial conditions change. It’s a scenario that holds true during the pandemic and also during a less-than-volatile economy.

The Right Tools for Reforecasting and Recovery

Equipping teams with the proper tools for budgeting, reforecasting, and financial planning empowers finance teams to navigate COVID-19 recovery with agility. It also positions teams to more effectively support the institution’s long-term financial plans and goals.

Among higher education institutions with adequate budgeting and financial planning solutions, finance teams report not only improved accuracy and data integrity, but also stronger collaboration institution-wide. Reporting becomes easier, and budgeting takes less time.

In institutions where three-quarters of revenue or more comes from tuition, reforecasting two to three times per year provides a good basis for decision-making. Larger universities and those with more revenue sources can benefit from more frequent forecasts.

The right tools can ease the transition to reforecasting and offer valuable financial insights. Here are five ways to get started with more effective budgeting, reforecasting, and planning.

- Replace spreadsheets with a system that standardizes data, calculations, and reporting. While replacing Excel spreadsheets with a budgeting or planning tool isn’t a cure-all, it ensures a level of insight and transparency that can’t exist when data is disparate and not well-managed. Look for a solution that:

- Automates the budget process. This enables finance teams to budget faster and spend more time on high-value strategic analysis.

- Enables budget variance reporting. This gives finance teams more time for analysis and reduces time spent on subsequent forecasts.

- Integrates enrollment data and financial data. This empowers finance teams to assess the financial impact of real-time enrollment numbers and respond in ways that protect the institution’s financial health.

- Invest in scenario modeling. Scenario modeling moves higher education institutions out of emergency mode toward more strategic discussions around academic product mix, enrollment, and pricing/discounting across schools and units. With this capability, finance teams can efficiently project the impact of a range of scenarios, from a recession to a pandemic, on enrollment, strategies, and the institution’s long-range financial plan. New initiatives that could stem from scenario modeling include offering different majors, a new mix of classes, quantity discounts based on credit load, and discounts for taking classes during unpopular times.

- Use cost allocation tools to uncover the actual cost of providing an education. With these tools, leaders can establish tuition price points based on data and analyses that meet the needs of both students and the institution. The increased transparency that cost allocation tools provide also fuels more collaborative discussions with key stakeholders around how resources are used, the direct and indirect costs associated with programming, where cost shifting and cost sharing exists, and the value of an activity versus its cost.

- Leverage predictive analytics. Today, just 27% of institutions use predictive analytics to support financial planning activities, although nearly half (47%) aspire to do so in the future, the Syntellis Performance Solutions survey shows. Those who do engage in predictive analytics apply this capability to:

- Prediction of revenue (94%)

- Enrollment optimization (59%)

- Performance-based budgeting estimates (59%)

Predictive analytics is an essential tool for finance teams to anticipate changes in their largest source of revenue, but even as analysis technology becomes more readily available, there’s a lot of variability in how higher education understands and applies predictive analytics capabilities. Whether by performing manual analysis and using that information to make predictions or relying on technology designed to model and predict future scenarios, institutions can benefit greatly by analyzing key data to plan for the future.

- Strengthen stakeholder engagement throughout the budgeting and reforecasting process. One way that leading institutions engage key stakeholders is through dashboards and highly visual reports. At these institutions, progress toward meeting the institution’s targets is shared widely, with dashboard scorecards created and distributed for long- and short-term initiatives. When performance falls below expectations, leaders investigate what went wrong, make modifications, or deploy exit strategies — all guided by data. In an evolving environment, visual reports also can help model scenarios for deeper understanding of challenges and help chart the path forward.

A Modern Budgeting Approach

Making mission-critical decisions for higher education in a volatile environment depends on timely data, modern budgeting processes and tools, and stakeholder engagement.

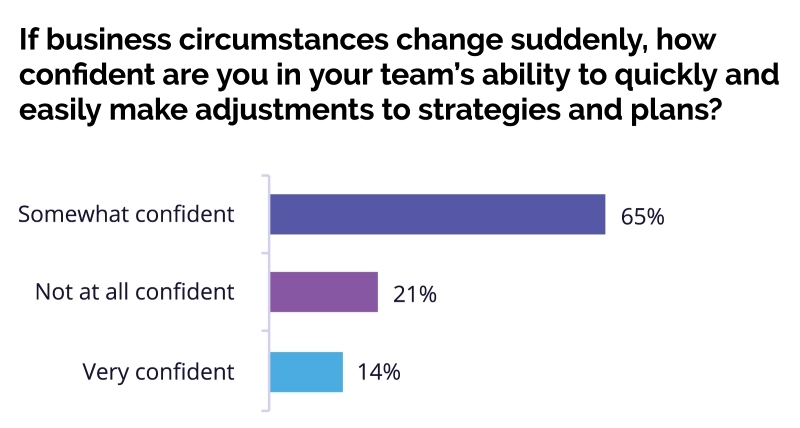

Before the pandemic, 65% of higher education finance leaders were only somewhat confident in their institution’s ability to respond with agility to sudden changes in business circumstances. Now, the ability to demonstrate and strengthen an institution’s value proposition depends on having the tools and the data needed to adapt quickly when circumstances change. Embracing the move to reforecasting, supported by more modern budgeting and financial planning tools, will better position finance leaders to support institutional success, now and in the years to come.

EXHIBIT 2:

Source: Higher Education Financial Trends: Priorities, Challenges, and Insights to Get Ahead in 2020, Syntellis Performance Solutions, 2020.