Thank you for requesting your Axiom RPPS ROI report

Expect an e-mail shortly that shows your potential savings

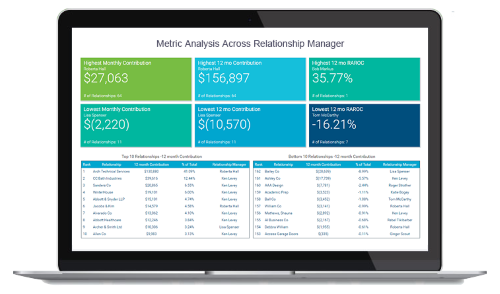

Accurately price, analyze, and manage portfolios with Axiom RPPS GET A DEMO