More than a year into the COVID-19 pandemic, healthcare organizations are seeing clear signs of financial recovery, but not all sectors have returned to pre-pandemic activity levels. To better understand the state of healthcare recovery, we analyzed data from more than 125,000 physicians and 1,000 hospitals in March 2021 — one year after COVID-19 caused drastic changes to the U.S. healthcare system — and compared it to the same time period in 2019, which led to three key findings:

- In some care settings, patient volume and gross revenue have surpassed pre-pandemic levels, pointing to a healthy recovery

- Volume recovery in acute and non-acute care settings is not equal

- Gross revenue per unit is up but often not enough to cover rising expenses

Patient Volume and Gross Revenue Growth

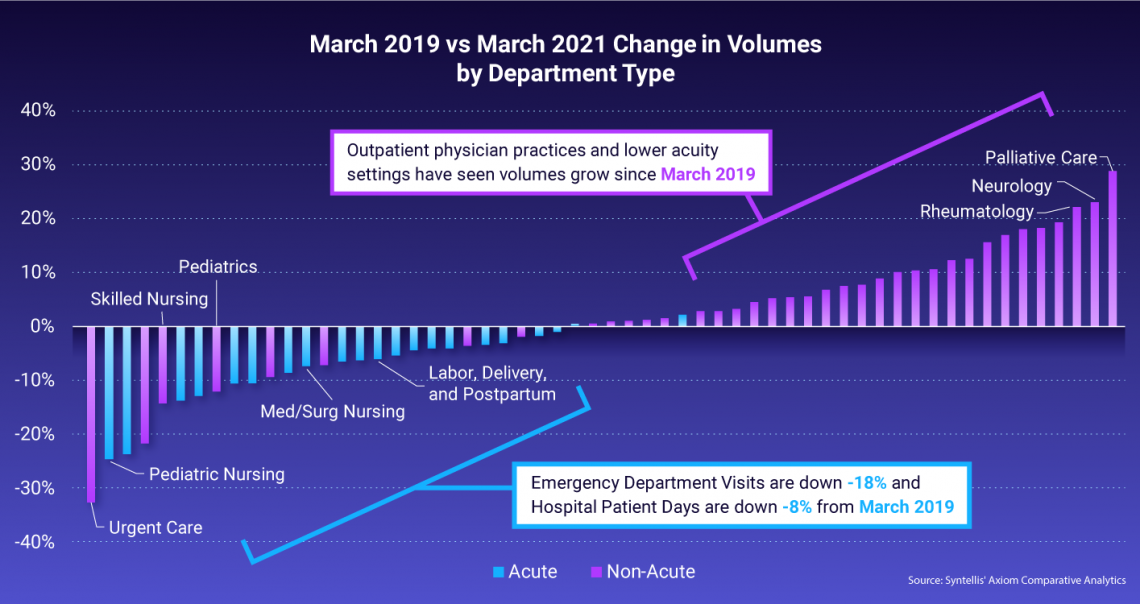

Though 2020 was marked largely by decreasing volumes for hospitals and healthcare providers, in some care settings — particularly non-acute departments — volumes are now surpassing pre-pandemic volumes.

Compared to March 2019, several ancillary services increased in volume in March 2021, most notably imaging, diagnostic procedures, and lab tests. Many outpatient physician practices have also seen an increase in volumes in March 2021 compared to March 2019.

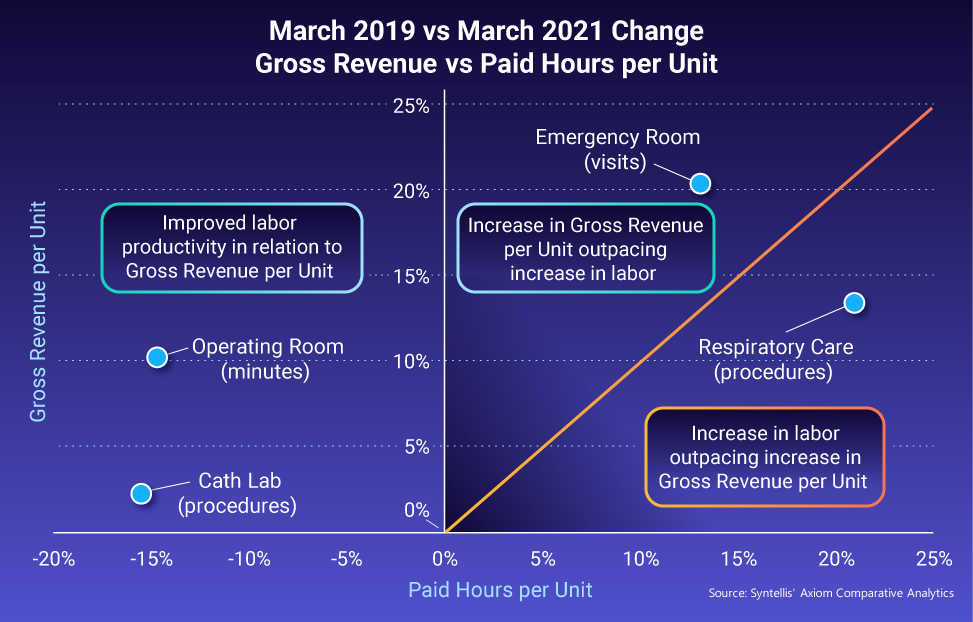

Operating rooms and catheterization labs improved labor costs while increasing gross revenue per minute by 10.3% and increasing gross revenue per procedure by 2.3% in March 2021 compared to 2019. Increases in gross revenue alongside a reduction in labor costs were key to this improvement.

Volumes Remain Low in Acute Care Settings

Compared to March 2019, acute care settings saw patient volumes decrease in March 2021. Emergency department (ED) visits, for example, decreased 18% and patient days in acute nursing departments dropped 8%.

Mother and newborn departments such as Labor, Delivery, and Postpartum have also seen declines in volumes, though this is consistent with recent U.S. Census data showing a decline in birth rates from 2014-2020, and may not be pandemic related.

Expenses Outpace Gross Revenue

While many hospital departments have been able to improve gross revenue, other departments saw increases in expenses that outpaced those revenue improvements.

In respiratory care, for example, paid hours per procedure increased 20.9%, while gross revenue per procedure only increased 13.5% over the same period. In addition, non-labor expenses are up by 26.6% per visit in emergency departments and 36.2% in respiratory care.

The Road Ahead for Healthcare Financial Recovery

To continue in the direction of economic recovery, health systems must continue to monitor the shift in patient volumes to lower acuity environments. This may mean embracing and planning around a new normal in patient volumes at acute settings. However, hospitals should also continue educating patients on when and how to safely seek appropriate care in the ED.

Hospitals must also carefully monitor costs in relation to gross profit. Because non-labor costs can take longer to adjust, it’s critical that hospitals continue to pay special attention to labor costs to maintain or improve profitability.

With an understanding of these changes, hospitals and health systems can better position themselves to make informed planning decisions so they can evolve and adapt business models to ensure exceptional patient care and long-term financial sustainability.

Source: Syntellis’ Axiom™ Comparative Analytics, which offers access to real-time data drawn from more than 1,000 hospitals, and 125,000+ physicians from over 10,000 practices and 139 specialty categories. Powered by Syntellis IQ, Comparative Analytics also provides the data and comparisons specific to a single organization for visibility into how their market is evolving.