The latest data show that hospitals and health systems nationwide continue to see sizable growth in outpatient demand, as patients increasingly opt for more convenient and accessible care options.

It’s a phenomenon made possible by medical advancements in recent decades that have made it safer to conduct many surgeries, procedures, and other healthcare services away from the more robust infrastructure and resources of inpatient settings. As a result, hospitals are experiencing fundamental shifts in patient volumes and revenues.

Recent data from more than 1,300 U.S. hospitals show significant growth in outpatient revenues over the past year. December 2023 marked the eighth consecutive month of year-over-year increases in outpatient revenue. The metric was up 8.7% compared to December 2022 and jumped 15.7% versus two years ago in December 2021, according to Syntellis’ AxiomTM Comparative Analytics data.

The growth was consistent throughout 2023. From January through December 2023, outpatient revenue was up 9.8% versus 2022 and jumped 18.8% versus 2021.

Hospitals also saw increases in outpatient revenue as a share of overall gross revenue, measured as the inpatient/outpatient adjustment factor. The metric was up 3.1% for 2023 versus 2022 and 6.8% for 2023 versus 2021.

Hysterectomy procedures reflect care setting shifts

To dive deeper, analyses of trends in hysterectomies across both Syntellis’ clinical and claims datasets provide further evidence of the shift from inpatient to outpatient care. With about 600,000 hysterectomies performed in the U.S. annually, it is one of the most common surgeries for women.

An analysis of clinical data over the past five years shows that hysterectomies are gradually moving away from inpatient settings, with most of such surgeries now done in outpatient settings.

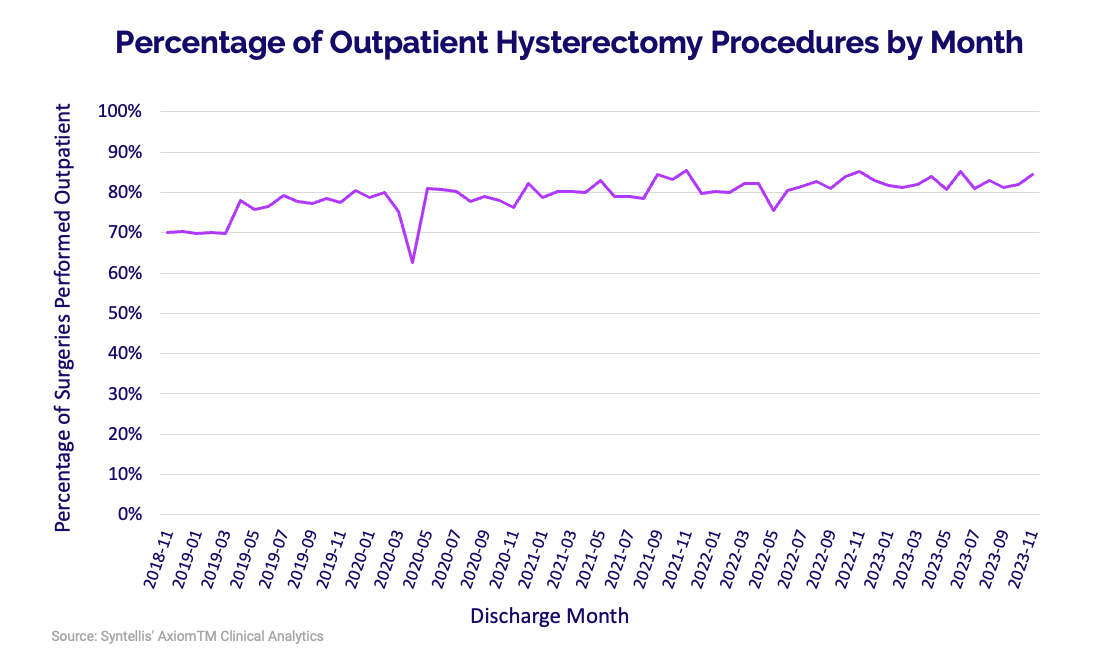

Syntellis’ AxiomTM Clinical Analytics and All-Payer Claims Dataset (APCD) data show the share of hysterectomies done on an outpatient basis rose more than 14 percentage points over the last five years. Looking first at the Clinical Analytics data, the share of outpatient hysterectomy procedures by month rose from 69.9% in November 2018 to 84.5% in November 2023

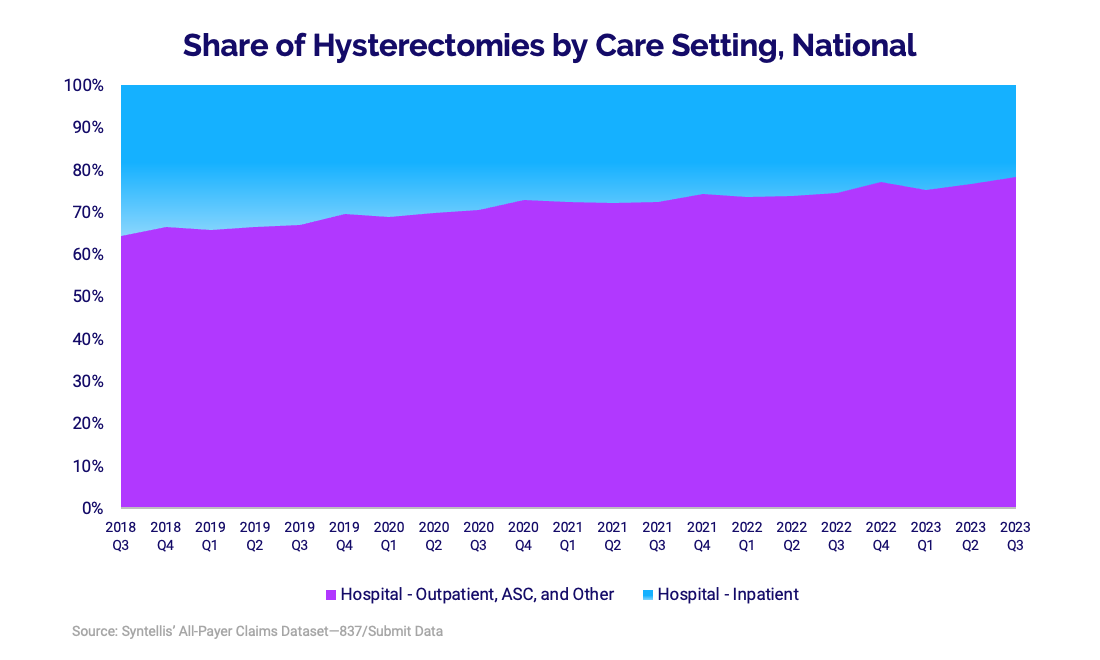

Data from Syntellis’ APCD tell a similar story. From the third quarter of 2018 to the third quarter of 2023, the percent of hysterectomies performed in outpatient hospital settings or ambulatory surgery centers rose from 64.5% to 78.4%. Meanwhile, hysterectomies performed in inpatient hospital settings declined from 35.5% to 21.6% over the same period.

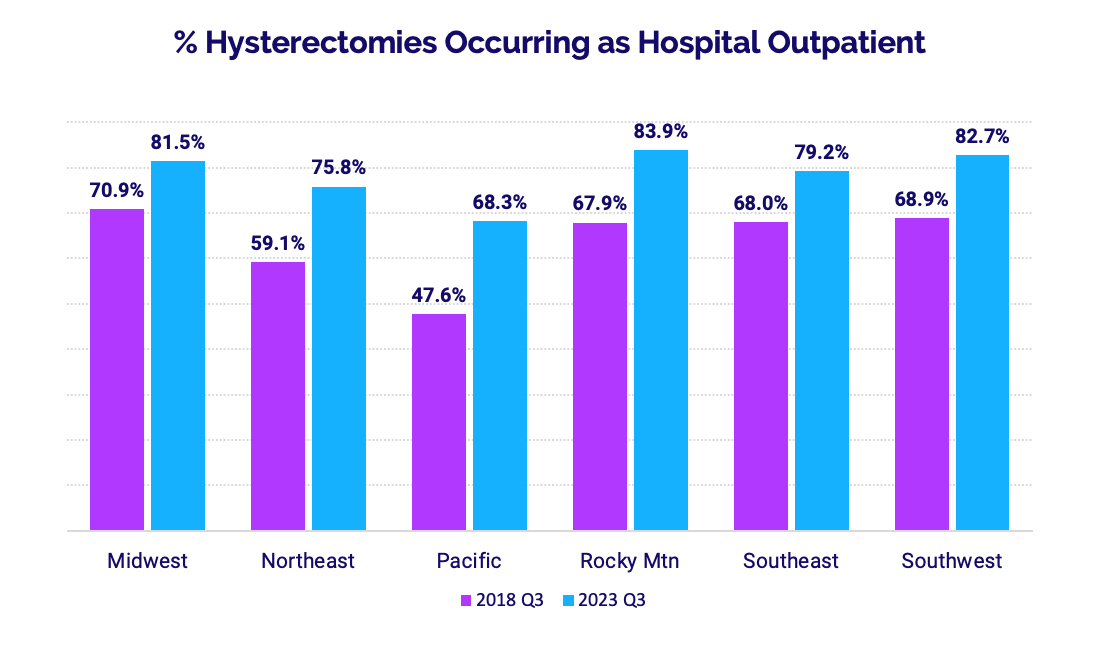

While growth in demand for outpatient care is consistent nationwide, the APCD data show regional variations in how quickly hysterectomy procedures are moving to outpatient settings. As of the latest data from Q3 2023, the Rocky Mountain* region had the largest share of the surgeries performed on an outpatient basis at 83.9%, up 16 percentage points from 67.9% in Q3 2018. The Pacific* region had the lowest share of hysterectomies performed in outpatient settings, but saw the biggest jump up 20.7 percentage points from 47.6% in Q3 2018 to 68.3% in Q3 2023.

Multiple factors may be contributing to regional variations in outpatient care, such as the availability of outpatient facilities, different payment models, or socio-economic or demographic factors that can influence things such as patient preferences or co-morbidities that require more intense patient care.

One thing is clear — the demand for outpatient services continues to climb, and hospitals and health systems must continue to evolve their service delivery models to meet that demand. With access to current market data and analytics through tools such as AxiomTM Market Opportunity Analysis, healthcare organizations can monitor patient behaviors — including what services they are seeking where and when — and adapt their growth strategies accordingly.

Learn more about AxiomTM Market Opportunity Analysis here.

*Note: Syntellis’ APCD Claims Dataset—837 Submit Data defines the Rocky Mountain region as consisting of Colorado, Idaho, Montana, Nevada, Utah, and Wyoming. The Pacific region includes Alaska, California, Hawaii, Oregon, and Washington states.

Learn more about Axiom Comparative Analytics

Healthcare’s Mounting Labor Challenges Strain Hospital Expenses, Operating Margins

3 Ways to Use Axiom's Analytics to Address Healthcare Labor Challenges