Value-based care, consumerism, and the pressure to strengthen balance-sheets demand a new breed of healthcare finance leader. A recent Black Book survey shows that a more intense focus on leveraging digital technologies and advanced analytics is needed to boost performance.

It’s no longer enough for healthcare CFOs to have deep skills in overseeing revenue cycle, managing insurance contracts, analyzing historical trends, and ensuring compliance, according to Black Book. Today’s CFOs also must manage technology decisions across the enterprise—and that requires out-of-the-box skills for many incumbents.

In this new era, “Financial managers must have a strong technical background, and CFOs will require the data science skills that currently fall under the health system CIO,” said Doug Brown, president of Black Book, in a release.

That’s a daunting prospect for CFOs—but it’s also an incredible opportunity. One key to success: embracing this challenge using data science capabilities that are already within their grasp.

Diagnosis: Heavy reliance on manual processes

Black Book’s survey results show healthcare organizations face increased pressure to automate highly manual tasks and leverage data analytics for improved performance:

- 83% of healthcare finance leaders rate big data and advanced analytics as the biggest potential disrupters to their current workflows and operations

- 92% say their organization is actively addressing technology- and analytics-fueled disruption

- 96% of finance leaders know they must develop future or existing talent to gain necessary capabilities in advanced finance technology and analytics

- Healthcare organizations’ digital capabilities are extremely limited, with few organizations having digitized more than 25% of their transactional work, despite the potential for strong returns

Significant gains can be achieved by moving toward highly digitized, analytics-based finance functions. Eighty-six percent of hospitals that digitized more than 25% of their financial processes since 2017 realized a “substantial” return on investment.

A prescription for innovation

Kaufman Hall’s Axiom Solutions were named one of the nation’s top client-rated software and services vendors by Black Book, and our experience building these solutions and partnering with many of the country’s leading healthcare organizations provides a unique perspective on how healthcare CFOs can lead their organizations through disruptive change by embracing advanced analytics.

Shorten long budgeting cycles with rolling forecasting. Nearly half of healthcare CFOs say their budgeting cycles don’t give leaders enough time for value-added analysis that can inform strategic decisions, a recent survey found. One in three CFOs say their budgeting process takes six months or longer.

These timeframes don’t support the level of organizational agility required to change course quickly in response to evolving market conditions or competition from new entrants to healthcare. In addition, lengthy budgeting cycles drain organizational assets and energy—two scarce resources in a disruptive environment.

These challenges have prompted 40% of healthcare organizations to use rolling forecasting as a complement to the annual budgeting process. Rolling forecasting strengthens the healthcare finance department’s ability to provide frequent and timely performance analysis. It also integrates strategic and financial planning more effectively.

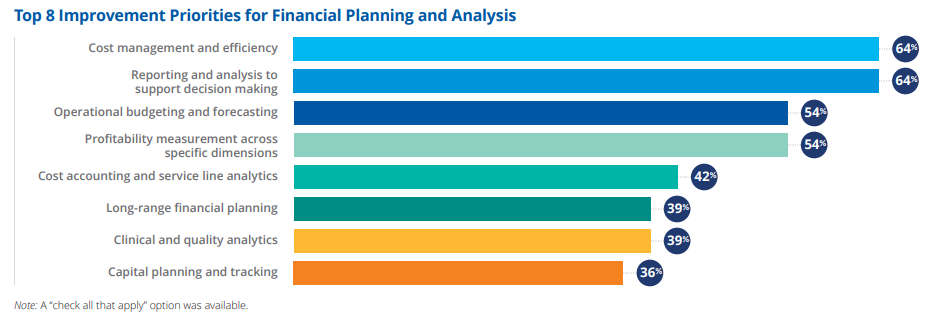

Elevate profitability measurement across dimensions using advanced analytics. There is no shortage of opportunities to boost financial planning and analysis capabilities in healthcare, CFOs agree. One in two CFOs point to the need to strengthen profitability measurement, likely due to intense executive interest in the impact of service line performance on cost.

Proactive healthcare leaders use profitability analyses to inform decisions around right-sizing and right-placing services and facilities. By connecting the dots between such analyses and their organization’s strategic financial plans, these CFOs ensure limited resources are allocated effectively.

Exhibit 1: CFOs Share Top Improvement Priorities for Financial Planning and Analysis

Beef up cost accounting capabilities with tools that automate advanced analysis. Most healthcare leaders say their biggest challenge in improving performance is a lack of good data around costs and savings opportunities. With new payment models emerging, the ability to assess costs across the continuum of care is critical. So is the ability to simulate value-based payment methodologies to project their bottom-line impact.

High-quality cost accounting tools enable CFOs to model and forecast the impact of value-based payment contracts. They also strengthen CFOs’ abilities to visualize costs at the patient or service line level and use the data to design strategies for improvement.

A New Mantra for Change

Lack of advanced analytic capabilities increases pressure on healthcare organizations in an era of disruption, the Black Book survey shows. These results call for CFOs to embrace not only the need for change, but also the technological capabilities required to drive improvement. By shoring up bench strength and resources for technology-enabled disruption, CFOs can more effectively lead their organizations through transformational change.