The pandemic put pressure on the healthcare workforce in numerous ways, including intensifying the labor shortage. Some areas, such as outpatient settings, flexed their staffing models to help offset volume variability. Others, such as inpatient medical units, quickly found their labor overworked without enough staff to cover the influx of patients seeking care.

Even before the pandemic in 2019, the healthcare industry had the highest percentage of job openings, according to the U.S. Bureau of Labor Statistics. Nurses have been in high demand for several years now, and, in 2020, many healthcare organizations had to bring in temporary staff — at a much higher hourly rate — to cover the shortage as COVID-19 cases surged. Now, as healthcare organizations look to fill open positions with permanent staff, several are offering never-before-seen signing bonuses as an added incentive.

Across the entire healthcare landscape, data from organizations nationwide shows wide swings in overtime, contract hours, and labor expenses. These measures intended to cover the labor shortage have put additional pressure on healthcare organizations as financial, operational, and clinical leaders work towards recovering financially from a tumultuous year. We know that labor challenges aren’t new in healthcare, but the question remains, how can healthcare leaders better prepare for labor volatility and ensure profitability going forward? And how can the experts and consultants who work with them easily identify problem areas and drill into root causes?

A Closer Look at Healthcare Labor Data

Labor data from over 1,000 hospitals across the country paints a picture of some of the unique challenges facing hospitals today.

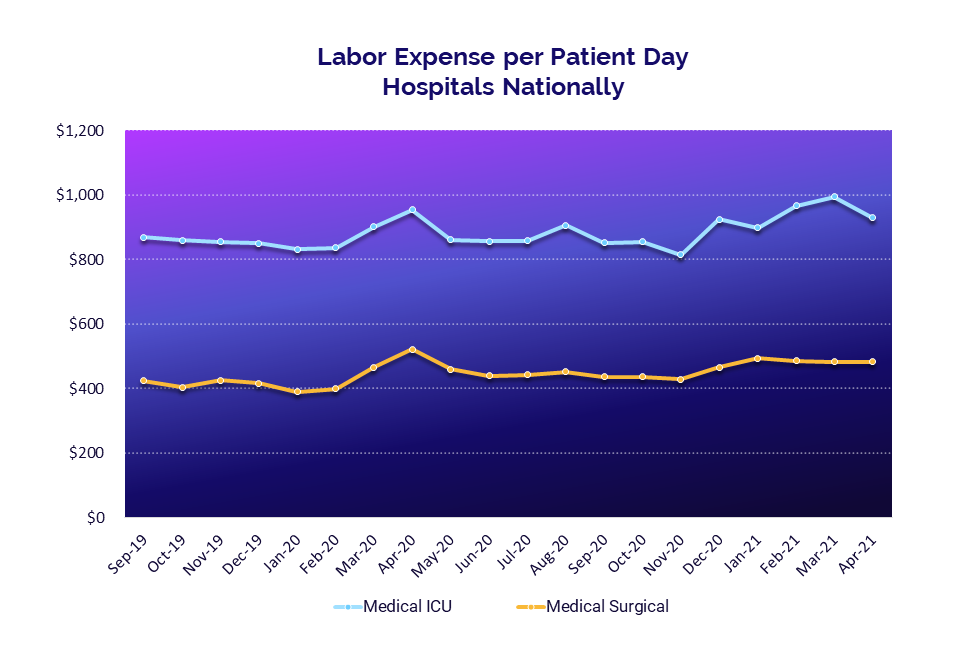

Among Medical ICU and Medical Surgical departments, labor expenses per patient day have increased 9% and 18%, respectively, compared to the historical trend prior to the pandemic.

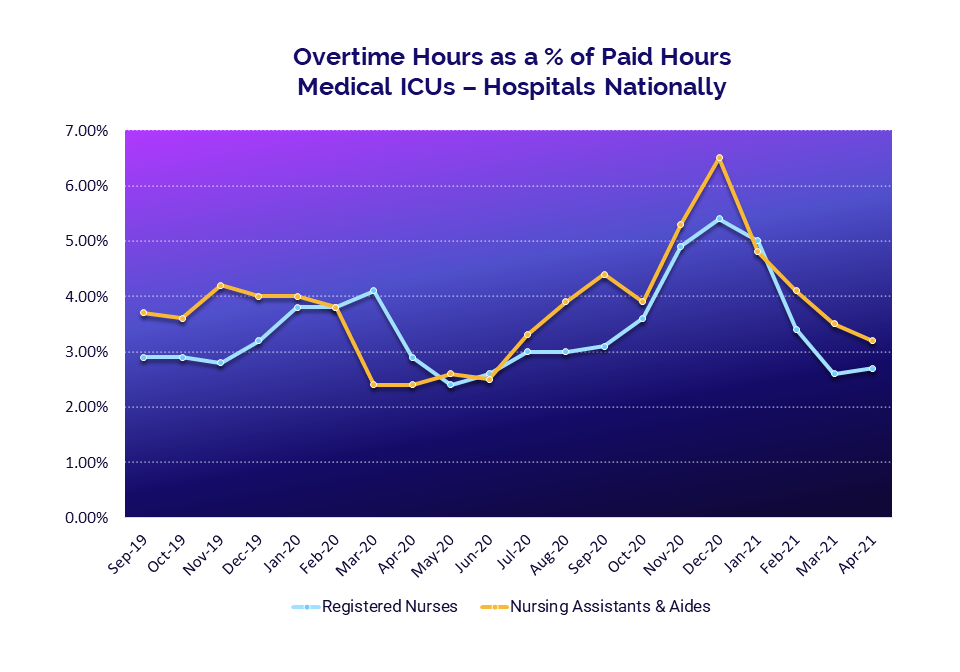

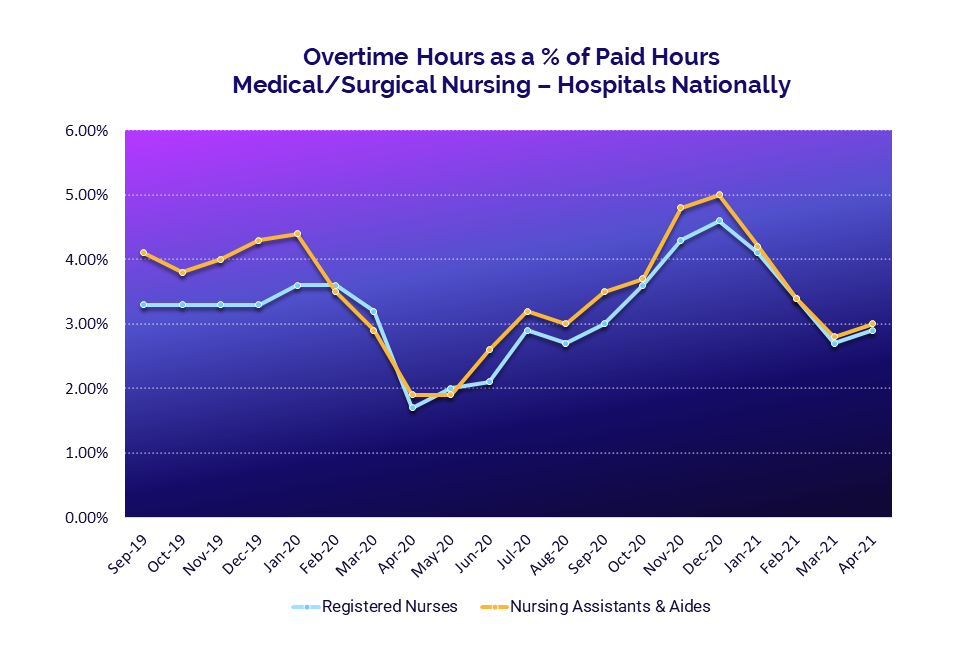

One contributing factor is overtime pay among Registered Nurses and Nursing Assistants & Aides in these departments. Both departments show a similar pattern of overtime hours as a percentage of paid hours — declining in the first half of 2020 then accelerating in late 2020 to levels higher than the historical trend before the pandemic. While these levels have reduced below historical trends in recent months, time will tell if this trend will hold.

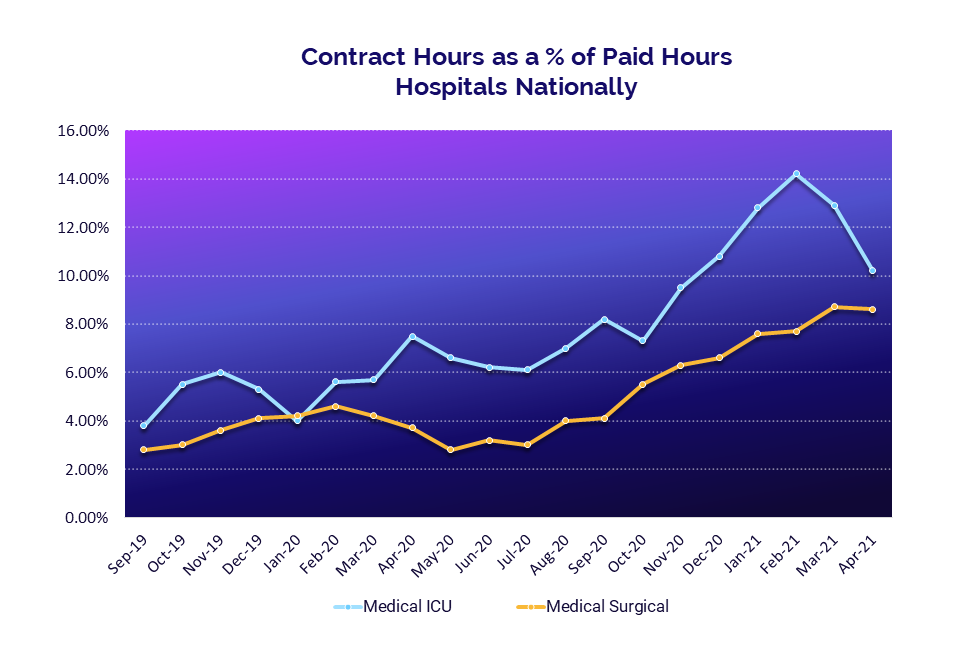

Another possible contributing factor to high labor expenses is the use of temporary or contract labor, measured by contract hours as a percentage of paid hours. Since mid-2020, contract labor has risen in Medical Surgical departments and in Medical ICUs — except for the most recent few months.

To help offset the high cost of contract labor, hospitals may consider incenting permanent staff with a bonus to pick up more shifts.Ideally, this would result in a softer blow to the bottom line and offer the bonus that staff continuity brings to an organization’s workforce. However, the question of long-term sustainability remains.

Comparative Benchmarks Provide Context for Evaluating Staffing Models

A careful examination of labor expense and the contributing factors is essential to understanding an organization’s financial health and the “new normal.” Comparing an organization’s performance to that of their peers in the region or of a similar type of organization helps take that analysis to the next level and identify opportunities for improvement. The use of comparative benchmarks, particularly at the department and job code level, provides the best visibility for evaluating staffing models, such as the use of overtime and contract labor.

This level of analysis is made possible by data from Syntellis Market Insights, which delivers to consultants timely, robust benchmark data and provides context to what’s happening in the healthcare market as recently as the previous month.

Syntellis Market Insights empowers continuous improvement investigation and conversations with the entire healthcare enterprise by bringing together data monthly from more than 1,000 hospitals, 125,000 physicians, and non-acute facilities nationwide to give you the most objective and current view into the evolving healthcare market landscape. Leveraging these insights, you can accurately compare a hospital, health system, or physician practice’s performance to peer organizations, set improvement targets, guide organizational change, and evaluate the success of organizational transformation action plans.

Contact us to learn more.

Read more about Syntellis Market Insights:

Healthcare Data Set

Syntellis Market Insights for Capital Markets