This series aims to help leaders of U.S. colleges and universities with financially based planning and management needed to navigate a rapidly changing business environment. In this fourth article, we describe a high-quality process for allocating capital resources, and its fit into a recommended planning and funding cycle. Read the first, second, and third articles in the series.

Why is resource allocation so difficult?

Resource allocation is the process by which leaders of an institution quantitatively define available capital resources and make decisions regarding the deployment of those resources for re-investment purposes, investment in future growth, or as reserves on the balance sheet.

Sounds simple, right? Not really, as many of you may experience.

Often the key challenge stems from the fact that while true resource allocation is a strategic process, sufficient capital resources are not available to fund all desired strategies. As a result, a less structured and disciplined process easily becomes a political exercise instead of a data-based decision-making process. Leaders always must make choices. Their decision-making process and the choices that emerge are critical to the long-term sustainability of all colleges and universities. Resource allocation must ensure the continued financial strength and mission effectiveness of the institution.

How is this best assured? By allocating resources within a planning cycle.

The recommended resource-allocation process, with a proven multi-decade record of accomplishment in non-profit organizations and for-profit companies, supports a university or college’s strategic goals by doing the following:

- Linking financial planning and capital resource planning to the objectives and priorities of the organization’s strategic plan

- Providing a “portfolio” context for allocation decisions that incorporates the priority strategic, mission, and operational goals of the institution

- Defining a disciplined and consistent framework for evaluation of all proposed uses of defined capital resources

- Ensuring a process structure that is rigorous and transparent, supporting comparisons among initiatives throughout the institution and accountability for investment results

This type of resource-allocation process will allow universities and colleges to find an acceptable balance between the need for continuing strategic investment and the ability to generate resource capacity.

Find an acceptable balance between the need for continuing strategic

investment and the ability to generate resource capacity

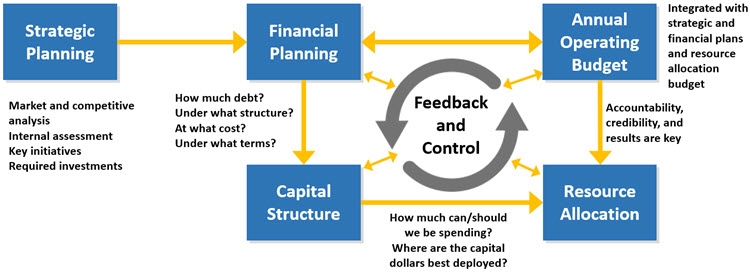

By definition, such an approach brings together into one cycle, strategic planning, financial and capital planning, and annual budgeting, as shown below.

Best-practice resource allocation is grounded through the institution’s strategic planning process. Leaders should use this process to identify the market- and mission-based strategies that they want to pursue to achieve institutional objectives, and that will require funding during the next five to ten years.

In the next stage, the financial planning process, leaders should quantify the broad investment requirements and potential effects of the defined strategies, evaluating whether the strategies can be implemented (i.e., funded) within an acceptable credit context. At the same time, leaders should look at how to optimize the use of external debt and philanthropy (capital structure) to fund the identified strategies in a manner that ensures maximum flexibility and the lowest possible cost of capital.

Prioritization of specific resource-investment opportunities is an iterative step that should occur through an institution’s capital resource-allocation process. Once leaders make those allocations, the annual budgeting process, which creates a current-year implementation and operating plan, integrates the targets of the strategic and financial plans with the specific investment decisions of the resource-allocation process.

Best-practice resource allocation is grounded through the

institution’s strategic planning process

To succeed in a competitive environment, leaders must competently manage the cycle through feedback and control mechanisms at every stage. To do so involves understanding the technical and mathematical relationship among cycle components. Success or failure with one component affects success or failure in other parts of the cycle.

Improve Strategic Financial Planning at Your University

How Budgeting Differs from Resource Allocation

An improved understanding of the differentiation is required in higher education. As shown in the figure, capital or operational budgeting is a small piece of the comprehensive resource-allocation process. It is the administrative process used by institutions to spend allocated dollars, involving detailed listing of spending during the next fiscal year. Typically, budgeting relates only to “routine” items, recurring expenses, and new spending that fall under the purview of a school dean or department manager, who, by virtue of function, do not have the full view of institutional spending priorities and allocations.

While many institutions are beginning to adopt initiative-based planning as part of the budgeting process, such planning typically occurs in a decentralized fashion and is not a systematic process for deciding which initiatives to approve institution-wide. That strategic evaluation occurs during capital resource allocation to ensure the strategic and financial health of the institution.

Using the Cycle

Use of the resource planning and management cycle helps to foster a culture that respects the relationships among strategic objectives, resource capacity—i.e., the resources required to fund strategic and routine capital needs—and financial risk. Dollars allocated to specific initiatives reflect the organization’s long-term financial vision, and create an overall portfolio that will generate an optimal return. Leaders of high-performing organizations recognize that operating margins are the key ingredient for cash reserves that they can potentially deploy for future strategic investments, and for credit quality that allows access to the debt markets. Such margins result from persistent, focused management of all aspects of the organization’s decision-making processes.

Produced in collaboration with Kaufman Hall, our strategic alliance partner.