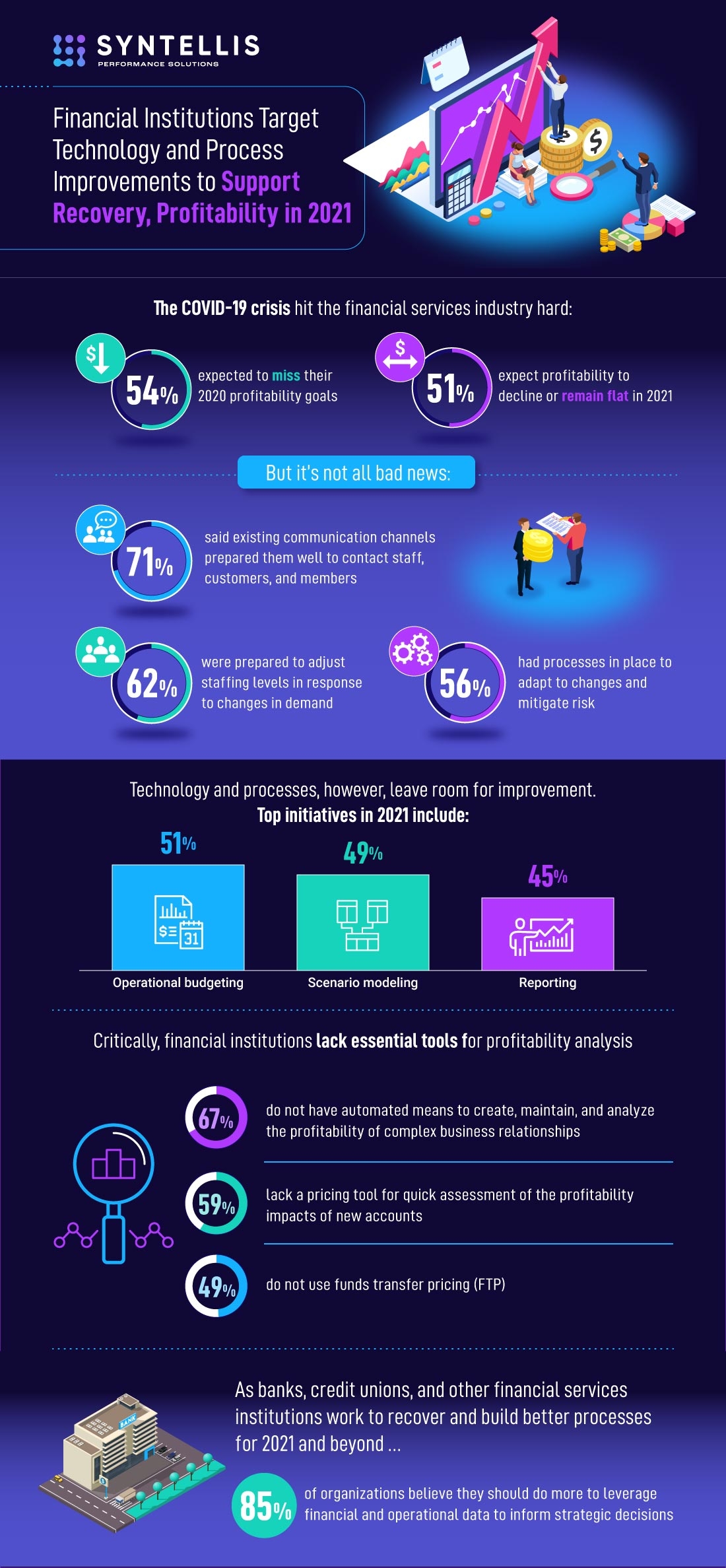

Finance leaders at many banks, credit unions, and other financial services institutions said their organizations were not prepared for the level of disruption brought on by the COVID-19 crisis in 2020. Almost no one was, but financial institutions seem to have a harder time bouncing back than some other industries, as more than half expected to miss their 2020 profitability goals, and 51% expect profitability to decline or remain flat this year.

In 2021, financial leaders at banks, credit unions, and farm credit associations will strive to ensure they are never caught unprepared again. Financial institutions nationwide are targeting technology and process improvements that drive agility and readiness for whatever comes next, according to Syntellis’ 2021 Financial Institutions Finance and Technology Trends report.

This is Part 1 of a two-part series discussing the annual report, which features insights from a survey of 185 finance leaders at a range of financial services institutions. The report provides perspective on a particularly challenging year as financial institutions worked to balance liquidity issues, avoid damaging credit decisions, and help struggling customers in the face of a staggering economy and volatile financial markets.

Identifying Key Issues in 2020

Of the 54% of survey respondents who said their organizations would miss their 2020 profitability goals, 27% expected to miss it by 10% or more, according to the report. Credit unions and smaller institutions were most affected — 58% of credit union respondents and 60% of respondents from institutions with assets of $1 billion or less expected to miss 2020 goals.

Fifty-five percent of credit union respondents said they expect profitability to decline or remain flat in 2021, compared to 42% from banks and other financial institutions.

But it’s not all bad news — finance leaders effectively used existing tools and resources to adapt to the changing environment spurred by the COVID-19 pandemic in 2020. Nearly three-quarters (71%) said their existing communication channels prepared them well to contact staff, customers, and members; 62% were prepared to adjust staff levels to meet current needs.

Technology preparedness was a mixed bag — 43% had adequate technology for profitability analysis and reporting to prepare for COVID-19 impacts, while 19% did not. The remaining 38% provided neutral responses.

Asked to identify the most significant challenges relative to financial planning and analysis:

- 60% identified resource restraints

- 48% admitted personnel skill set challenges

- 43% said outdated or insufficient processes

- 42% cited insufficient tools

Financial services organizations across the country continue to rely on prolonged and outdated budgeting processes and systems, with 70% reporting a budgeting cycle of three months or longer. Larger institutions were more prone to long budget cycles, with 80% of respondents at organizations with more than $10 million in assets reporting a budget cycle that exceeds three months.

Building Better Processes in 2021

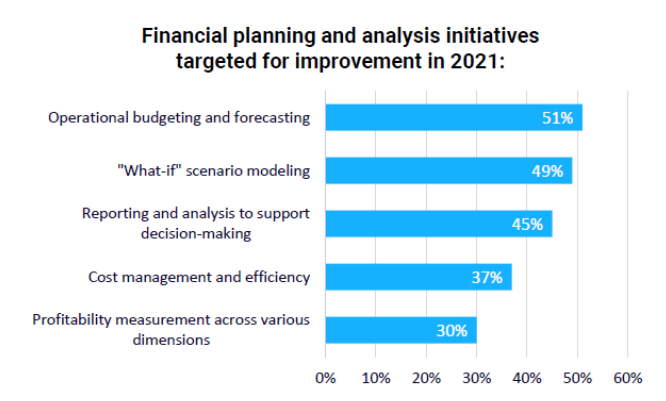

Across the industry, finance leaders are using the lessons learned over the last several months to better prepare for future uncertainties. About half of survey respondents said they plan to improve operational budgeting and forecasting, scenario modeling, and reporting in 2021 (see Figure 1).

Figure 1. Financial Planning and Analysis Initiatives Targeted for Improvement in 2021

Looking specifically at technology, finance leaders said the pandemic revealed solutions gaps or weaknesses for many banks, credit unions, and other financial services institutions in the following areas:

- Scenario planning and analysis

- Long-range/strategic planning

- Performance dashboards

- Capital projects planning and management

- Profitability and funds transfer pricing

- Relationship management, profitability analysis, and pricing

The events of 2020 reinforced the need for financial institutions to have comprehensive enterprise performance management systems. Such systems make it easier for finance professionals to collate data from multiple sources for more accurate and efficient budgeting and forecasting, reporting, and profitability analysis — all of which are critical to remaining agile in turbulent times.

Part 2 will dive deeper into the challenges and opportunities in some of these areas and provide key strategies that many banks, credit unions, and farm credit associations should consider in their quest for profitable growth while recovering from the COVID-19 crisis.

Learn about the strategies + tech to help you succeed in 2021