Financial fallout from the interrupted spring semester, potential reductions in state aid to higher education, and continued economic and pandemic uncertainty are creating an untenable situation for colleges and universities.

More than $7 billion in federal stimulus funds has been earmarked for public colleges and universities, but their losses far exceed the amount of proposed aid. In addition to refunds for tuition, room and board, and student fees, institutions are braving financial losses from the summer term, as well as canceled camps and events that bring in much-needed revenue. Institutions with a large research function or an academic medical center are dealing with even-greater losses.1

Reconciling this chasm between dwindling revenues and greater expenses weighs heavily on the minds of higher education Finance teams. Items on their voluminous to-do lists include budget planning for the fall semester and spring 2021, juggling various and quickly changing financial inputs to bring visibility to decision-making, and providing guidance on medium-range and long-range plans to plot a way forward.

Data analysis can provide valuable insights to guide these challenging tasks, but many colleges and universities can’t leverage their data to inform decisions either because they don’t trust the accuracy of data, or because it’s not available in a format that can be readily analyzed. A fall 2019 survey revealed that 74% of institutions struggle to pull data from multiple sources into one report, 63% have difficulty with reporting dashboards and visualizations, and 55% say it’s challenging to access clean, consistent and trusted data.2

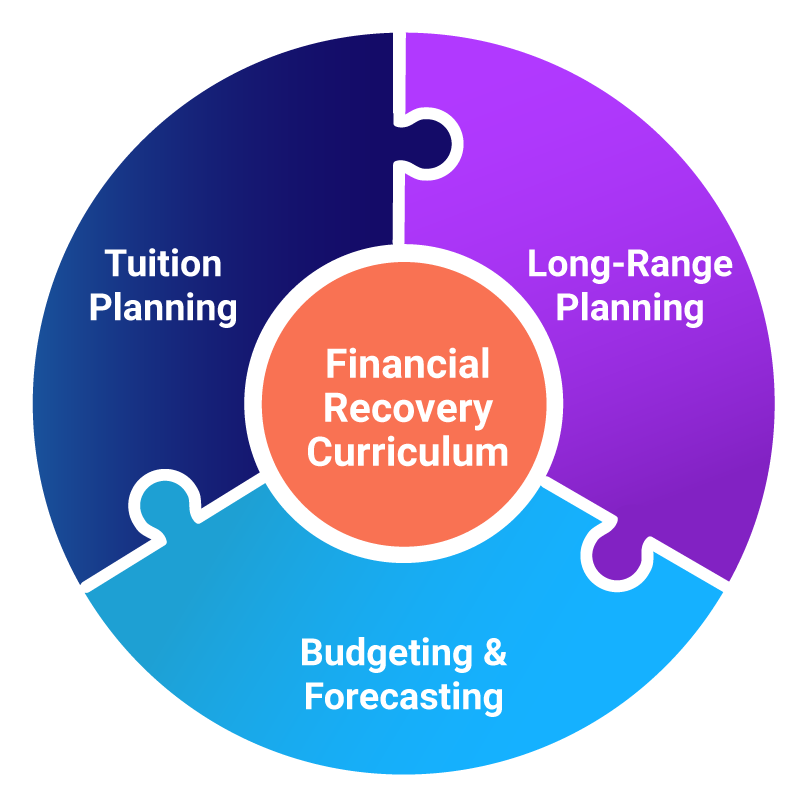

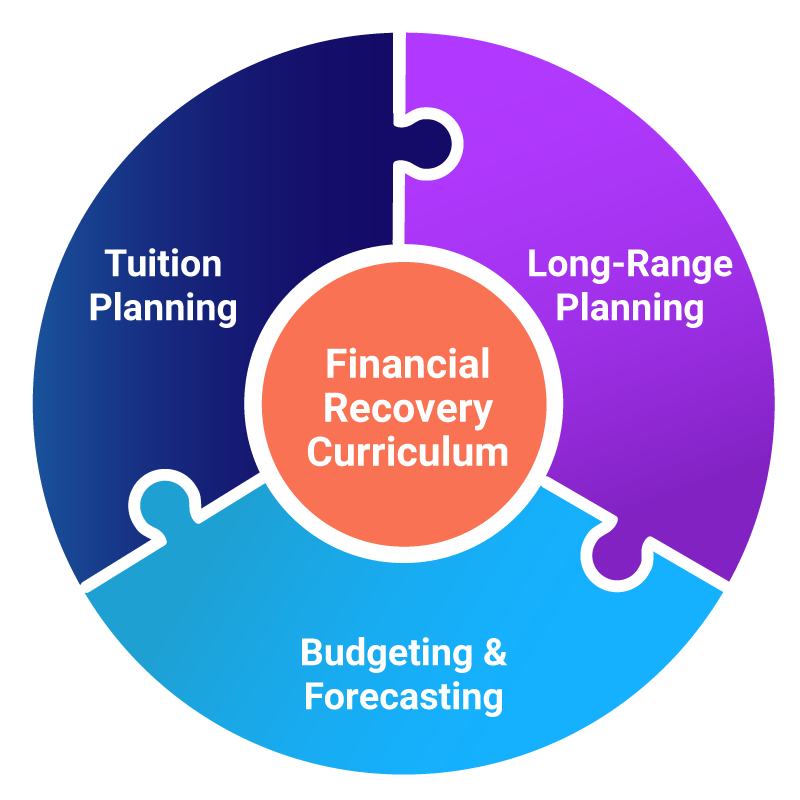

Financial Recovery Curriculum provides actionable guidance for higher education financial planning using best practices, proven strategies, and data-driven techniques that higher education institutions can apply with access to the right tools.

Sections include:

- Budgeting and forecasting: Replacing spreadsheets with a budgeting and financial planning system can integrate data from core higher ed systems to create a single source of truth. Standardizing data, calculations, and reporting brings transparency and collaboration to the decision-making process, reducing manual work and allowing for better and quicker decisions based on real-time data.

- Tuition planning: Tuition is the largest revenue stream for most colleges and universities, so small changes in the tuition model can affect the entire institution. By integrating tuition and enrollment information with financial data, institutions can more accurately project tuition revenue through scenario modeling.

- Long-range planning: Take much of the guesswork out of long-term financial plans with financial modeling, reporting, and analytics based on institutional data. See the impact of proposed strategic initiatives and capital projects on existing operations and create scenarios to mix-and-match assumptions for more accurate planning.

CFOs and Finance leaders across the nation are stepping up to guide their institutions through these unprecedented times. But the ability to make good decisions hinges on having the right software tools to leverage the necessary data.

2Higher Education Financial Trends: Priorities, Challenges, and Insights to Get Ahead in 2020