Fundamentals and Best Practices in Budgeting, Planning, and Forecasting, Part 2

Finding your way from point A to point B has never been easier.

Just type your current location and destination into Google Maps, Waze, MapQuest or another navigation app to find the most direct route, general traffic patterns, and anticipated travel times. If you make a wrong turn or if a roadblock arises along the way — like an accident or unexplained traffic jam — the app quickly recalibrates, offering one or more alternative routes for you to take.

For financial institutions, these map apps are analogous to the objectives of budgeting, planning, and forecasting processes — and if the COVID-19 pandemic has taught us anything, it is the importance of recalibrating.

This is the second in a two-part blog series focused on reshaping budgeting and planning processes for these turbulent times, drawn from my recent “Budgeting, Planning and Forecasting Boot Camp” webinar series. In Part 2, we will discuss:

- Assessing your institution’s current state

- Evaluating and advancing your planning processes

- Optimizing scenario analysis and reforecasting

As I mentioned in Part 1 of this blog, nothing about today’s environment is like it was last year or the year before, and there is no going “back to normal” anytime soon. Financial leaders need to be thorough and highly agile as they chart their organization’s path forward. As with any navigation app, it all starts with knowing where you are now.

Assess Your Institution’s Current State

Understanding your organization’s current state requires evaluating internal and external conditions, and using a comprehensive cause-and-effect analysis to identify various factors driving financial and operational results.

The U.S. banking industry has experienced its fair share of disruption in 2020. Even before the pandemic, the industry faced inversion of the yield curve and mounting competition from other banks and tech-savvy, non-traditional finance organizations. COVID-19 has compounded the challenges exponentially.

Financial performance is down as a result, with significant drops in net income and return on equity (ROE) due to continued contraction in net interest margin (NIM) and large increases in loan loss provisions due to widespread credit concerns. The downside impacts have been mitigated somewhat for many due to aggressive cost cutting, non-interest income growth, and securities and investment gains from excess liquidity as deposit growth has significantly outpaced loan growth.

Balancing all of these factors along with new operational processes for both employees and customers is challenging enough. Compounded by heightened uncertainty related to COVID-19, the political and social environments, and credit concerns, Finance leaders must understand what is driving performance today, and what will best drive performance going forward.

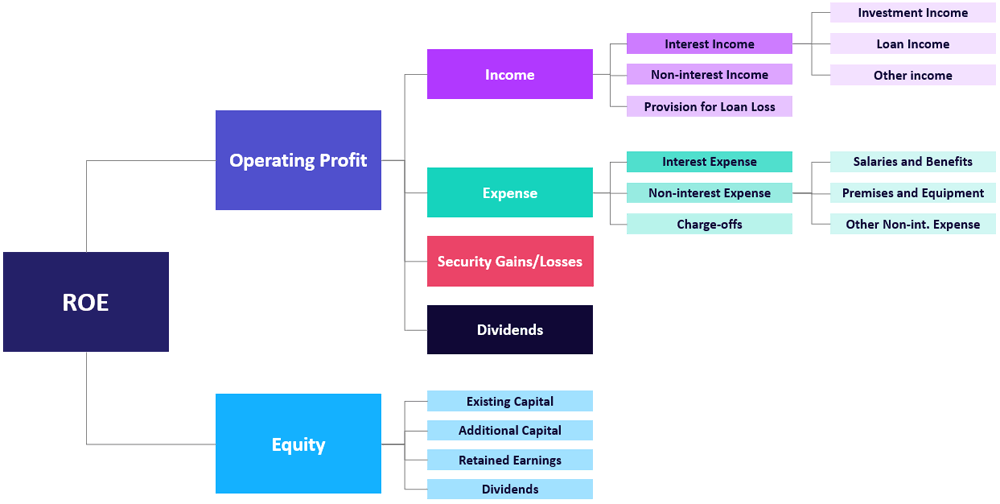

It is within this context that institutions must perform a detailed assessment of where they stand today. A cause-and-effect analysis (as detailed in Figure 1) can help banks, credit unions, and farm credit associations link financial and operational results. For example, an analysis of ROE results might break them down into Operating Profit and Equity, and then break each of those down into their component parts or into individual product or line-of-business categories, where operational factors come into play. This approach enables you to better understand how operational factors affect financial results — and ultimately, progress toward broader strategic goals.

Figure 1. Cause-and-effect Analysis

Conducting cause-and-effect analysis requires sophisticated data, analytics, and reporting tools that can efficiently collate disparate data in a central repository, perform various types of analyses (financial, profitability, liquidity and credit, etc.), and aggregate and report data in accessible dashboard formats. Organizations also need to foster a top-down data-driven culture with the right people and appropriate training for both analysts and end-users.

Evaluate and Advance Planning Processes

A similar cause-and-effect approach can apply to budgeting and planning. For example, let’s say the strategic goal is to improve ROE through increased operating profits. To increase operating profits, we want to increase income, specifically non-interest and interest income pertaining to our loan portfolio. We then break our loan portfolio down by product group or line of business and set goals in each area, that in total will help achieve the increased profit and ROE targets.

As we break that down to each line of business/product area, we focus on increasing mortgage loan income, targeting a 10% increase. Just as a personal trainer might present ways to make an exercise progressively more difficult as you get stronger, there are different levels of planning based on organizational capabilities and needs. For this example, we’ll consider three levels of planning:

Level 1: Projecting the financial aspects needed at a high level to achieve those results. For example, projecting average rate and runoff percentages at a GL level, along with targeted growth in new business.

Level 2: Building in additional detail by forecasting the balances, yields, and resulting income for existing mortgage loans at the individual loan level ― while also projecting additional refinancing levels and fee income ― along with detailed new loan origination projections. This approach requires historical data and the ability to project new volumes and related yields, spreads, runoff, and sale assumptions to derive more accurate income and expense estimates.

Level 3: Providing a comprehensive plan by connecting operational and financial plans. This requires adding operational factors (such as required FTEs, marketing plans, and digital capabilities) to achieve the financial projections laid out in level 2 above. In addition to the detailed cash flow-based forecasting, this level 3 approach allows you to connect and project operational needs and related costs to financial plans and targets. Since it is typically the operational performance that managers and teams can control, understanding the linkage between the operational plans and financial plans will allow your managers to derive better plans and make better decisions.

Finance leaders must determine the best approach for their institution. The level of detail will depend on available data, the required effort, and whether the value derived from having that additional detail is worth the effort. In other words, as I emphasized in part 1 of this blog series: Is the juice worth the squeeze?

Optimize Scenario Analysis and Reforecasting

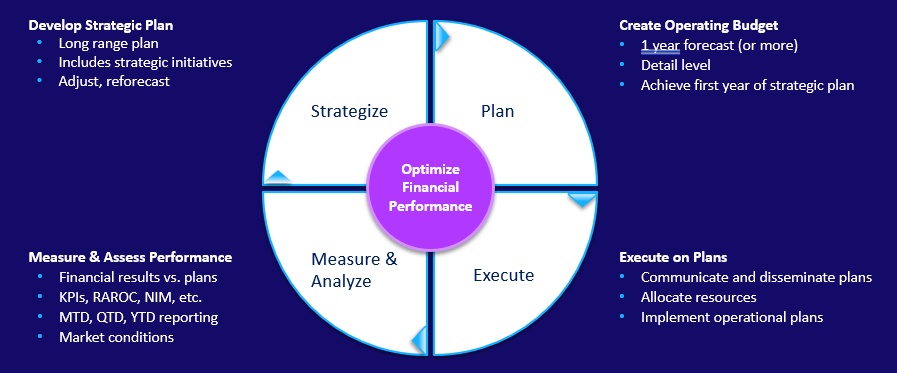

Financial Performance Management (budgeting, planning and forecasting, and performance analysis) should ideally be viewed as a single integrated process (Figure 2). The strategic and long-range plan provides a high-level roadmap of where you want the organization to go, which informs your budgeting and planning process. Tactical financial and operational plans are then communicated across the organization so various teams can execute on those plans.

Throughout the year, it is imperative to track progress by analyzing actual financial and operational results on a monthly, quarterly, and year-to-date basis (be sure to think about the cause-and-effect analysis described earlier). That information is then used to determine if course corrections are needed along the way to achieve overall strategic goals ― recalibrating your route!

Figure 2. The Financial Performance Management Cycle

Scenario analysis is key. It allows you to move beyond the baseline forecast and run multiple scenarios from the best to worst case, incorporating both financial and operational impacts. Alternative plans then can be developed for each scenario around your organization’s balance sheet strategy, liquidity options, and operational changes.

As with any navigation app, scenario analysis can quickly recalibrate and map alternative routes when unexpected roadblocks arise. It also enables you to understand the various impacts of each possible route to ROE, earnings, different credit metrics, and other factors.

Given the current environment and the many uncertainties ahead, the ability to reforecast will be critical for all financial institutions — because no matter how good your plan is for 2021, I can guarantee one thing: It will change.

There are too many unknowns given the current state of the pandemic, as well as the political, social and economic environments, and all of their related long-term impacts. As you plan for 2021, institutions need to do more than just rearrange the proverbial deck chairs. You really need to look back at your overall planning process, and your strategic and tactical plans, and make significant improvements to determine the best course forward for your institution.