Though recent CDC metrics show signs that the U.S. may be turning the corner on the pandemic, hospitals and health systems had a difficult start to 2021. Ongoing financial challenges — such as decreased Outpatient Revenue, a double-digit drop in Emergency Department Visits, and rising Expenses — illustrate that hospitals face a long road to recovery.

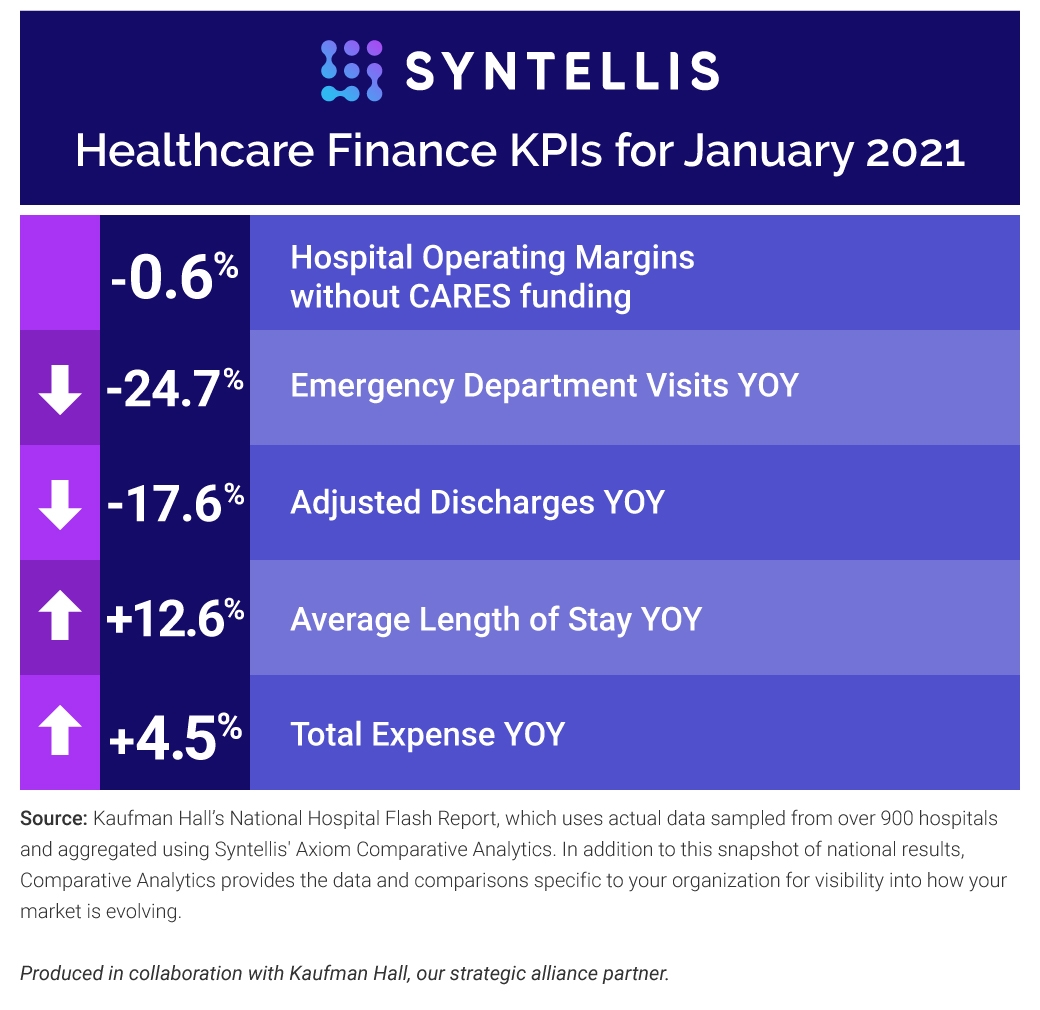

Here are the January 2021 financial KPIs for U.S. hospitals and health systems:

#1 — YTD Operating Margins down

January 2021 Operating Margin narrowed to -0.6% without CARES funding and -0.1% with CARES. Not including CARES funding, Operating Margin fell 46.1% year-over-year (YOY).

#2 — Emergency Departments remain hard hit

Emergency Department (ED) Visits saw the biggest YOY volume drop at 24.7%, continuing a trend of double-digit YOY declines every month since March 2020.

#3 — Patient Discharges, Days decrease

Many patients continued to avoid or delay care in hospital settings. As a result, Adjusted Discharges fell 17.6%, and Adjusted Patient Days declined 8.3% compared to January 2020.

#4 — Average Length of Stay increased over 2020 levels

Average Length of Stay (LOS) was the only volume metric to increase compared to 2020 levels, rising 12.6% YOY in January due to higher acuity patients requiring longer patient stays.

#5 — Expenses remain high

High costs of labor, drugs, and personal protective equipment (PPE) continue to drive expenses higher. Total Expense increased 4.5%, Total Labor Expense rose 6%, and Total Non-Labor Expense was up 2.4% YOY.

Monthly spotlight: Mixed revenue results

Revenue results for the month were mixed. Dropping 10.4% YOY, January marked the ninth time Outpatient Revenue fell below prior-year levels in the past 10 months. Lower outpatient revenues drove Gross Operating Revenue (without CARES funding) down 4.8% YOY, while Inpatient Revenue rose slightly at 1.3% YOY.

Once adjusted for January’s low volumes, revenues increased. Net Patient Service Revenue (NPSR) per Adjusted Discharge rose 19%, and NPSR per Adjusted Patient Day was up 9.7% YOY.

Turning data into action

As the pressures of the pandemic continue to strain hospital resources, Treasury Operations teams must pay close attention to key financial resources — cash, credit, leverage, and invested assets — to ensure agility.

Syntellis’ Axiom™ Treasury Cash Management solution saves time and improves the accuracy of daily cash monitoring to optimize working capital. Accurate, timely data allows healthcare finance teams to properly size and manage cash reserves, automate payment and data infrastructure, manage commercial banking relationships, and monitor points of tension to lower costs and optimize access to capital and credit. At a time when agility is especially critical, Treasury Cash Management ensures there’s enough cash on hand at the right time to fund core business operations.

Learn more about Comparative Analytics

Checklist for Operational Improvement and Financial Success