November 2020 saw an increase in COVID-19 cases that placed new pressures on hospitals and health systems, even as executives eagerly anticipated emergency use authorization of COVID-19 vaccines. Margins decreased and volumes and revenues fell across most metrics, while expenses remained high compared to 2019 levels and current budgets. Inpatient volumes rose as COVID-related hospitalizations more than doubled in November.

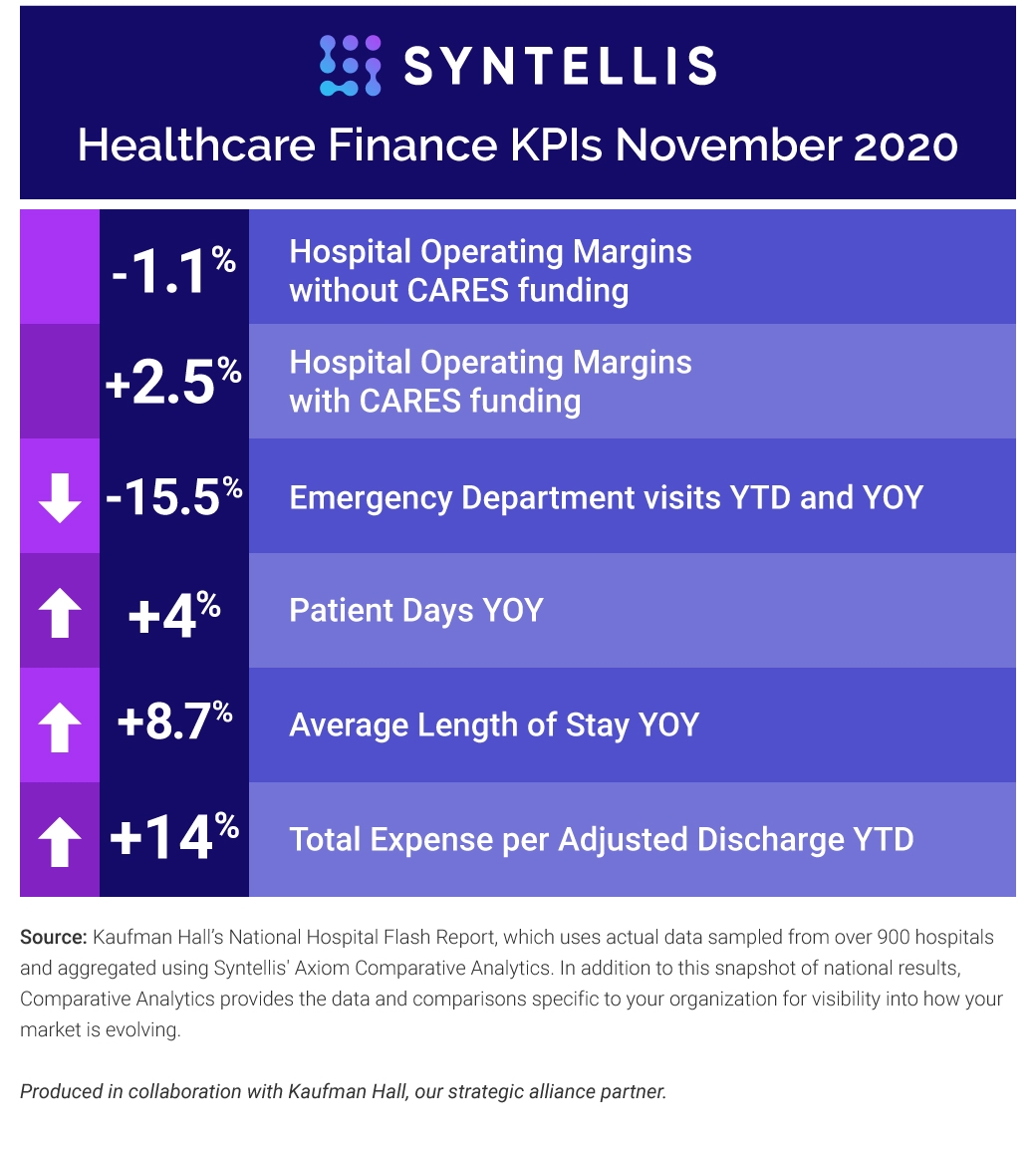

Here are the November 2020 financial KPIs for U.S. hospitals and health systems:

#1 — YTD Operating Margins remain below budget

Year-to-date (YTD) November 2020 Operating Margin narrowed to -1.1% without CARES funding and +2.5% with CARES, according to the Kaufman Hall Operating Margin Index. Operating Margin fell nearly 12% compared with November 2019.

#2 — Negative effects on Emergency Departments continue

Patient reluctance to receive care in hospital settings continue to hit Emergency Departments and operating rooms. Emergency Department visits fell 15.5% YTD in November, while Operating Room Minutes declined 12.2%.

#3 — Patient Days increase

Inpatient volume passed 2019 levels for the first time since the pandemic hit, rising 4% year over year (YOY).

#4 — Average Length of Stay also rose

Average Length of Stay increased 4.7% month over month and 8.7% YOY, reflecting more higher-acuity COVID-19 patients.

#5 — Expenses outpace 2019 levels

Total Expense per Adjusted Discharge rose 14% YTD and 17% YOY, while non-labor expenses rose by similar percentages.

Monthly spotlight: Revenue Metrics

The monthly roller coaster of revenue peaks and valleys continues, with Gross Operating Revenue (without CARES) rising 4.2% YOY and Inpatient Revenue increasing 12.7% YOY. At the same time, Outpatient Revenue declined 0.6%, and the Inpatient/Outpatient Adjustment Factor dropped significantly, down 6% YOY.

Despite anticipated relief stemming from the emergency use approval of two COVID-19 vaccines, hospital and health system finance executives should expect to stay on the revenue roller coaster for the next several months as vaccine distribution and administration ramps up. As the virus continues to spread, hospital volumes — especially in outpatient areas — are not expected to return to pre-pandemic levels.

Turning data into action

The possibility of widespread inoculations provides hope for the future, but hospital finance executives must confront the disparities between revenue and expenses now. The continuing drag on revenues amid increased expenses strongly points to the need for balance while maintaining high quality care. Starting now will help facilities adjust in the current environment and leave them in better shape once operations normalize.

Any balancing effort starts with visibility into clinical and financial data across your organization to make informed decisions. Axiom Decision Support reporting tools empower finance and clinical leadership teams with insights across cost, quality, and service performance measures. With the addition of 100+ Clinical Performance Measures, the reports and analytics give finance teams a high-level understanding of their clinical variation and highlight opportunities where quality and cost outcomes can be improved.

Other readers also browsed these resources:

6 Benchmarking and Comparative Analytics Best Practices

Market Analysis and Monthly Hospital & Physician KPIs: October 2023