Key performance indicators (KPIs) from October 2020 indicate a difficult winter for the nation’s hospitals and health systems amid a fast-rising increase in COVID-19 cases and ongoing uncertainty. Margins and volumes fell, revenues flattened, and expenses rose as some states moved to retighten social distancing guidelines. Despite the prospect for vaccines to ease the effects of the pandemic, volume declines unrelated to COVID-19 patients could further destabilize hospitals financially.

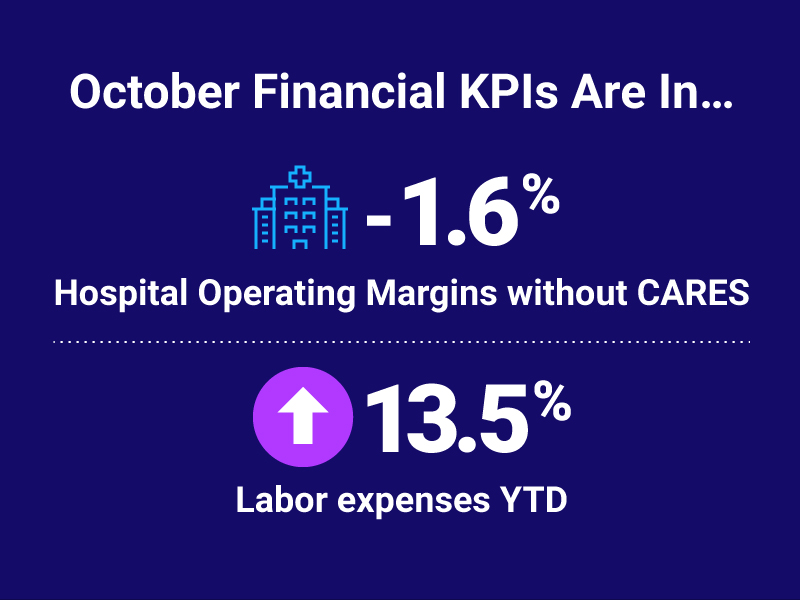

Here are the October 2020 financial KPIs for U.S. hospitals and health systems:

#1 —Monthly Operating Margins remain lower than 2019

October 2020 Operating Margin year to date (YTD) was -1.6% without CARES funding and 2.4% YTD with CARES Act funding, according to the Kaufman Hall Operating Margin Index. October margins were down compared to 2019 measures, but above budget.

#2 — Emergency Departments still down YTD

ED visits picked up 1.9% month over month (MOM) but remain hard hit, falling 16% YTD and year over year (YOY). Visits are expected to rise in the months ahead, fueled by the surging pandemic and seasonal flu.

#3 — Patient discharges, days decrease

Adjusted discharges fell 11.2% YTD, while adjusted patient days fell 7.7% YTD.

#4 — Labor expenses on the rise

Continued higher staffing contributed to a 13.5% increase in Total Expense per Adjusted Discharge YTD and 12.2% YOY.

#5 — Non-labor expenses also increasing

Non-Labor Expense per Adjusted Discharge overall rose 13% both YTD and YOY. Purchased service expense rose 18.6% YOY, while drugs and supplies expenses rose 8.9% YOY.

Monthly spotlight: Gross Operating Revenue

After increases in three of the last four months, Gross Operating Revenue (not including CARES) fell 4.8% YTD. Outpatient revenue dropped 6.6% YTD and 2.5% YOY. Likewise, inpatient revenue was down 2.4% YTD but rose 2.6% YOY.

As the pandemic surges in all parts of the country, patients again are reluctant to visit providers, driving down top-line revenue. When coupled with increases in both labor and non-labor spending, hospitals and health systems are treading a fine line to maintain margins amid the pandemic and related economic uncertainty.

Turning data into action

Continued declines in operating revenue against budget underscore the importance of budget flexibility. Regional pandemic surges threaten to depress revenue and raise costs, while the ongoing uncertainty continues to affect local economies.

Organizations must effectively manage clinical and financial operations even in the face of economic and societal difficulties. Axiom™ Rolling Forecasting provides health systems a powerful tool to monitor and model financial impacts of market changes by functional area and serves as an important bridge between long-range financial plans and Departmental operating budgets. Better, timely data allows healthcare leaders to remain nimble and agile in their decision-making.

Other readers also browsed these resources:

Axiom Rolling Forecasting for Healthcare

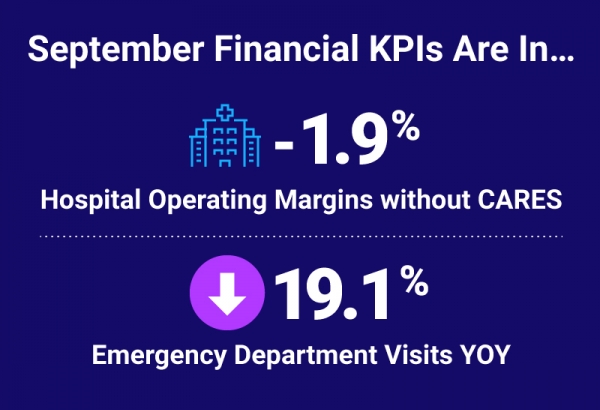

Top 5 Healthcare Finance KPIs: September 2020