Skilled nursing facilities, nursing homes, and other senior care facilities nationwide face chronic staffing shortages that are driving up labor expenses and contributing to difficulties in transitioning patients along the continuum of care.

More than half (54%) of senior care facilities have had to limit new admissions because they do not have enough staff to meet state and federal staffing requirements to responsibly care for residents, according to a recent survey from the American Health Care Association (AHCA). Fewer residents mean less revenue, and as pandemic-era government assistance dries up, senior care services providers are concerned about financial stability.

Although understaffing in nursing homes has long been an issue, the COVID-19 pandemic exacerbated the problem. Since March 2020, the nursing home industry has lost nearly 200,000 jobs — roughly 12% of the workforce — according to an analysis of U.S. Bureau of Labor Statistics data.

The AHCA survey revealed nursing homes’ staffing issues show no sign of slowing:

- 84% of nursing homes are experiencing moderate to severe staffing shortages

- 96% of nursing homes are struggling to hire additional staff

- 78% of nursing homes have hired temporary agency staff

The survey also revealed that 55% of U.S. nursing homes are operating at a financial loss, with 52% indicating that they cannot stay open for another year at the current pace. Staffing shortages, expense increases, potential policy changes, and overall economic uncertainty contribute to this troubling trend.

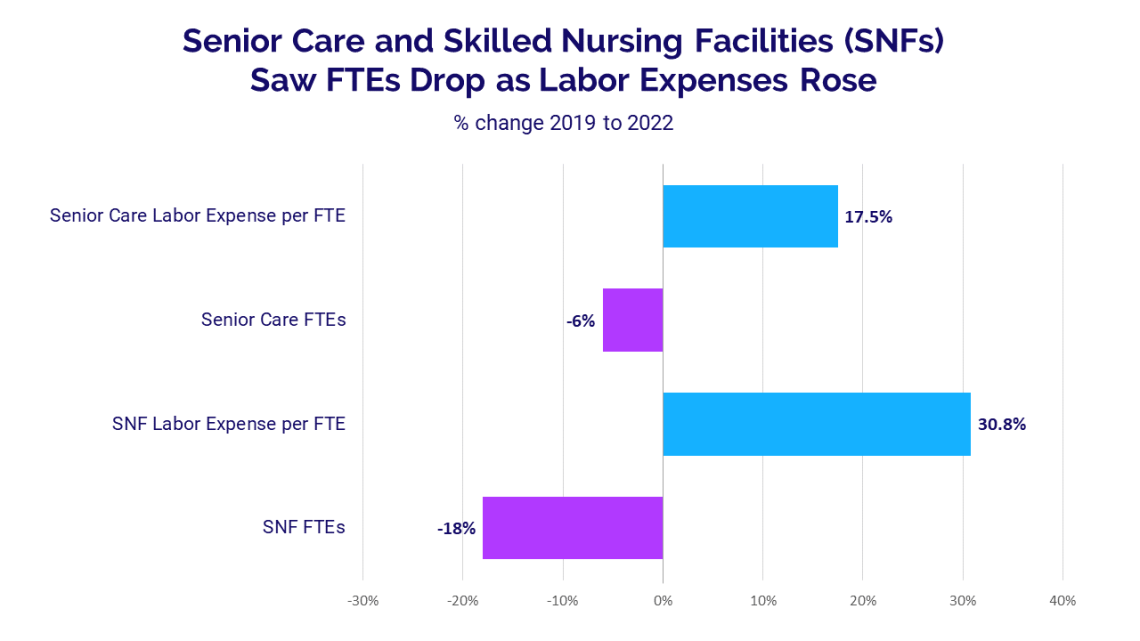

Staffing levels fall, expenses continue to rise

Syntellis’ recent Hospital Vitals: Financial and Operational Trends report, presented in partnership with the American Hospital Association, highlights the impacts of the staffing issues on expenses and transitions in care. At both skilled nursing facilities and senior care facilities, workforce challenges drove up labor expenses from 2019 to 2022, with the median Labor Expense per Full-time Equivalent (FTE) jumping 30.8% and 17.5%, respectively. Meanwhile, Total FTEs (including both employed and contracted labor) at skilled nursing and senior care facilities dropped 18% and 6%, respectively, compared to pre-pandemic levels.

Workforce challenges at skilled nursing facilities and senior care centers affected key hospital metrics. Discharges declined 9.4% from 2019 to 2022, partly because hospital personnel faced delays in discharging patients to post-acute care facilities. The median hospital length of stay rose 10.4% over the three-year period.

Ensuring future financial sustainability

A recent poll from Leading Age revealed 70% of senior care services providers said they've implemented different strategies to help with recruitment efforts, including offering sign-on bonuses (69%), flexible scheduling (61%), and emphasizing career advancement opportunities (56%). Ninety-two percent have increased hourly wages. According to more than 200 association member comments from the poll, foreign workers may be part of the solution — 12% of senior care providers have already recruited foreign workers on visas.

As the baby boom generation ages, demand for long-term care is projected to increase in the coming years. Coupled with additional nursing home staffing requirements under consideration at the federal level, healthcare leaders must act now to ensure the long-term success of the nation’s senior care facilities. Focusing on recruiting and retaining workers in both post-acute and senior care settings will help minimize the financial, operational, and clinical ripple effects on the nation’s hospitals and health systems.

Hospitals and health systems under pressure

The Syntellis and American Hospital Association report also revealed some of the financial impacts of workforce challenges on hospitals and health systems.

Compared to before the COVID-19 pandemic, hospital total expense per patient, as measured by median Total Expense per Adjusted Discharge, rose 22.5% in 2022 — due largely to a 24.8% increase in Labor Expense per Adjusted Discharge from 2019 to 2022. Total Expense rose 17.5% and Total Labor Expense jumped 20.8% over the same period.

Many hospitals relied heavily on labor from contract staffing firms to help fill gaps from the long-standing labor shortages, contributing to higher overall labor expenses. As a result, Total Contract Labor Expense skyrocketed 257.9% from 2019 to 2022. Contract Labor FTEs jumped 138.5% over the three-year period, and the median wage rate paid to contract staffing firms rose 56.8% as organizations competed for a limited pool of qualified healthcare professionals.

Confronting workforce challenges with data

Challenges associated with ongoing workforce shortages are expected to intensify in coming years as healthcare professionals retire or seek other jobs in response to burnout, competitive wages, and new opportunities. Health analytics platforms equipped with robust data capabilities are essential for healthcare organizations seeking to manage workforce challenges and provide high-quality, cost-effective patient care on an ongoing basis.

Syntellis’ Axiom™ Comparative Analytics offers near real-time data drawn from more than 135,000 physicians from over 10,000 practices and 139 specialty categories, and from 500+ unique departments across more than 1,000 hospitals. Powered by Syntellis IQ, Comparative Analytics also provides data and comparisons specific to a single organization for visibility into how its market is evolving.