90% of Finance Leaders Reveal Interest Rates Are No. 1 Driver of Banking Business Model Changes, Finds 2023 CFO Outlook from Syntellis Performance Solutions

Report uncovers finance leaders nationwide are wrestling with significant market shifts, ongoing labor challenges, and technology adoption

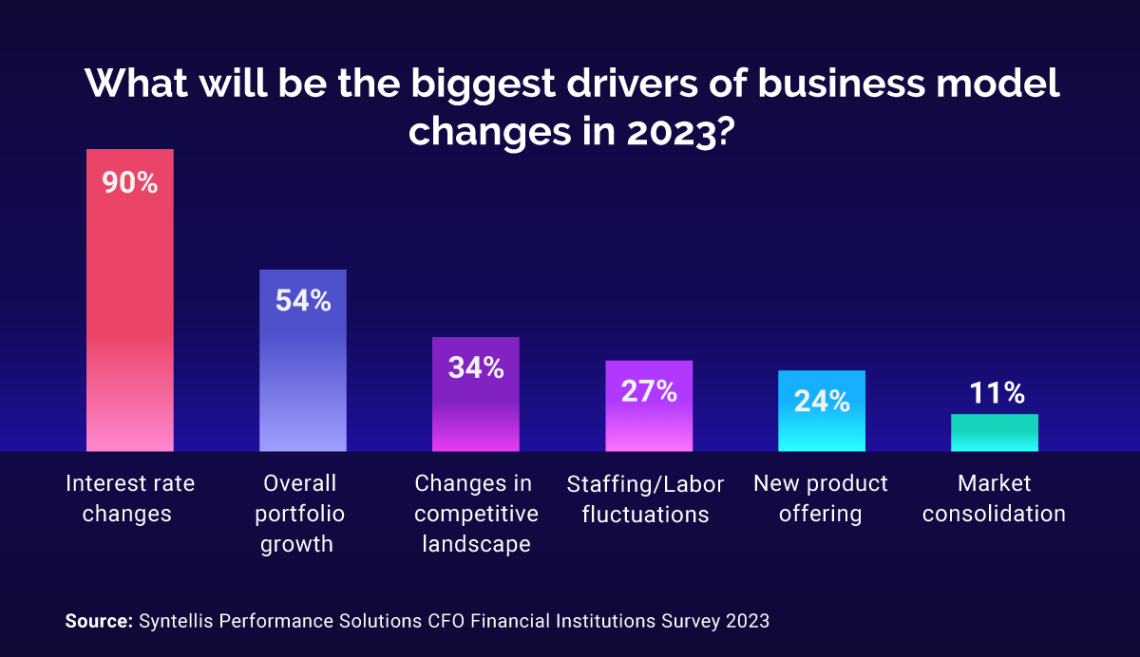

CHICAGO – January 19, 2023 – Syntellis Performance Solutions, the leading provider of enterprise performance management software, data, and intelligence solutions, today published its seventh annual CFO Outlook for Financial Institutions revealing that 90% of finance professionals at banks, credit unions, and other financial services institutions anticipate interest rate changes will be the biggest driver of business model adjustments throughout 2023.

Syntellis’ 2023 CFO Outlook for Financial Institutions draws on data from a survey of more than 100 finance leaders at banks, credit unions, farm credit associations, and other financial institutions across the U.S. and Canada. The report – which takes an in-depth look at current industry challenges, trends, and priorities – also exposes that finance leaders believe overall portfolio growth (54%), competitive landscape changes (34%), and staffing/labor fluctuations (27%) will be additional key drivers of business model changes in 2023.

“Financial institutions continue to navigate economic uncertainty,” said Flint Brenton, CEO of Syntellis Performance Solutions. “The results from our 2023 CFO Outlook report highlight the need for dexterity in their operations and strategic planning processes. To address the ongoing challenges like rising interest rates, workforce shortages, and shifting consumer preferences, finance leaders need comprehensive, modern performance management solutions to analyze, plan, respond, and remain competitive in an evolving business environment.”

Key findings of the report include:

Loans Drive Consistent Profitability, but Non-Interest Income Fluctuates

Despite the economic outlook, many institutions saw profits grow in key areas in 2022 and expect growth to continue in 2023. After suffering during the pandemic, demand for commercial loans is once again on the rise and projected to be a major source of profitable growth, with 80% of respondents reporting growth in 2022 and 88% expecting it to be a growth area in 2023. Consumer loans were the second highest area, with 63% of respondents seeing profitability growth in 2022 and 73% anticipating further growth in 2023. Other common areas of profitability growth in 2022 included mortgage loans (51%), deposits (61%), small business loans (45%), and credit cards (35%).

Meanwhile, many institutions anticipate changes in their primary sources of non-interest income in 2023. Sixty percent of respondents anticipate growth in wealth management income which includes fees from the administration of trust funds, gains and losses on venture capital investments, and fees from various underwriting activities. While 43% project increases in income from card fees, including debit and credit card servicing and other card fees, 50% expect income from such fees will remain unchanged, and 7% anticipate it will decrease. For income from service charges — such as ATM fees, overdraft fees, and maintenance charges — 29% expect increases, 52% project it will remain unchanged, and 19% project decreases.

Workforce Shortages Force Institutions to Evolve

Labor shortages continue to impact all industries, including the financial services sector. Facing elevated competition for labor amid a limited pool of available workers, banks and credit unions are struggling to attract and retain employees with existing knowledge of their systems and processes. With 27% of respondents identifying staffing and labor fluctuations as major drivers of business model changes in 2023, many organizations are identifying ways to adapt. To augment their staff in response to shortages, 89% of respondents are cross-training existing staff members, while 38% said they obtain services provided by their software vendor, and 22% bring in temporary resources.

Data Is on the Rise, but AI Lags Behind

In a sign of continued progress, 88% of respondents said their institutions leverage financial and operational data to inform strategic decisions. Those include 74% who said they do so moderately well but could do more, and 14% who said data is central to their strategies and they use it exceptionally well. Still, many financial institutions rely on outdated tools — 33% of respondents said they use spreadsheets for budgeting and forecasting.

When it comes to reporting, accessing reliable data and integrating data from multiple sources remains the top challenge, said 32% of survey respondents. Other reporting issues include drilling into reports to understand underlying data (25%), creating reports, dashboards, visualizations, or report packages (22%), and offering meaningful ad hoc reporting (21%).

Few have implemented artificial intelligence (AI) data analysis tools to streamline manual tasks and improve productivity and quality of work, with most respondents claiming they have no plans to use AI in areas such as optimizing trading strategies (74%), market analysis (59%), regulatory compliance (57%), or to streamline underwriting (52%).

AI is most prevalent in fraud prevention, where 53% use AI and 17% plan to implement it within the next 12-18 months. One-third (33%) use AI to improve risk management and 23% plan to implement it for that purpose. Twenty-nine percent use AI and 22% plan to implement it to enhance the customer experience, while another 22% use AI and more than a quarter (26%) plan to implement it to streamline underwriting.

“Access to timely, accurate, and strategic data is critical to the financial future of an organization,” said Beth Sutton, vice president of Financial Institutions at Syntellis Performance Solutions. “While we’re encouraged to see banks, credit unions, and other financial institutions using more data than ever before, the industry has a long way to go. New challenges will continue to arise in the financial services sector, and organizations need the right tools to make informed decisions to ensure profitable growth for their organizations.”

Download the full 2023 CFO Outlook for Financial Institutions report here.

About Syntellis Performance Solutions

Syntellis Performance Solutions provides innovative enterprise performance management software, data, and intelligence solutions for financial institutions. Our powerful budgeting and planning, profitability, and analytics solutions help institutions elevate organizational performance and transform vision into reality. Hundreds of leading banks, credit unions, and farm credit associations use our Axiom solutions to manage nearly $1 trillion in assets. With top satisfaction rankings from BPM partners for more than a decade, our proven industry expertise helps financial institutions acquire insights, accelerate decisions, and advance their business plans. For more information, please visit www.syntellis.com.

Syntellis Social Networks

LinkedIn: Syntellis Performance Solutions

Twitter: @Syntellis

Press Contact:

Cam Granstra

Syntellis Performance Solutions

872-246-6358

CGranstra@syntellis.com