One word adequately describes the current banking environment: turmoil. From a decreasing number of banks, high interest rates, emerging non-traditional competitors, and increasing regulatory burdens fueled by recent bank failures, financial institutions face monumental challenges.

“It feels like we’ve been in a crazy environment since 2020,” said Chelsea Stephens, Director of Finance and Corporate Development at Origin Bank. Stephens was one of three finance leaders to speak at a recent panel discussion hosted by Syntellis.

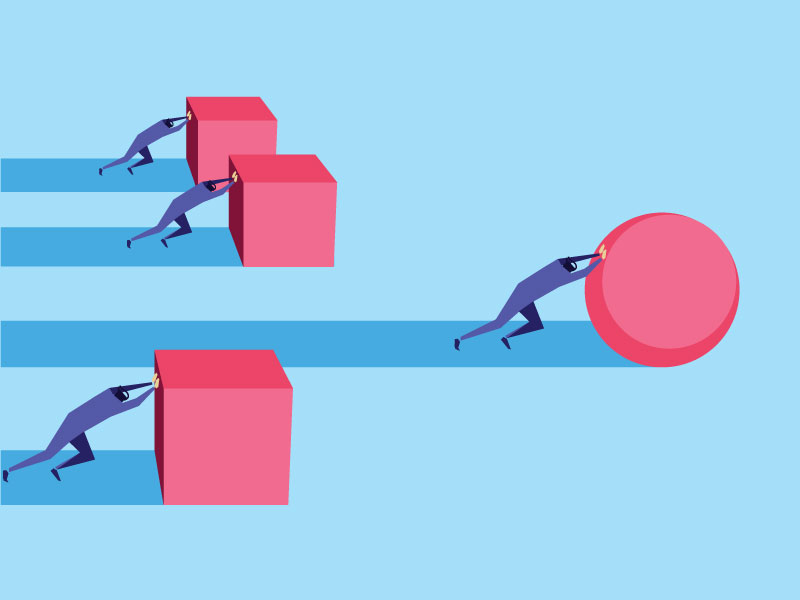

To navigate the turmoil, financial institutions must take a fresh look at their operations and plans for growth, the panelists said.

“Our word for the year has been ‘flexibility,’” said Clint Hilley, then-Vice President of Market Risk at Georgia United Credit Union,1 noting that the bank’s priorities include balanced growth and closely managed liquidity.

Kenny Moyer, Director of Profitability, Pricing, and Performance Management at Republic Bank, agreed. His institution now focuses on credit discipline and underwriting, rather than trying to get too competitive and expose the business to future risks, he explained.

To succeed in this unique environment, financial institutions should acknowledge the following challenges and develop plans to successfully address them.

1. Ripple effects of bank failures

Bank failures — especially when amplified by media coverage — generate fear, uncertainty, and doubt. Bank customers want to be certain that their money is safe. In particular, community bank customers may wonder if they can minimize risk by transferring their money to a larger institution that is “too big to fail.”

Banks should use this as an opportunity to remind customers of their capital strength and products, such as Insured Cash Sweeps (ICS) or Certificates of Deposit Account Registry Service (CDARS), that allow financial access beyond the Federal Deposit Insurance Corporation's (FDIC's) insurance threshold. Leaders should reach out to disengaged clients who may be quietly wondering about the status of their bank.

Internally, banks need advanced and robust reporting capabilities to provide leaders with vital information — such as deposit outflows and inflow sources — so they can understand risk exposure and make business decisions quickly.

Reporting is especially important in response to liquidity pressures. “We use the Axiom Financial Institutions Suite on a daily basis to generate our daily loan and share trend report, which shows us higher-level insights into movements on both the loans and the deposits,” Hilley said.

2. Thin margins

The high interest rate environment and mounting competition have put pressure on margins. In response, banks should take a closer look at profitability to ensure they use their finite resources most efficiently. To effectively examine profitability, banks must be able to look at it from a range of angles, such as by branch, line of business, and customer.

With that information, leaders can make more informed strategic business decisions. For example, a bank could offer a low-profit product only to customers who make large deposits. That product may offer additional value to the customer and aid in retention — which, in turn, can boost profitability.

Banks also can look at new, non-traditional ways to improve margins. For instance, Moyer said Republic Bank recently extended its early termination policies to help retain larger or higher-margin Adjustable-Rate Mortgage (ARM) loans or commercial real estate loans.

3. Tying profitability to incentive plans

As banks seek to better understand what drives profitability, the next step is to do more of what generates revenue. However, tying profitability metrics to staff incentive plans can be complex when considering different types of employees (i.e., frontline workers, back-office staff, executive leaders) and how to attach compensation goals to factors they can directly impact or control.

“To create that buy-in across the board, we're focused on pure revenue generation,” Moyer explained. “And we've been able to effectively design incentives around that.”

Republic Bank rewards employees who, for example, achieve growth in low- or no-cost deposits or generate origination fees on commercial loans. This makes it critical for internal teams to work in alignment. The marketing team, for instance, must generate campaigns that support the sales team’s goals.

4. Data flow and governance

Recent bank failures have spurred a greater focus on data governance and efforts to reduce the number of stops and manual processes data encounter between source systems and end reporting. Banking institutions must have a trusted, reliable, single source of data, so all internal teams generate the same information, regardless of where in the system they pull the data.

“We use Axiom essentially as a financial data mart and push that data to other sources so it can be pulled straight from there,” Stephens said. “That’s a really big focus of ours, so that we’re not spending a wasteful amount of time trying to reconcile between two reports before we can research the actual need.”

To further collaboration and overcome data challenges, Republic Bank created a focus group comprised of technical and business teams. The group meets on a regular basis to discuss reporting and ensure alignment from a business standpoint.

“It’s created this healthy dialogue to ensure everyone is on the same page about what we can do today, and to develop a strong roadmap of where we need to go — working in cohesion all along the way,” Moyer said.

Navigating these challenges requires financial institutions to think differently about profitability, reporting and analytics, and long-term planning for a range of potential future scenarios. Syntellis’ AxiomTM Financial Institutions Suite equips bank leaders with visibility into relationships, actionable insights, and driver-based planning and forecasting, so banks can navigate through the turmoil and emerge successful on the other side.

Note:

1 Clint Hilley recently transitioned to a new role as Vice President of Finance at APCU/Center Parc.

Additional Resources

6 Best Practices for Integrated Margin Planning in a Rising Rate Environment

RAROC: A Best Practice Approach to Profitability