The first year of the COVID-19 pandemic was a difficult year for financial institutions across the country. For Manitowoc, Wisconsin-based Investors Community Bank (ICB), now part of Nicolet National Bank, the volatility and uncertainty of the economy in those first few months led the bank’s leaders to reforecast the annual budget for the first time.

“In the bank’s 23-year history, we had never done a reforecast before,” said Cari Larsen, ICB’s Vice President and Controller.

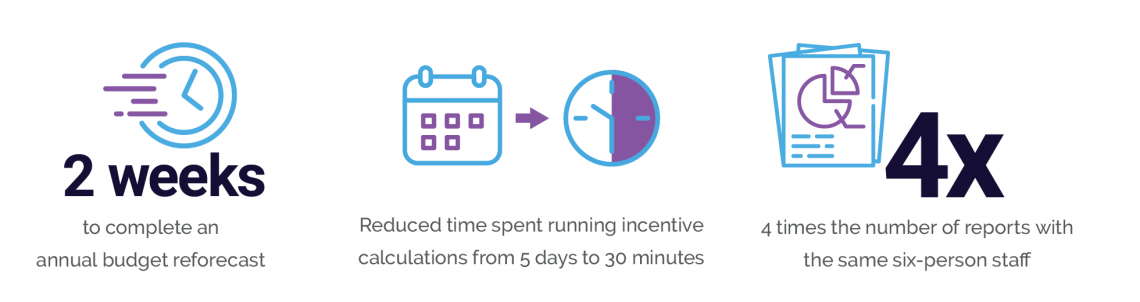

The finance team completed its first budget reforecast in less than a month in April and its second in two weeks in July. The process was smooth and efficient. Two years earlier, ICB had implemented the Axiom™ Financial Institutions Suite. Larsen said that having those tools in place prepared the bank to navigate a disruptive event like the pandemic.

In addition to reforecasting, ICB used Axiom software to conduct net interest margin calculations to monitor the financial impacts of the federal Paycheck Protection Program (PPP) loans on the institution. They also easily tracked lenders’ progress toward incentive compensation targets, which fostered engagement and helped the bank succeed during a challenging year.

“We exceeded our targets in 2020, which with COVID was a huge undertaking,” Larsen said. “It happened because people were driven and were monitoring those targets. For everything awful about 2020, we actually ended up doing pretty well.”

Improved Efficiencies and Accuracy

Prior to implementing Axiom, ICB relied on many of the same manual planning and reporting processes used since the bank was established in 1997. The old processes were time-consuming and contributed to inaccuracies because the data often became outdated before reports could be finalized.

With a six-person team leading the bank’s finance and reporting functions for ICB’s four branches and four loan offices across Wisconsin, bank officials were looking for a more accurate and efficient solution. Today, ICB uses Axiom for everything from profitability analysis to payroll budgeting.

“It’s great to have a centralized platform that can function as a data mart for just about anything you need, instead of going into several systems to gather the information.”

— Frank Joachim, ICB’s Assistant Treasurer

“We have a central hub not only for housing the data but also for planning, profitability reporting, incentive compensation, and other functions,” said Joachim.

Before Axiom, most of the institution’s pricing decisions and many of its reports were done manually. For its incentive calculations, for example, the bank had nine different tiers and 24 different criteria, and everything was done on a spreadsheet. As a result, incentive calculations took five days or more over the course of the year to complete and had to be reviewed for accuracy at multiple levels within the organization. Now, the reports are generated quickly and are more accurate because they pull data directly from the bank’s payroll system.

“Now, I can run incentive calculations in less than 30 minutes ,” Larsen said. “I can have accurate numbers on any given month in a very short period of time. It’s amazing.”

Other processes that previously took a day or more — like investments reconciliation and net interest margin calculations — now take only minutes or seconds to generate. The system — which has at least quadrupled the number of reports the small staff can produce — also is set up to automatically generate monthly variance reports and regular reports for the Board of Directors that previously took several hours to compile manually.

“It’s maybe a little exaggeration to say it’s just a push of a button, but it’s not much more than that,” Larsen said. “We run pretty lean, but we’ve been able to do so much more. [Axiom has] created efficiencies for us that have in turn created efficiencies for the rest of the bank.”

New Data-Driven Insights

With Axiom, ICB has more visibility into data across the institution. Having the data and analytics available in-house also helps to ensure informed decisions. Previously, finance discussions were limited to the finance department and a few top executives. Now those discussions occur at multiple levels, including lenders.

“Now everybody’s talking about profitability and the bottom line,” Larsen said. “It’s allowed for much more analytical thought and margin discussions at levels that had never happened before.”

Loan pricing and portfolio strategies

With Axiom™ Funds Transfer Pricing and Profitability, the finance team built a pricing model to assist ICB’s loan and deposit teams. The model analyzes where the bank stands from a risk-adjusted return on capital (RAROC) perspective.

“We look at all levels of profitability from line-of-business to officer, and all the way down to product, customer, and instrument profitability,” Larsen said. “That analysis helps drive the decisions that are made from both a bank strategy perspective, as well as which loan and deposit relationships we want to pursue.”

ICB has an extensive loan portfolio that is sold on the secondary market and for which they retain the servicing rights. Previously, portfolio profitability analysis was performed on a macro spreadsheet and took an entire day on a designated computer to run. Now it takes only a few hours, and the profitability metrics help determine which loans to keep on ICB’s balance sheet and which loans to sell.

Profitability

The finance team also is better-equipped to identify how individual lenders, customers, and broader customer relationships contribute to the bank’s overall profitability. Before Axiom, the finance team used a complex system to track lender profitability, with loan codes and general ledgers for each loan officer. “It was so granular that it got to the point that it was almost impossible to keep accurate,” Larsen said.

The Axiom solution helps identify the more valuable relationships worth fostering and which ones may not be so valuable. The bank can focus its profitability analyses at the line-of-business (e.g., agriculture, business, retail) and officer levels.

Ad hoc reporting

The ability to produce customized ad hoc reports with the Axiom™ Reporting and Analytics Platform has been another significant benefit, Larsen said. Axiom was the best solution they found to help them serve their unique agriculture clients. “Agriculture is such a different animal that we wanted to have that flexibility to write our own reports,” she said.

The solution has opened a “world of information,” and the finance team now regularly gets ad hoc report requests throughout the institution. If needed, they can set up recurring reports that are automatically generated and distributed to managers whenever they need them. “One thing I like best about Axiom is the ability to create and customize,” Joachim said. “I don’t know that we’ve ever had to turn away a reporting request.”

Variance analysis

The Axiom suite also allows ICB to examine variances in actual performance metrics to budget month-over-month or year-over-year. The finance team can then drill down into the data to identify the root causes behind variances to help determine how best to close any gaps.

Greater Accountability Boosts Profitability

Having greater visibility into the data has led to more accountability within the institution and has positively impacted ICB’s profitability. Bank officers hold monthly meetings to walk through their RAROC numbers and trends at both the portfolio and customer instrument levels. It has helped lenders better understand what drives those metrics and how they can improve their results. Joachim says he gets calls from lenders all the time to discuss what caused their RAROC to increase or decrease from month to month.

With Axiom™ Incentive Compensation Management (ICM), the finance team produces quarterly reports to show managers and executives where the bank is relative to its ICM goals throughout the year. Before Axiom, managers often set ICM goals at the beginning of the year and then did not discuss them for many months because there was no way to track progress toward those goals over time. The quarterly reports have led to a lot more strategic discussions on how managers can meet their goals.

More Time for Valuable Analysis

“Now we’ve got people thinking and talking about incentive compensation,” Larsen said. “It has people more aware, so it is more top-of-mind, which has been great.”

Larsen and Joachim both said they would recommend Axiom to other community banks in search of a solution.

“I think it’s great for improving efficiencies, from both the reporting and planning perspectives. I haven’t seen a better tool to do that. Once everything is set up and you’ve got everything running, it really frees up your time. Instead of building reports or other day-to-day tasks, it gives you the time to do actual analytics.”

Having the time to conduct analyses and build accountability across the organization was especially critical in 2020. ICB did a zero-based budget for the first time last year to thoroughly understand its finances. Even with deeper granularity, Axiom made the budget process much faster and smoother than in years past, Joachim said. There also was greater engagement by managers institutionwide.

“The fact that managers are engaged and asking questions has made us financially stronger, because it’s not just accounting telling them what they can and can’t spend,” Larsen said. “It’s the managers at all levels getting involved.”

Learn how Axiom can help your bank get to the next level

Axiom Incentive Compensation Management Solution Brief

Axiom FTP and Profitability Management: Financial Institutions Solution Brief