Though American National Bank of Texas (ANBTX) boasts a long and rich history of nearly 150 years, it has experienced some of its most significant growth just in the last 10 years. “We’ve more than doubled in size in that timeframe,” said Enrique Gonzalez, Vice President — Financial Planning & Analysis Manager at ANBTX.

As it increased its scope of business to encompass consumer, mortgage, commercial, and wealth management services, the bank needed more robust budgeting software. ANBTX implemented Syntellis’ Axiom™ Funds Transfer Pricing (FTP) and Profitability, Axiom™ Planning, and Axiom™ Reporting & Analytics for their flexibility, scalability, and deep insight that could empower department heads to take ownership of their financials.

Reducing the allocations process from months to minutes

The bank found its prior budgeting software slow, Gonzalez noting, “It just dragged on and on.” Axiom FTP and Profitability helped speed up one process in particular: allocations. What used to be a multi-day process now takes mere minutes.

“I started allocations at 9:30 this morning, and just seven minutes later, they were done,” Gonzalez said.

Because the bank runs allocations every month — even more during the budgeting process — Axiom generates significant time savings for ANBTX.

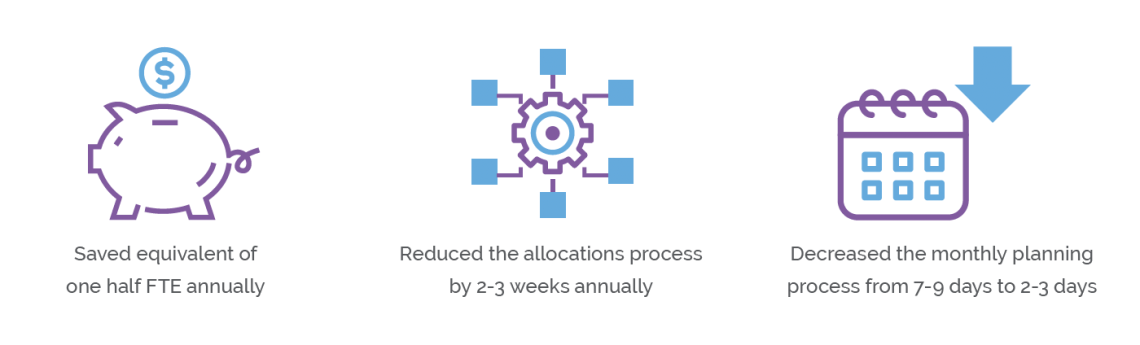

“Just that one module saves us two weeks, maybe close to three weeks of time,” Gonzalez said.

“Our previous monthly planning timeframe was about seven to nine business days. Now, we start working on financials on a Friday, and by Monday morning, we’re about 80% of the way done already.” Enrique Gonzalez, Vice President — Financial Planning & Analysis Manager at ANBTX

Generating time savings across the board

Axiom also reduced the time needed for FTP simulation testing. Previously, it took an entire week, with the simulations often botching the bank’s actual data and forcing the team to restart the process from the beginning, adding another seven days to the timeframe.

“Now, we’re able to do so much more with our time,” Gonzalez said, explaining that simulations now take just a day or two.

Beyond shortening FTP simulations, Axiom expedites the bank’s monthly planning process.

“Our previous monthly planning timeframe was about seven to nine business days,” Gonzalez explained, saying the team would kick it off around the second of the month and complete it around the 14th. “Now, we start working on financials on a Friday, and by Monday morning, we’re about 80% of the way done already.”

Between its robust functionality and speed, Axiom easily surpasses the bank’s prior software. “It’s like comparing a bicycle to a car,” Gonzalez said. “It’s the efficiency — you can get to the same place, but with a bicycle, you will not get there as fast or as comfortably as with a car.”

Minimizing staff required to drive the budget process

In addition to time savings, ANBTX sees significant labor savings with Axiom. Historically, the budget process took months — from the beginning of August until the middle of January — and required fully staffed resources working overtime for that entire period. “Back in the day, we would tell people, ‘Don’t even knock on our doors during these months. We’re not available,’” Gonzalez said.

Now, he said he conducts the process with just a little administrative assistance, allowing him to continue to focus on his other responsibilities and ultimately saving the bank the equivalent of one half of a full-time employee (FTE) annually.

Deeper insight through margin planning

With Axiom, ANBTX can dig deeper into its data and margin planning capabilities.

“We have a much wider scope of what we can look at,” Gonzalez explained, noting that the bank can now analyze its cost of funds versus its cost of yields to drill into individual classes of products. “We can slice costing into those product classes in ways we weren’t even remotely able to do functionally in our old system.”

The bank currently uses Axiom reports to glean these insights and is working to build dashboards to see that information at a glance.

Quicker and more flexible reporting

“Axiom has provided us with nimbler capabilities, and we’re able to show people a lot more information than we ever had,” Gonzalez said — highlighting budget detail in particular. Historically, ANBTX may have been able to see that accounting spent $100,000 on software, but ultimately lacked insight into what made up that expense. Now, the team can see precisely how each cost category breaks down, allowing them to monitor budget deviations more closely.

“We have a lot more visibility into the granular, sub-general ledger information that we’ve never been able to see before, with the ability to access it quicker, too,” he said. “Report creation these days takes about a week, versus weeks and weeks and weeks back in the old days.”

"Axiom has provided us with nimbler capabilities, and we’re able to show people a lot more information than we ever had."

Creating budget advocates across the institution

For ANBTX, Axiom doesn’t only offer value to executives; it creates an environment for everyone within the organization to understand budgets and costs.

“The visibility that we get with this software enables every individual in the bank to drive cost savings,” Gonzalez said. From middle managers to department heads, anyone with budget concerns can now understand what goes against their budgets and have more perspective on how they can improve and more effectively preserve their budgets.

"The visibility that we get with this software enables every individual in the bank to drive cost savings. "

ANBTX experienced incredible growth over the past 10 years. Even with that expanding workload and increasing lines of business, Axiom scaled with the bank, offering flexibility, deep data, and transparency — ultimately enabling everyone at the bank to be more effective in their roles.

Learn more about Axiom for financial institutions

How to Determine the Best Non-Interest Income Sources for Profitable Growth

How Data Analytics Improve Banking Customer Service and Profits