How Axiom FTP & Profitability improves profitability and product mix, incentivizes growth, and streamlines reporting

How quickly can Syntellis’ Axiom™ FTP & Profitability deliver a return on investment (ROI) for your financial institution?

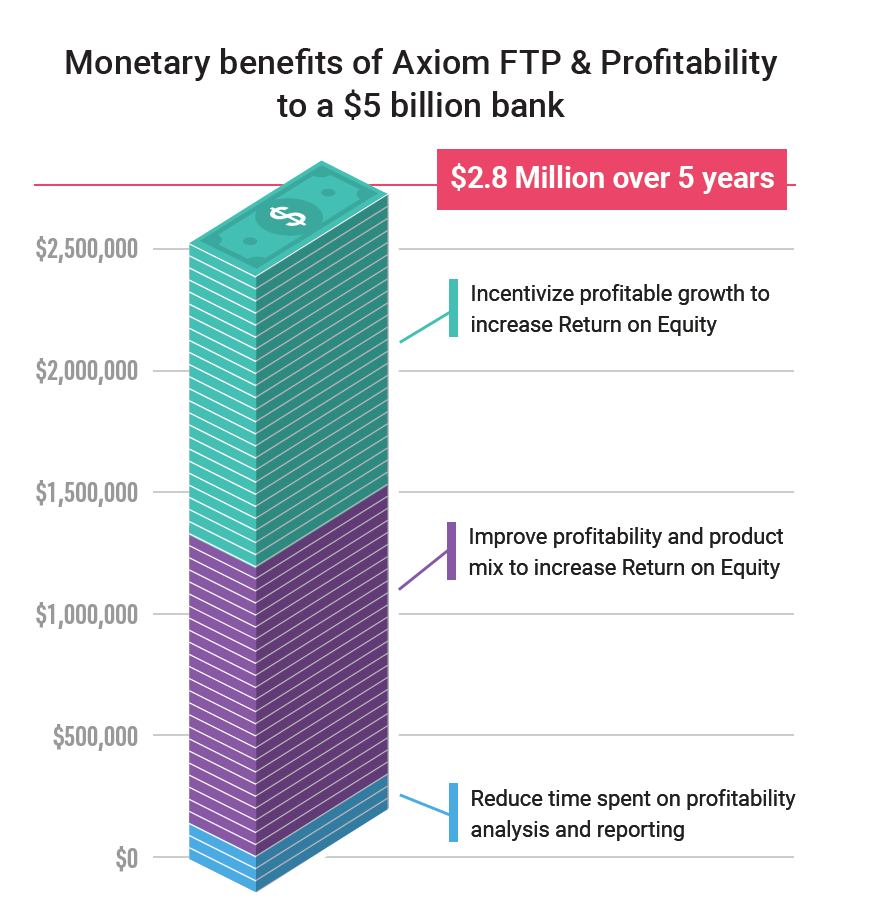

Hobson & Company, a third-party research organization focused on total cost of ownership and ROI studies, conducted in-depth interviews with 12 financial institutions and found that Axiom FTP & Profitability solution delivered exceptional results and efficiency. A typical institution with $5 billion in total assets will:

Increase Return on Equity (ROE) by 5 basis points (banks and other financial institutions) or Return on Assets (ROA) by 1.5 basis points (credit unions) by improving profitability and product mix

Increase ROE by an additional 5 basis points (banks and farm credit associations) or ROA by 1.5 basis points (credit unions) by incentivizing profitable growth

Reduce time spent on profitability analysis and reporting by 60%

For a credit union with $5 billion in total assets, payback would occur in 5.1 months and generate a total ROI of 487% over five years (42.4% annualized) through improved efficiency and increased profitability.

For a bank or other financial institution with $5 billion in total assets, payback would occur in 11.1 months and generate a total ROI of 171% over five years (22.1% annualized ROI).

See for yourself how Axiom FTP & Profitability can bring savings and efficiencies to your institution!