The Ultimate Guide to Scenario Planning + Modeling

- 101: The Basics of Scenario Planning

- 201: How to Create a Scenario Plan

- 301: How to Streamline Your Scenario Modeling

101: The Basics of Scenario Planning

What is scenario planning?

Scenario planning is a method of strategic financial planning that enables finance leaders to mitigate risk and prepare for volatility.

Scenario planning accounts for inherent future uncertainties by quantifying the financial and operational implications of change, and analyzing a range of possible outcomes. The process involves identifying the key drivers of change for an organization, calculating an array of projections based on scenario modeling for potential variations in performance for one or more of those drivers, analyzing the results, and then determining how best to apply those results to the organization’s long-term financial and strategic plans.

Scenario planning may be done across an organization, or at the unit or initiative level. With initiative planning, finance leaders use scenario planning to assess the potential financial impacts of key business decisions, such as closing a specific department or business unit, or launching a new service line.

What is the purpose of scenario planning?

Scenario planning helps finance leaders better understand the influence of various factors driving fluctuations in an organization’s performance and overall financial health. It enables them to evaluate the possible financial impacts of different external forces — such as shifting market demand or increasing expenses — or internal forces — such as variations in staffing levels or organizational investments. Armed with these insights, leaders can better mitigate risks and prepare for change through more informed decision-making.

As Paul J.H. Schoemaker, Professor at the University of Pennsylvania’s Wharton School, writes:

“Scenario planning attempts to compensate for two common errors in decision-making — under prediction and over prediction of change. Most people and organizations are guilty of the first error.”

How does scenario planning relate to strategic planning?

Scenario planning is a valuable strategic management tool that allows for more robust strategic planning. Through scenario planning, finance leaders gain insights to assumptions and biases that may otherwise be hidden, reveal opportunities and areas of risk, and expand the scope of their strategic options.

Finance leaders can use the scenario planning analysis to help reset strategic priorities, determine future budget targets, reforecast an annual budget, update a rolling forecast, or reshape a five-year strategic plan.

What are the advantages? What are the challenges?

Scenario planning is a powerful learning tool that helps organizations predict and plan for a variety of possible futures. The benefits include the ability to:

- Understand and define key drivers of organizational performance

- Quantify the organization’s sensitivity to key drivers

- Reduce or eliminate bias or aspirational thinking that is not grounded in reality

- Test a strategy’s strength and flexibility under adverse or changing conditions

- More effectively manage risk and uncertainty

- Treat financials primarily as outcomes rather than inputs in the planning process

- Produce higher quality strategic plans, budgets, and forecasts

- Be better prepared if adverse circumstances should manifest

- Consider new possibilities

The most common issues with scenario planning center around either modeling too many scenarios, or too few. With the former, organizations can spend inordinate amounts of time and resources running numerous scenarios that do not significantly differ, and thus offer limited insights for strategic decision-makers. With the latter, finance leaders risk missing opportunities to better understand the complexities of change, and the interplay of various factors on the organization’s future performance.

Other common challenges include data deficiencies and lack of institutional knowledge. One cannot model what one does not understand. Finance leaders must proactively engage with others from across an organization to better understand what drives fluctuations in revenue, operating costs, and other financial indicators.

Lastly, scenario planning can be incredibly time consuming without the right strategic planning tools. Organizations need well-designed solutions that quickly couple the right data with modeling logic to rapidly generate a range of scenario models.

What are the three most common types of scenario planning used by finance teams and leadership?

- Single Variable Sensitivity Analysis involves changing one variable at a time while holding others constant and quantifying the impact of that singular change. These types of scenarios can help identify the drivers or model inputs that have the greatest effect on the organization and therefore deserve the greatest attention.

- Multi-Level Driver-Based Analysis is also known as “what-if analysis,” and includes both independent and dependent drivers. This scenario planning example incorporates a series of independent drivers — such as volume and growth assumptions — which then cascade down to affect downstream dependent drivers, such as departmental workload or supply needs. Multi-level driver-based analysis is a critical tool for effective contingency planning and offers insights to the “cause and effect” of multiple assumptions.

- Initiative-Based Scenario Planning involves incorporating different sets of initiatives together into a composite plan or strategy. Finance leaders can layer different initiatives or combinations of initiatives on top of a baseline to gauge their combined impacts.

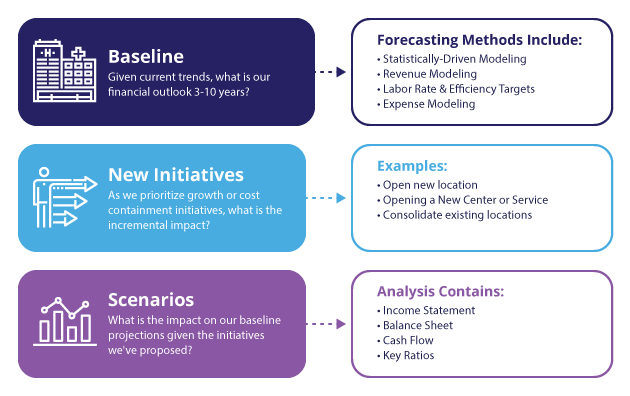

201: Creating a Scenario Plan

How do you create an effective scenario plan or model?

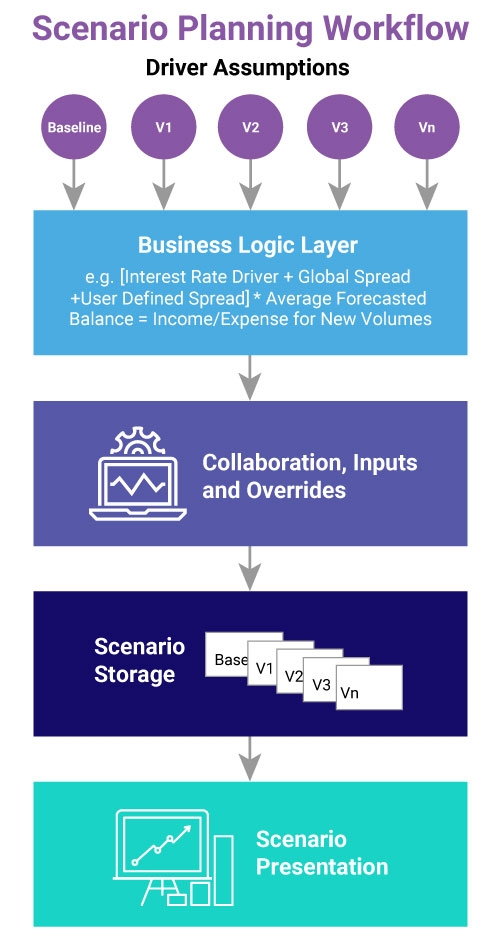

Creating a robust scenario plan involves five key steps:

- Establish driver assumptions. Well-constructed scenario planning models identify an organization’s key business drivers. In a standard cause-and-effect relationship, these are the independent or causal variables.

- Define the business logic. The interplay between driver variables and financial outcomes is the heart of any scenario planning model. In this step, finance leaders must define algorithms that best emulate the dynamics of the organization.

- Collaborate with key stakeholders to review inputs. Once finance leaders have identified key drivers and defined the business logic, they should work with stakeholders or subject matter experts to review those assumptions and make adjustments based on their feedback.

- Execute scenario analysis. Finance leaders use a variety of tools to conduct scenario modeling, from simple spreadsheets that require manual calculations to more advanced scenario planning software solutions that allow for automated calculations.

- Store and present scenarios. After the scenario mapping is complete, finance leaders should save their scenario analysis in an accessible format for future reference and recalibration. The core findings then should be translated into easy-to-understand presentations for stakeholders, with side-by-side comparisons that include key drivers, financial information, and narrative around the contents of the scenario.

Why should I use scenario modeling software versus spreadsheets?

Using spreadsheet templates or Excel financial models for scenario analysis is time consuming, falls short in managing and incorporating financial and operational data, and often relies too heavily on preset external drivers. With the right scenario modeling software, finance leaders can greatly reduce the amount of time, effort, and resources needed to perform scenario modeling, and greatly increase the accuracy and range of their analysis.

Strategic planning software that includes scenario modeling capabilities can rapidly create and process multiple scenarios, and can be used for financial modeling, cash flow analysis, or other reporting needs.

Syntellis’ Axiom Long-Range Planning provides the strategic planning tools that enable organizations to model multiple scenarios and develop mid- and long-term financial plans that align with their strategic goals. The solution empowers finance leaders to:

- Create scenarios to mix and match assumptions such as current demand, projected growth, wage inflation, and interest rates

- See the impacts of proposed strategic initiatives and capital projects

- Generate a full set of forward-looking financial statements based on the desired planning horizon

- Deliver executive-level dashboards with operational, financial, and third-party data

301: Integrated and Streamlined Scenario Modeling

Syntellis’ Axiom™ Financial Planning solution guides finance leaders in planning for the future by modeling initiatives and potential scenarios to help better understand long-term financial impacts.

Financial Planning uses best-practice financial management principles to society's foundation organizations develop multi-year financial plans.

Key capabilities of Axiom Financial Planning include:

Initiatives Planning and Scenario Modeling

- Simulate and model the financial impact of any combination of proposed strategic initiatives or potential scenarios

- Assess the viability of identified and proposed initiatives, and pinpoint the incremental volume, revenue, cost, debt, and capital structure implications

- Incorporate alternative financing scenarios to define a comprehensive plan with an optimal underlying financing structure

- Track ongoing performance of approved initiatives via comprehensive reporting and workflow notifications

Integrated Financial Planning

- Fully integrate long-range financial plans and processes with capital planning, operational budgeting, forecasting, and more

- Develop projections for your financial planning and analytic needs

- Prepare, produce, and integrate modeling across financial statements, including income statement, balance sheet, and cash flow

Build a brighter future with financial modeling and scenario planning software

Learn the best practices for scenario planning in your industry

Scenario Planning for the Agile Healthcare Organization

4 Best Practices for Long-Range Strategic Financial Planning