The COVID-19 crisis brought decreasing volumes for hospitals and health systems, and while some departments have started to return to pre-pandemic levels, recovery is not equal across all sectors.

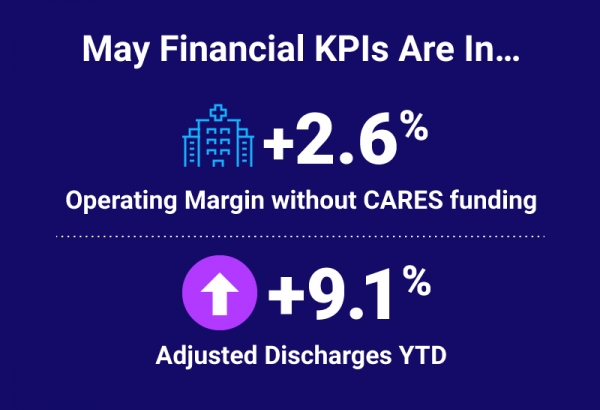

To better understand the progression of healthcare recovery, we analyzed data from more than 125,000 physicians and 1,000 hospitals in May 2021 and compared it to the same time period in 2019. This led to these key findings:

- Pediatric and mother/baby nursing department volumes increased between April and May 2021. Specifically, Obstetrics and Gynecology nursing volume increased 0.4% and Labor, Delivery, and Postpartum volume increased 4.4%

- However, overall pediatric and mother/baby nursing department volumes are down by more than 5% in May 2021 compared to May 2019

- Other nursing services, such as those focused on adult patients, have experienced quicker recovery

- Drops in hospital patient days have affected supporting departments, such as food and nutrition service departments

Slow Recovery for Pediatric and Mother/Baby Nursing Departments

Hospitals saw a dramatic change in inpatient volumes during the coronavirus pandemic. Many departments have now started to experience a return to normalcy, but recovery isn’t equal across the board. While volumes in pediatric and mother/baby nursing departments increased over the past month, overall volumes are down in May 2021 compared to May 2019.

Specifically, obstetrics and gynecology nursing department volume increased 0.4% between April and May 2021, but volume is down -10.8% compared to two years ago. Labor, delivery, and postpartum volume increased 4.4% since April 2021, but is down -7.9% compared to May 2019.

This is a stark contrast to volumes in nursing departments for adult patients, which are up in May 2021 compared to May 2019.

This slow recovery could be a response to a variety of circumstances, including the 4% overall decline in births in 2020 compared to 2019. Other contributing factors could include:

Shifting Delivery Preferences

Early in the coronavirus crisis, many hospitals made the decision to exclude partners and support persons (such as doulas) from birthing rooms. During that time, there was a spike in internet searches for home birth services. While the number of U.S. births at birth centers and at home was on the rise even before the COVID-19 pandemic, this growing interest in alternate birthing services may indicate that women are increasingly reluctant to deliver in hospital settings.

Child Vaccination Rates

While the FDA authorized the use of the Pfizer COVID-19 vaccine in children ages 12 to 17, no vaccine is currently available for younger children. That, coupled with concerns around virus transmission, may cause parents to postpone taking their children to the hospital for elective or non-emergency procedures.

Labor Shortages

Concerns over staffing issues and patient safety have triggered recent nurse strikes in hospitals across the U.S. During the height of the coronavirus pandemic, many hospitals also laid off, furloughed, or cut the pay of employees and providers. Together, these factors could contribute to labor shortages that may limit volumes in some departments.

Shortened Hospital Stays

Many hospitals implemented modifications to labor and delivery units to protect patients and healthcare workers from COVID-19 infection. Research reveals that following the introduction of these policies, the length of hospitalizations decreased for mothers after both vaginal births and c-sections.

This may also be partially attributable to patient preferences around length of stay; if given the choice, new mothers may prefer to minimize time spent in the hospital due to concerns around COVID-19 infection.

Effects on Supporting Departments

The drop in volumes across patient care departments has also affected supporting departments. In May 2021, food and nutritional service departments experienced about a -19% drop in meals compared to May 2019. At the same time, there have been corresponding increases in expenses. Labor expense per meal increased for patient food services (25%), patient food services combined with retail (15.8%), and nutritional and dietary services (21.9%) departments.

Hospital leaders should closely monitor supporting departments like these to determine if operational or budget adjustments are needed. As the general food service industry has struggled to rehire staff post-pandemic, the healthcare industry may also face increased competition for hiring.

With an understanding of these changes, hospitals and health systems can make informed planning decisions and evolve business models to ensure exceptional patient care and long-term financial sustainability.

Source: Syntellis’ Axiom™ Comparative Analytics, which offers access to real-time data drawn from more than 1,000 hospitals, and 125,000+ physicians from over 10,000 practices and 139 specialty categories. Powered by Syntellis IQ, Comparative Analytics also provides the data and comparisons specific to a single organization for visibility into how their market is evolving.

Users also read:

Top 10 Financial and Operational Metric Areas for Healthcare