Do you know which clients generate your greatest profit, and what client types your bank, credit union, or farm credit association should pursue to maximize profitability?

Among financial institution clients, only 20% create economic profit, with the top 1% creating the most profit. On the other hand, 30% of clients don’t generate profits at all.1

Axiom™ Relationship Profitability and Pricing System (RPPS) helps institutions identify complex relationships, gauge the profitability of each, incent employees, and price according to risk, relationship, and other factors to provide appropriate returns.

Take these 5 steps to improve the profitability of your banking relationships:

- Define relationships

- Identify top and bottom performers

- Manage risk appropriately

- Price based on the relationship

- Incent based on profitability

#1 — Define Relationships

Business relationships are complex and often include intertwined holding companies, subsidiaries, partnerships, family relations, and more. To manage each relationship profitably, you must have strong end-to-end knowledge of what constitutes a single relationship.

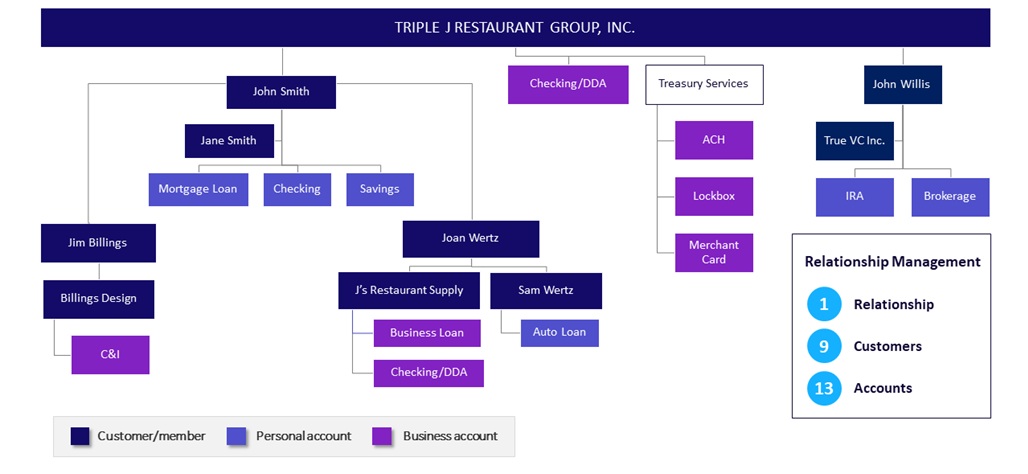

Figure 1: Definition of a relationship

In this example (Figure 1), a single relationship consists of nine customers and 13 accounts, but those ties may not be readily visible without in-depth analysis. There’s an owner, business partners, an investor, spouses, and additional companies that combine to form that one relationship.

Pricing decisions have more impact when the institution fully understands the entirety of a relationship.

#2 — Identify Top and Bottom Performers

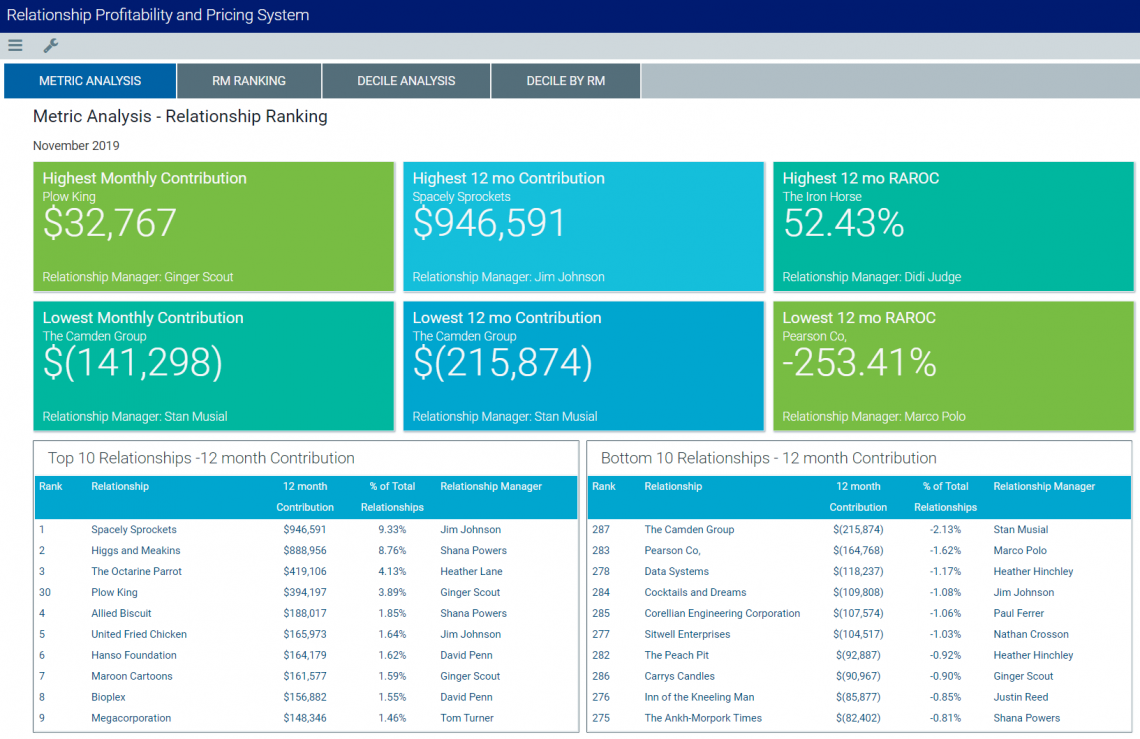

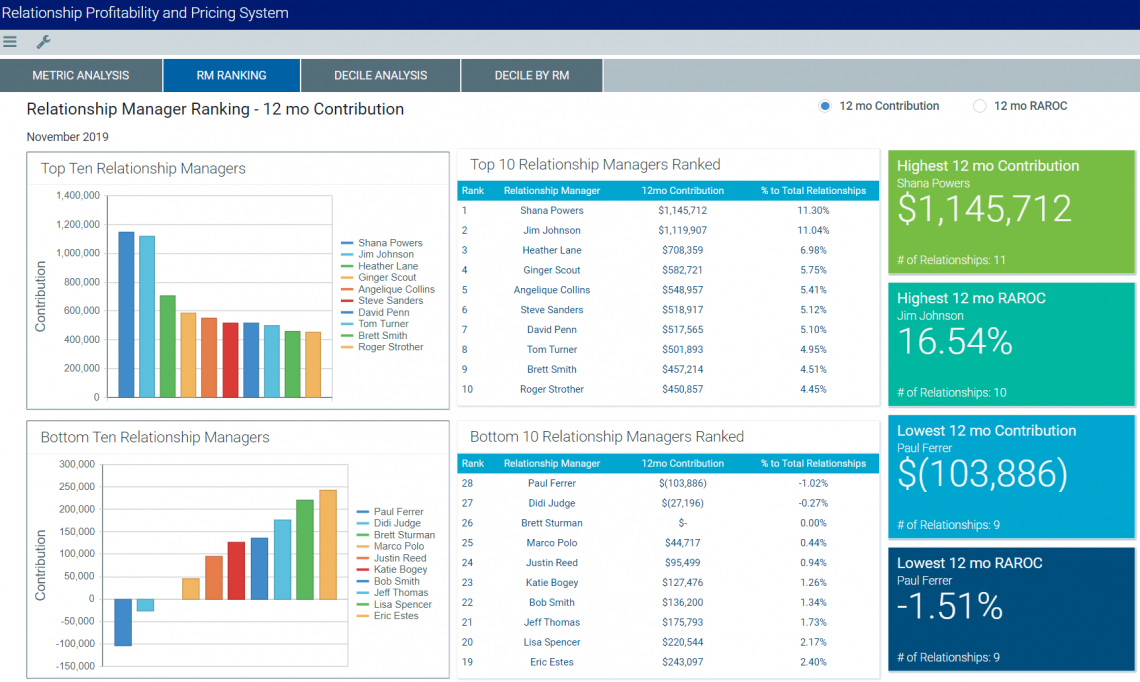

Figure 2: Axiom RPPS Relationship Ranking

One metric in Axiom RPPS shows your top and bottom performers (Figure 2) in terms of highest and lowest 12-month contribution and risk-adjusted return on capital (RAROC). It’s important to look at profitability not only in terms of contribution, but also on a return of risk basis.

By outlining top and bottom performers, institution leaders know where to focus their attention to retain the best clients and improve relationships with the lowest performers. The Axiom RPPS dashboard helps leaders understand why certain relationships are more profitable than others, which customers and accounts within those relationships contribute positively or negatively, and what risks exist within those relationships.

#3 — Manage Risk Appropriately

Maximizing profits involves a delicate balance to optimize each relationship while balancing its inherent risk. Three specific risk categories relate to relationship profitability:

- Concentration risk exists when a small number of relationships generate a high proportion of profit, which could leave an institution vulnerable should a top client suddenly leave.

- Credit risk is an obvious factor that’s more critical in the current COVID-19 environment or anytime a particular industry faces increased credit risk. Any relationship should include a risk analysis to limit institution loss exposure.

- By making sure you recognize your most important relationships, institutions can limit reputation risk that occurs when influential clients speak negatively about the institution.

Banks and credit unions need to work prudently and proactively with borrowers at risk or unable to meet their ongoing contractual payment obligations.

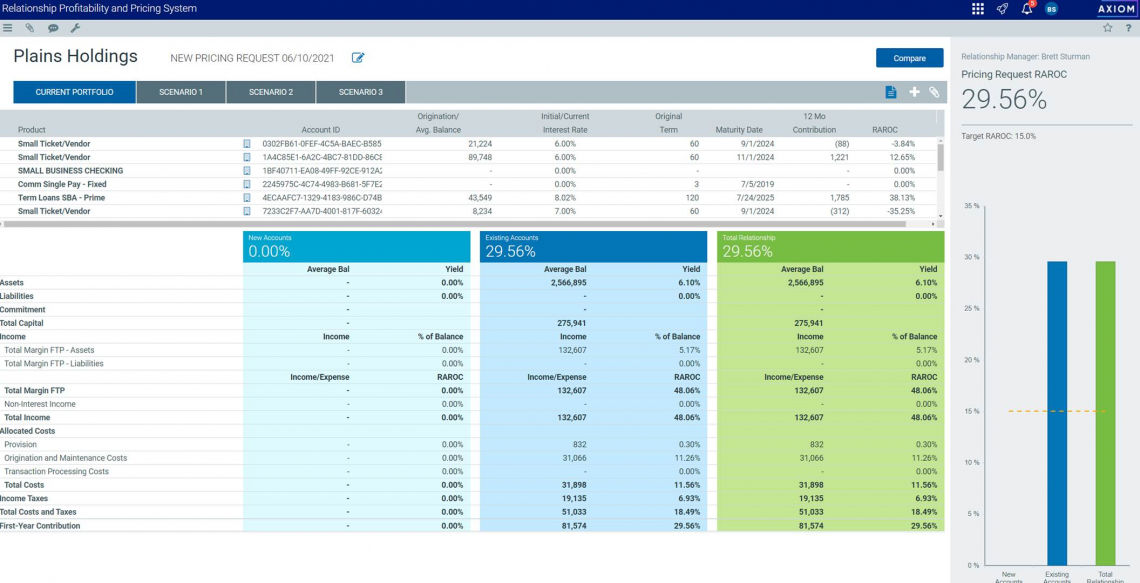

Figure 3: Axiom RPPS Risk-Based Pricing

#4 — Price Based on the Relationship

The most successful banks understand the interplay between pricing and risk, structuring deals that balance customers’ best interests with projected institutional returns. Pricing decisions must be based on the empirical profitability of each relationship and include adjustments for client risk profile.

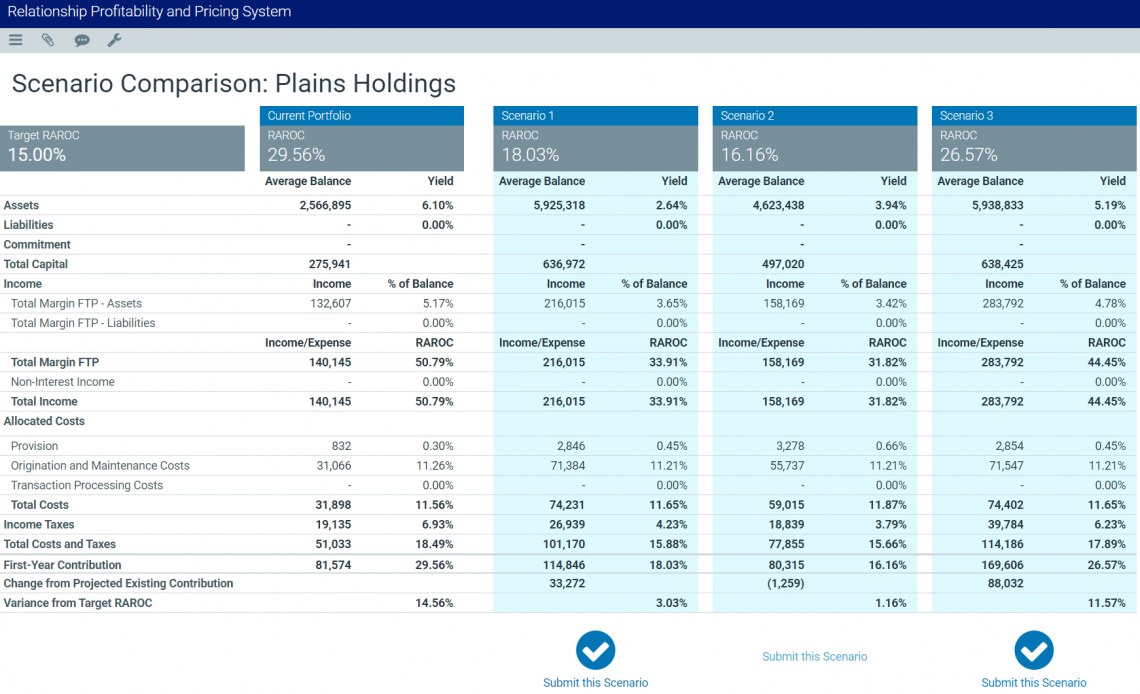

Figure 4: Axiom RPPS Pricing Scenarios

Perhaps a bank can offer a more attractive rate on a 12-month CD that will be offset by a slightly higher interest rate on a commercial loan to maintain profits across the client relationship. Axiom RPPS models scenarios (Figure 4) across a wide range of assumptions and conditions, including interest rate, risk profile, risk rating, fees, term, loan type, and more.

#5 — Incent Based on Profitability

Most institutions (78%) see value in including profitability as an employee incentive compensation metric, but few incentive programs align with institutional profitability goals.2

Figure 5: Axiom RPPS Relationship Manager Ranking based on 12 month contribution

In addition to understanding the value of client relationships, Axiom RPPS (Figure 5) can help institutions see the value contributed by lenders, officers, and relationship managers. Growth for the sake of growth isn’t the same as profitable growth based on earnings, returns, and dividends.

Linking incentive compensation to the value created from an employee’s relationships will drive the concept of maximizing profitability throughout the organization. Compare 12-month contribution and 12-month growth — not just in terms of performance, but also in terms of profitability and profitable growth — and use those metrics in employee goal-setting.

Conclusion

Axiom RPPS is a strategic tool that helps institutions effectively manage client relationships through identifying and understanding those relationships, quantifying the financial impact of each, understanding inherent or emerging risks, pricing new business accordingly, and incentivizing your relationship managers to focus on growing relationships profitably.

Syntellis’ Axiom Relationship Profitability and Pricing System (RPPS) provides financial institutions with a complete picture of each customer’s total relationship value and an understanding of how to accurately price and manage that business based on the customer’s empirical profitability. Axiom RPPS provides portfolio views and over 30 reports and dashboards to provide actionable insights, helping relationship managers and institution leaders optimize profitability while providing the best possible customer/member experience.

1 Huber, J., Steclik, I., Olsen, T.: How Banks Can Turn Around Unprofitable Corporate Clients. Bain & Company, May 16, 2017.

2 2021 Financial Institutions Finance and Technology. Syntellis Performance Solutions.

Read more on how to improve your profitability:

How to Combat Mounting Competition from Neobanks

Margin Planning in a Rising Interest Rate Environment