STAR Financial Bank is one of the largest privately held community banks in Indiana with 38 locations, $2.6 billion in assets, and over 500 employees offering services in banking, insurance, trust, and wealth management. An impending software sunset of the bank’s legacy system and the need for robust profitability reporting kicked off a search for powerful new software. Of the many options, Axiom software stood out as a solution tailored for financial institutions and backed by exceptional customer support.

Why Axiom Software?

Robust Profitability Analysis and Reporting

STAR Bank didn’t have a profitability management solution with its legacy system, yet increasingly needed to know exactly what was impacting profitability. Axiom™ FTP and Profitability offered a comprehensive profitability platform that pulled all the pieces together. As a result, the bank now has complete visibility into which customers, products, channels, and services drive the greatest value. “Axiom reporting allowed the business to have greater transparency and understanding of profitability,” says Mark Hutchinson, VP, Director of Financial Planning and Analysis for STAR Bank. “We can get to the lowest levels of instrument data and then roll that up into various segments."

"Axiom improved the finance team’s credibility through higher data accuracy and timeliness. Reporting quickly emerged as our major value-add with Axiom.”

Bank leadership leverages the profitability tools in Axiom “to drive a new incentive plan for the commercial banking team that was built on both profitability and loan growth,” explains Hutchinson. He attributes half of commercial loan growth — which was about 8% year over year from 2014-2019 — to profitability analysis through Axiom, which equated to over 50 basis points’ growth in return on equity, improving shareholder value.

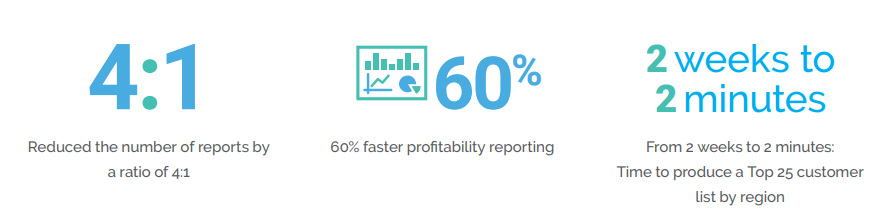

Axiom’s wide spectrum of analytical profitability reporting and analysis includes data segmentation, ranking, and slicing and dicing. With Axiom handling these tasks, Finance saves time and can take on more of an advisory role in the bank. “Our profitability reporting is 60% faster overall,” says Hutchinson. “It used to take us a couple of weeks to produce our Top 25 customer list by region. With Axiom, it takes just a couple of minutes. Axiom changed my role for the better. I’m spending more time advising management instead of compiling data.”

Efficient Budgeting and Reporting

STAR Bank uses Axiom for all budgeting, planning, and reporting, consolidating financials across entities. Line-of-business owners leverage Axiom daily to look at current business results and streamline decision-making.

“Using Axiom, we moved from annual budgeting to quarterly forecasting, and lengthened the time horizon for our budget,” says Hutchinson. “This allowed us to stay nimble, which has been especially useful as we face the financial consequences of COVID-19, and model different assumptions and repricing scenarios.”

For non-finance personnel, the time to create a budget was reduced by over 80%. “One of the biggest contributors to faster budgeting is that we moved from having 262 budget workbooks to 20 budget/forecast workbooks in Axiom.”

Intuitive and Easy-to-Use Platform

Axiom software is built on familiar Excel syntax, so it is intuitive and easy-to-use. Finance owns the system and can edit or create components without having to consult IT. Users work more quickly and efficiently thanks to Axiom’s unique “save back” feature, which enabled the bank to reduce its number of reports by a ratio of four to one.

STAR Bank executives also use Axiom to pull real-time information and make decisions on the fly. “Our users continue to provide outstanding feedback about Axiom,” says Hutchinson. “They feel comfortable with it, which is extremely important because it is the one source of truth for all decision-making.”

Outstanding Customer and Implementation Support

Axiom’s world-class support and the Axiom team’s financial institution expertise were primary reasons why Axiom landed on STAR Bank’s list of top vendors.

“We could comfortably ‘talk shop’ about things like funds transfer pricing that we weren’t comfortable talking about with other vendors,” explains Hutchinson.

Once in the door, the Axiom solution blew away the bank’s upper management. “Upper management was so impressed with the Axiom presentation that they challenged Finance to implement the solution one year earlier than anticipated, which put us in a three-month implementation time,” says Hutchinson.

The structured, expert-guided Axiom implementation made the tight timeline possible and built a strong partnership between the Axiom support team and STAR Bank users. “The Axiom implementation consultants were very committed to our project and their customer support continues to be top-notch,” says Hutchinson. “They are efficient and responsive to our needs. The level of support is a primary reason why we chose Axiom and why we continue to be happy with our choice.”

Your peers also read...

FTP & Profitability Boot Camp: Part 1 - Funds Transfer Pricing Theory and Best Practices

Axiom FTP and Profitability Management: Financial Institutions Solution Brief