Your Complete Guide to Cash Flow Forecasting in Banks + Credit Unions

101: The Basics of Cash Flow Forecasting

What does cash flow mean?

Cash flow is the net amount of funds coming in and out of an organization.

What is the difference between a cash flow forecast and a budget?

A traditional budget includes estimates of revenue and expenses to project expected profit; it is based, for example, on interest earned or paid each month. A cash flow forecast further details when receipts and payments are likely to occur.

Why is cash flow forecasting important?

Cash flow forecasting provides greater accuracy, accountability, and insight into performance than regular budgeting.

What are some examples of cash flows for balance sheet planning?

For a financial institution, cash flows for balance sheet planning are generated by interest income, interest expense, and runoff.

Interest income and interest expense are derived from loans and time deposits/shares held by customers/members. Runoff comes from payments and prepayments of outstanding loans.

How do you calculate cash flow, and what is included?

For each line of business at the institution, cash flows are modeled at the instrument level, accurately taking into account balances and yields based on runoff projections, prepayment expectations, interest rate scenarios, and more. It can optionally include funds transfer pricing (FTP) spread.

Cash flow forecasting (also referred to as cash flow margin planning or cash-flow based planning) is used by financial institutions to better predict NIM.

Cash flow forecasting is like a marriage between Asset Liability Management (ALM) and traditional financial planning approaches — it projects balances, yields, and FTP spread (if used) to accurately inform a cash flow-based budget. This approach makes it possible to process fixed and adjustable records across all instrument types, adding prepayment assumptions so future cash flows reflect a more realistic view of customer/member behavior.

Why is Cash Flow Forecasting Important?

- Greater precision for balances, NIM, and margin projections

- Increased accountability with line of business stakeholders

- Ability to plan margin contribution through time via forward FTP

- Stronger modeling to calculate “what-if” scenarios

- Greater insight into balance sheet and margin performance

How Does Cash Flow Forecasting Work?

Cash flow forecasting begins by modeling cash flows at the record/instrument level, considering factors such as projected interest rates, runoffs and rates of existing balances, the impact of new originations, and (optionally) FTP rates.

The process relies on dividing the consolidated balance sheet into smaller line-of-business or profit center balance sheets. The recommended level of granularity varies with:

- The size of the institution

- The number of plan contributors

- Whether the institution centrally manages pricing and volume goals

- The ability to distinguish fixed-rate and variable-rate portfolios

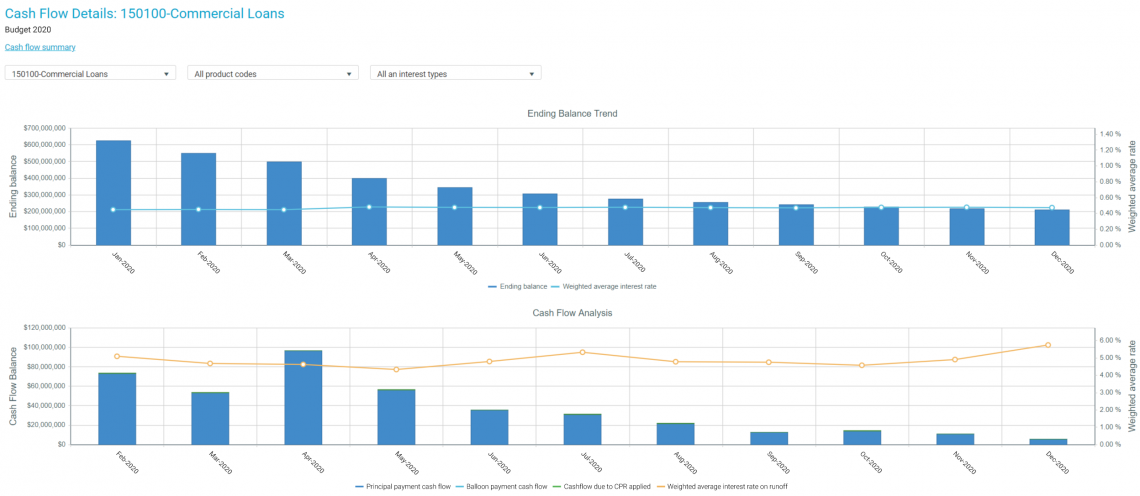

Current Portfolio Position

For each cost center-general ledger combination, a “current position” is established as the basis for cash-flow planning. For example, an auto loan portfolio at the institution’s Main Branch will have a current value, principal runoff projections (due to amortization and prepayments), and interest rates and FTP rates associated with each principal reduction. Optional “path-dependent” prepayments can be included based on interest rate scenarios modeled. Essentially, this lets you view loans and deposit records in portfolios — including those set to mature and reprice.

New Business Activity

Cash flow forecasting distinguishes historical originations from projected new ones — taking into account interest rate levels, runoff, and new volume demand. By manipulating these centrally-managed values along with interest rate projections and planned spread, various interest rate and product mix scenarios can be run with reasonable accuracy.

Determining future cash position also requires input from business owners, most accurately informed by:

- Historical origination levels

- Visibility into pricing and volume trends

How Can I Perform Deeper Cash Flow Analysis?

Because the foundation is the customer/member record, cash flow forecasting lets you analyze cash flow in different ways that are beyond many institutions’ capabilities, grouping instruments by cost center, general ledger, officer code, or more distinctive product categorizations (e.g. new autos from used autos).

Apply FTP to Forward Balance Sheet

Advance cash flow forecasting by applying FTP to the forward balance sheet. This practice has several key benefits, allowing the institution to:

- Create a single, efficient view of the business, unifying forward-looking processes (planning and budgeting) with retrospective processes (profitability measurement and managerial reporting)

- Inform an incentive compensation management plan, rewarding performance based on planning unit contribution, rather than just volume

A cash-flow forecasting engine must have certain capabilities to be effective and highly accurate. These include the ability to:

- Merge the existing and planned book of business

- Precisely model fixed, floating, periodic, and non-rate categories

- Aggregate all plan information, with visibility throughout product, account, and organizational hierarchies

- Process fixed and adjustable records across all term loans and deposits

- Add prepayment assumptions so that future cash flows reflect a more realistic view of borrower behavior

- Store aggregated cash flows for easy retrieval during the planning and forecasting process

- Drill through to view the loans and deposit records in their portfolios, including those set to mature

- Process millions of records using an efficient scheduler capability

- Improve data quality by relying on the system to capture and highlight incorrect field values in loan and deposit systems

Learn More About Cash Flow Forecasting

Improve Cash Flow Forecasting with Axiom Software

Axiom™ Cash Flow Forecaster makes it easy to calculate cash flow projections at the record level, aggregating them into planning portfolios to improve accuracy in net interest margin planning and provide better focus on incremental new business. Our cash flow forecasting software enables data analytics, enhances data visibility, and allows you to build a cash flow forecasting model into the standard budgeting process.

How Axiom Helped Other Financial Institutions

Compeer Financial

The Axiom Cash Flow Forecaster solution calculates individual customer cash flows and supports aggregation by any dimension. For Compeer, key benefits include:

- Predicting net interest margin. Axiom Cash Flow Forecaster calculates the runoff and repricing of existing balances and rates based on the interest-rate forecast and includes the impact of new originations so Compeer can accurately predict projected balances and yields.

- Improved accuracy. Compeer can add prepayment assumptions so future cash flows reflect a more realistic view of customer behavior.

“With Axiom Cash Flow Forecaster, we’ve been able to tie changes in our interest-rate assumptions back to a specific instrument, which has been very valuable. We’re also able to drill down into our drivers and budget assumptions. As others ask questions about the budget, we’re able to provide that level of detail back to the budget owners,” said Lisa Campbell, Vice President of Compeer Financial.

Community Bank System (CBSI)

CBSI implemented Axiom Cash Flow Forecaster, which converts individual customer records into future cash flows to enhance financial and operational planning.

CBSI now receives consistent, analytically rich reports that illuminate FTP and cash flows and transform raw data into actionable information — all of which improve profitability throughout the institution. CBSI has a clear representation of whether its income and spreads are going up or down, asset quality is getting better or worse, costs are going up or down, and product returns are improving or deteriorating.

“We import, transform, process, and analyze data more efficiently, giving us more time to focus our efforts on identifying areas for improvement and working with senior management to achieve those goals,” said Rob Frost, VP Finance and Director of Financial Planning and Analysis at CBSI.