Why bank and credit union financial leaders switch to Axiom

Fast, comprehensive profitability analysis on a unified platform

Leveraging instrument-level, matched-term funds transfer pricing, allocations, loan loss provisions and more, Axiom provides accurate, risk-adjusted profitability insights across your organization, branches/departments, products, officers, and customer/members on a unified platform.

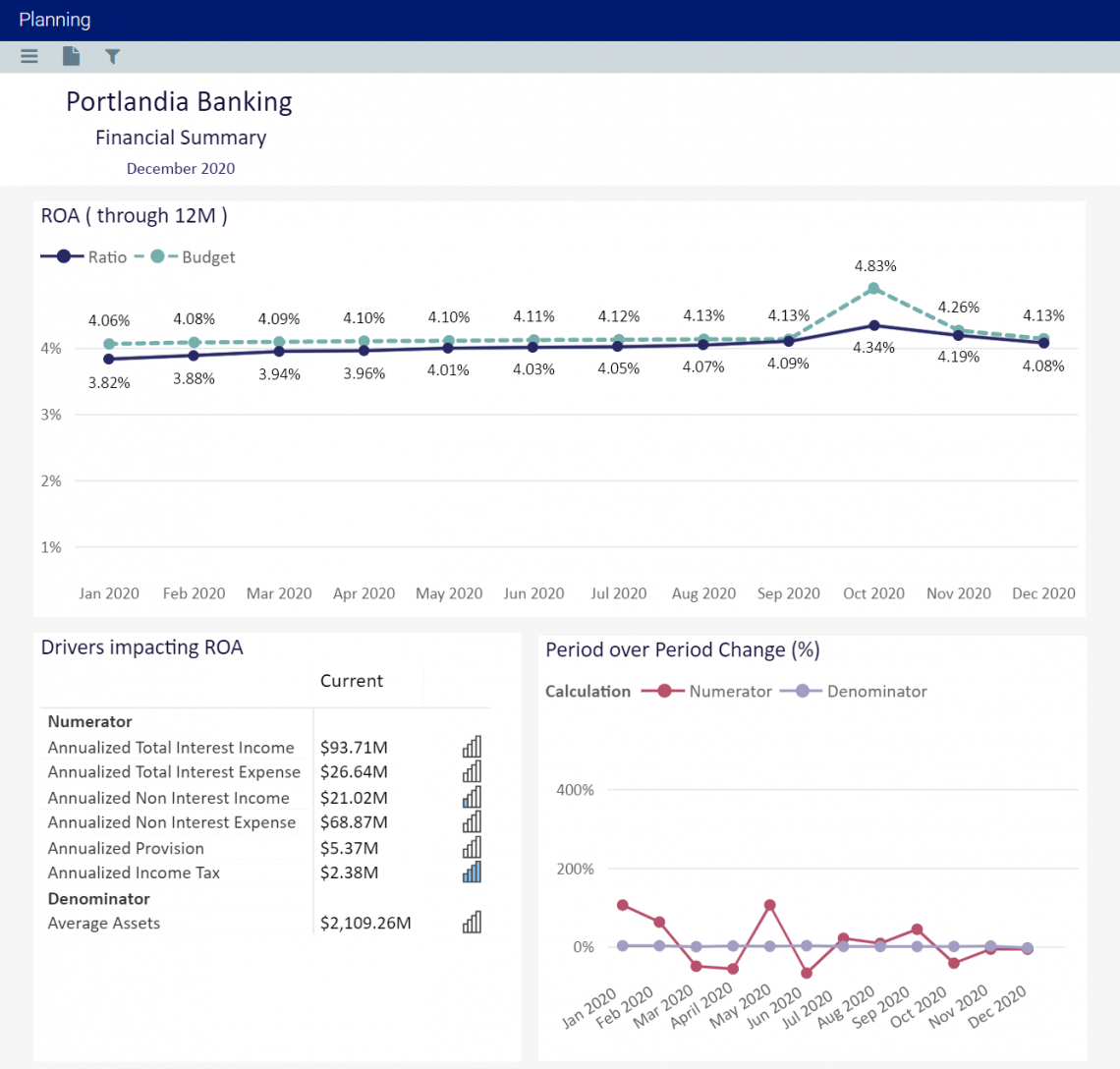

Streamlined robust reporting and data visualizations to inform business decisions

Axiom provides a templated report writer, ad-hoc report creation, dashboarding, and true Excel reporting for unparalleled data insights.

Processes made easier and faster

Clients see dramatic reduction in the amount of time it takes to import data, gather budget inputs, run calculations, and create and distribute reports.

Designed for the needs of banking by financial professionals and domain experts

Our team is made up of former banking and credit union finance professionals.

“The Axiom team's experience in financing and banking definitely helped us to succeed. They gave us better perspective."

— Ryan Neese, VP, Financial Planning and Analysis Manager at Lake City Bank

We speed up your processes so you can focus on growth

60%

less time spent on budget creation + profitability analysis

50%

faster scenario modeling and report distribution

1.5+ basis pts

growth in NIM through accurate balance sheet planning

We'll calculate your return on investment with Axiom

What sets Axiom apart from other options?

Unified performance management

Axiom is your hub for budgeting and planning, profitability analysis, and pricing. Gain powerful modeling and visualizations, historical and forecasted funds transfer pricing and profitability analysis, accurate cash flow forecasting, and measurable efficiencies. See what you’ve been missing -- salary planning, detailed fixed asset planning, streamlined eliminations, distributed budgeting inputs, and more.

Any data source

Import GL or instrument data from anywhere. Axiom can easily bring in data from your payroll, loan/deposit, GL, and any core system.

Access to dig into the calculations behind the forecast

Axiom has robust variance reporting to compare budget to actuals, and drill in for detail.

Funds Transfer Pricing built-in

With Axiom, the same monthly import from the core system is everything needed to calculate FTP.

Flexibility to support your growing business + needs

Cloud-native and hosted on Microsoft Azure, Axiom is secure and scalable, with high performance, reliability, and streamlined processes across solutions. Bonus — no reporting plug-in required.

Accurate and reliable

“Syntellis’ Axiom™ Cash Flow Forecaster is more accurate than our previous system. It allows our institution to accurately project cash flows and related income or expense for loans, time deposits, and other borrowings at the instrument level.”

Reporting made easy and fast

"When you look across the Credit Union, Axiom saves us at least 40 hours during each reporting cycle.”

Bring all your data into one place

“Very few systems have the ability to support multiple, disparate data sources, and Axiom was able to easily accommodate our data needs.”

Improve visibility and board reporting

All-in-one software

“Our goal was to find a system that has everything – budgeting, reporting and profitability – all in one place, with the power, flexibility and customization that we need, and Axiom’s platform does just that. Axiom also understands banking through and through, which is a huge value add for us.”

Award-winning software from industry leaders

Grow NIM + ROE/ROA

Let's talk! We'd love to show you Axiom and share how it helps you drive profitable growth

LEARN MORE ABOUT BOOSTING YOUR PROFITABILITY WITH AXIOM

The 5 Ws of Profitability Steering Committees in Banks and Credit Unions

Extracting More Value from Funds Transfer Pricing