The Basics of FP&A

What is financial planning & analysis (FP&A)?

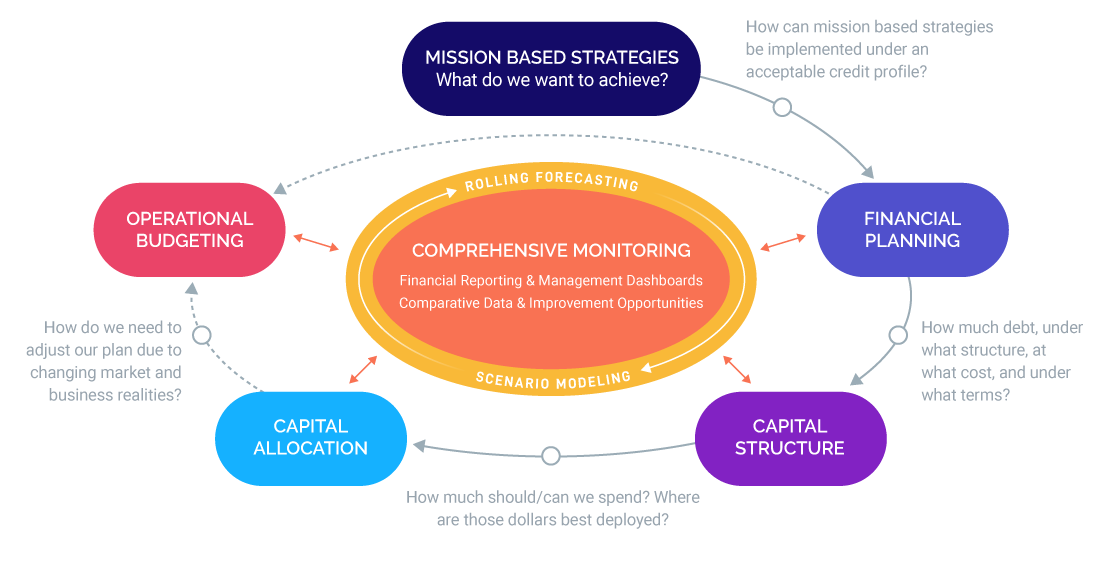

FP&A stands for financial planning and analysis. FP&A is the process that a company's finance department uses to perform operational budgeting, strategic financial planning, and forecasting to support organizational operations. FP&A functions can be performed manually, but most companies have adopted purpose-built software — such as enterprise performance management (EPM) solutions — to automate and streamline processes, leverage data from general ledger and other software systems, and expedite decision-making.

What is the purpose of FP&A?

FP&A is a critical and primary function of finance departments. Companies of all sizes need FP&A solutions to manage revenue, expenses and cash flows, measure actuals against forecasts, create financial statements, and provide the C-Suite or Board of Directors the data analysis necessary to set company direction, establish goals, monitor results, and grow profitably. The accuracy and transparency of data are important success factors, which is why more companies rely on FP&A software to gather data, perform calculations, and create reports.

What are best practice principles for financial planning and analysis?

High-performing finance departments that embrace FP&A principles do seven key things:

- Streamline and integrate financial planning processes

- Integrate data from disparate processes and software systems onto a unified platform

- Make data transparent and actionable

- Facilitate decision-making by providing relevant data in easy-to-understand formats

- Align decisions to budget, goals, and long-term financial plans

- Employ driver-based scenario modeling to gauge impact of scenarios

- Produce relevant reports easily

What makes a good FP&A professional?

At a minimum, FP&A analysts must have a strong finance and accounting background and data analysis skills. Those looking to improve their FP&A skills or hire someone in FP&A should focus on these vital areas that set leading FP&A analysts apart:

- Strong communication and collaboration. Good FP&A analysts have strong communication skills and can interpret complex financial data and communicate insights in a language that business stakeholders outside of finance understand. They should recognize what’s most important to the business and tailor reporting to drive collaboration and alignment across the business. They must partner well with other functions across the organization.

- Strategic mentality – keep up with modern finance. Especially in today’s changing business climate, FP&A leaders need to determine new ways to deliver meaningful, accurate, and timely budgets and reports. They will look to reduce time spent budgeting and creating reports so they can spend more time providing meaningful analysis and recommendations. This requires knowledge of FP&A trends and modern technology to improve financial planning processes.

- Familiarity with modern financial technology and tools. The FP&A landscape fundamentally changed over the past decade, and FP&A professionals are accustomed to using the latest tools to automate data collection and collation tasks, leaving more time for analysis that can improve business operations. If your organization doesn’t have a modern FP&A software solution, you may have difficulty attracting top talent.

FP&A Software: Beyond Budgeting

What is FP&A software?

FP&A software solutions help organizations modernize key planning and reporting processes to make quicker, data-driven decisions that align to financial and strategic plans and goals. But not all software vendors are created equal. Look for a company with deep expertise in your industry, specialized products designed for the unique needs of your industry, and implementation that includes advice on best practice configurations.

Seek software that meets these requirements:

- Incorporates data input from source systems across your organization and external data, as required, to empower informed decision-making

- Supports updating forecasts on the fly to encourage agility and course correction

- Builds highly formatted financial statements and analytic reports to suit your needs, with appropriate report distribution mechanisms

- Allows easy and intuitive ad hoc reporting that requires little or no training

- Includes dashboards with drill-down capability for analysis and data discovery

- Uses a scenario-based approach to create forward-looking financial statements and financial plans that support an organization’s strategic goals

- Prioritizes projects and tracks budgets for capital expenditures at the corporate, division, and/or department level

Why modern finance leaders switch from legacy methods to FP&A software

Legacy systems, such as ERP-provided budget solutions and Excel-based approaches, no longer meet the intense modeling and data transparency needs of modern finance departments. Robust FP&A software can provide better:

- Accuracy: Ensure that your data is up to date and all in one place. Modern budgeting software helps maintain version control and allows access only to authorized users.

- Speed & efficiency: A leading-edge FP&A software solution will save considerable time on budgeting and reporting processes, allowing quick budgeting pivots when business conditions change.

- Data integration: A single source of truth can drive unified accountability in data and decision-making, a feature that not all FP&A systems can accomplish.

- Industry-specific features: FP&A solutions aren’t one-size-fits-all, so look for software designed with your industry in mind. For example, healthcare organizations should seek a solution with cost accounting and contract management capabilities, banks and other financial institutions would need relationship profitability tools, while colleges and universities would prioritize grant planning and commitment planning functionality.

What to Look for in FP&A Software

6 must-have requirements in Financial Planning and Analysis (FP&A) software

- Modern budgeting. Budgeting and forecasting software includes distributed budget inputs, permission-based workflows, and visibility to underlying data — streamlining the budgeting process and financial accountability in ways that Excel can’t touch.

- Financial forecasting and scenario analysis. Forecasting tools provide the ability to stay nimble, understand the impact of varying business conditions, model scenarios quickly, and reforecast, when necessary.

- Financial reporting. A modern FP&A solution provides a robust collection of standard reports for required financial reporting, budget and forecast reports, validation reports, and profitability analyses; the ability to create ad hoc reports and better communicate through insightful visualizations; and appropriate report distribution mechanisms.

- Transparency. FP&A software offers the ability to drill down to the individual account level and produce reports on current data to quickly generate insights, improving efficiency and accountability throughout the organization.

- Unified data & solutions. Look for a solution that integrates data from numerous source systems (general ledger, payroll, HR, etc.) onto a single platform to create and monitor budgets and plans, measure profitability, and simplify reporting and analysis.

- Cloud hosting & security. Modern solutions are hosted in the cloud to minimize IT support, update seamlessly, comply with SOC 2 security and regulatory requirements, automate data integration, and ensure high performance and reliability, including a disaster recovery plan.

Advantages of cloud-based FP&A software and key factors to consider

Not all cloud solutions are the same. Here are the key characteristics to evaluate.

- Minimal IT footprint. A finance-owned solution gives the department more control and flexibility without reliance on IT resources for installation or ongoing support.

- Automated data imports and integration. Automatic and secure data import from core software systems (general ledger, payroll, HR, etc.) and full integration on a single platform eliminates manual data uploads, increasing accuracy while allowing more time for value-added analysis.

- Security. Third-party validation such as SSAE 18 SOC 2 compliance and security integration with existing protocols provide enterprise-level security, governance, and compliance standards that encrypt and protect your data in transit and at rest. A permissions model managed by finance enables users to view only the data they need to see.

- Scalability. Software functionality should grow and adapt with your organization. Scalable features include the ability to manage planning processes with multiple users, inputs, and approval steps, and a sandbox environment to test new software versions.

- Auditing. Data transparency is critical to understanding the “why” behind the numbers. Be sure any FP&A software captures all activity, tracks changes to planning and profitability numbers, and makes audit data easy to retrieve.

- Compliance. A software solution should comply with the applicable regulations for your industry.

What separates leading FP&A software from the rest?

You’ll find a wide range of FP&A software solutions with different price points and value propositions. Look for these differentiators:

- Tailored to the unique needs of your industry. A hospital system is nothing like a bank, and each needs configurable software solutions that adapt to individual planning processes while incorporating industry best practices. Banks and credit unions need such FP&A tools as cash flow-based planning, instrument-level matched-term maturity funds transfer pricing, and risk-based profitability analysis. Meanwhile, hospitals and health systems need robust clinical analytics and contract management. It’s extremely valuable for your vendor of choice to have industry experts to support you.

- Usability and ease of financial reporting. Budgeting and financial planning tends to be highly collaborative and many participants may not have extensive finance skills. Delivering reports in the terminology of the business can reduce the need for translation and generate more collaborative and transparent conversations.

- Focus on true partnership. Transforming performance management and improvement processes isn’t merely a question of technology — it requires teamwork from inside and outside your organization to implement new tools and processes and overcome challenges. A vendor whose solutions are responsible for facilitating all elements of your financial processes should provide more than just technology — they should partner with you to drive success. That means sharing best practices, making recommendations for how to set up systems and processes to fit your unique needs, and offering advice based on deep experience working in and serving your industry. A vendor’s commitment to your shared success will lay the foundation for an ongoing, fruitful partnership.

How to evaluate vendors

Researching potential vendors is just as important as test-driving the software and ensuring it will meet your needs. Put these 4 tasks on your to-do list:

- Learn about the vendor’s implementation processes and methodology. Do implementation principals work for the vendor or for a third party? Do they have expertise in leveraging best practices to transform planning processes and financial performance in your industry? Who is responsible if issues arise during/after implementation? The answers to these questions should inform your evaluation of the vendor’s commitment to partnership.

- Get references from existing clients similar in size and industry as your company. Ask questions about their implementation experience, ongoing support, and post-implementation support and training.

- Look to outside sources for vendor information. Industry analysts can provide unbiased vendor reviews based on standardized rating criteria. Check out reviews from agnostic reviewers and industry-specific associations.

- Review information the vendor publishes. You want a vendor that stays current on trends that affect your industry. Look at whether a vendor regularly posts articles and other resources that are relevant to you and your industry, offers market perspectives, and shares information about current events affecting your industry.

A Trusted Leader in FP&A Software

Axiom is the leader in FP&A software for society's most foundational institutions

Not all FP&A software — or vendors — are the same. You want a vendor that is dedicated to your success, with industry-leading solutions, dedicated implementation specialists, and a best practice methodology to take your planning and budgeting processes to the next level.

Syntellis’ Axiom FP&A solutions provide sophisticated, industry-specific software that supports financial planning and reporting on a single, integrated cloud-based platform. We focus exclusively on providing the most robust, innovative enterprise performance management software, data and analytics solutions to healthcare, higher education, and financial institutions.

Healthcare

Planning, performance improvement, and analysis software for the complexities of hospitals

Higher Education

Solutions to meet higher education's unique challenges, from tuition planning to long-range planning and more

Financial Institutions

Integrated financial planning software to budget, model scenarios, analyze and drive profitability

Start your journey towards helping increase budgeting efficiency and empower goal-based decisions throughout your organization.

Helpful resources on buying FP&A software